Central Bank Demand Surges on Rate Cut Expectations

Liquidity Expansion Expected Through Stimulus Measures

Greater Opportunities Opening Up for Risk Assets

Gold prices are rising as expectations for a U.S. benchmark interest rate cut are driving demand from central banks around the world. However, some analysts suggest that if global stimulus measures lead to abundant liquidity, risk assets such as growth stocks may present greater opportunities than traditional safe-haven assets.

On September 12, Daishin Securities expressed a somewhat conservative stance on gold in light of these circumstances. On September 8 (local time), the London Bullion Market Association (LBMA) saw spot gold prices hit an all-time high, trading at $3,646.29 per ounce (about 5.07 million won) at one point during the session. Since the beginning of this month, expectations of interest rate cuts have once again fueled a rally in gold prices.

The U.S. Department of Labor’s Bureau of Labor Statistics (BLS) employment report for August once again fell far short of market expectations. Nonfarm payrolls increased by only 22,000 compared to the previous month, and the June figure was revised down from 14,000 to 13,000. This marked the first decline since the COVID-19 pandemic, heightening expectations for a policy rate cut by the Federal Reserve. Federal Reserve Chair Jerome Powell also indicated at the Jackson Hole meeting that he would place more emphasis on employment than inflation, leading the market to take a September policy rate cut as a given. Furthermore, there is growing sentiment that additional cuts could follow.

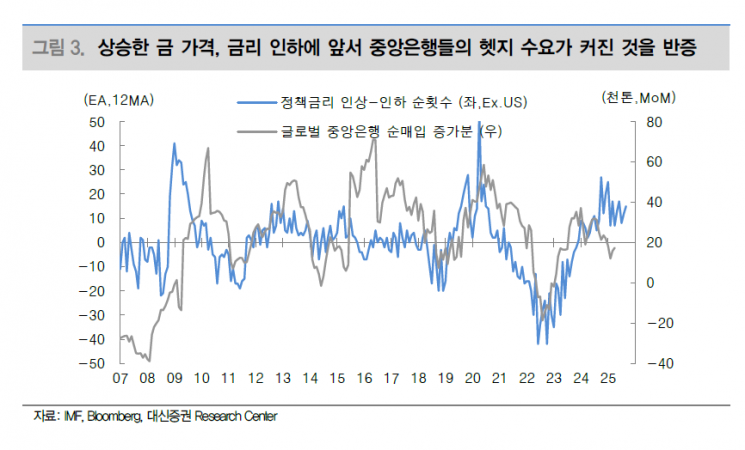

As a result, surging demand for gold has driven up its price. Central banks, which hold a significant proportion of bonds, have increased their holdings of gold-a non-yielding asset-in anticipation of a decline in real interest rates. Although the Chinese government restricted gold trading through credit card cash advances and personal loans in May, dampening demand from individual Chinese investors, hedging demand from central banks has offset this effect.

Full-Scale Stimulus Measures... Expectations for a Preference Toward Risk Assets

There is analysis suggesting that the focus should now be on the full-scale rollout of stimulus measures by various countries, triggered by policy rate cuts. This is expected to boost the construction sector first. U.S. Treasury Secretary Scott Besant mentioned that a nationwide housing emergency could be declared this fall. This is interpreted as an intention to stimulate the construction industry in line with the timing of lower financing costs. In addition, there are plans to distribute consumption coupons funded by previously collected tariffs.

Of course, the Federal Reserve’s total assets currently stand at $6.6 trillion, and compared to April 2020, when quantitative easing (QE) was implemented, it is difficult to say that liquidity has been sufficiently withdrawn. However, when viewed as a ratio to gross domestic product (GDP), there is still room for maneuver. The current ratio of total assets to GDP stands at 21.8%, which is 13.6 percentage points lower than the 35.4% recorded in the first quarter of 2022, when QE was halted. Given this, the Donald Trump administration may pressure the Federal Reserve to return to quantitative easing and inject more money into the economy ahead of next year’s midterm elections.

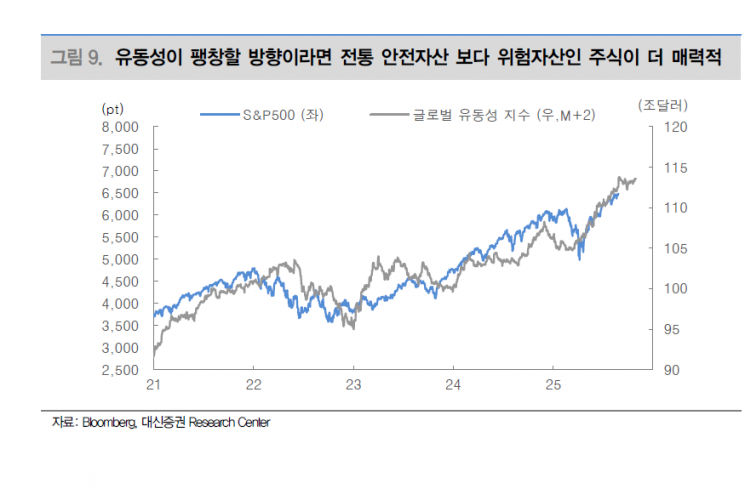

If liquidity expands, there is a greater likelihood that more opportunities will be provided to risk assets such as growth stocks rather than traditional safe-haven assets. In August 2020, when liquidity expanded rapidly, the S&P 500 index surged in response, while gold prices underwent a correction.

Choi Jinyoung, a researcher at Daishin Securities, stated, "For now, gold is benefiting from hedging demand, but if liquidity expansion becomes full-scale, its relative returns could decline." He added, "While the long-term outlook for gold is not pessimistic, at this moment, it is better to focus on equity assets that lag the global liquidity index by two months."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.