Bank of Korea Monetary and Credit Policy Report

Base Rate Cut: Assessing Interest Reduction by Income and Age Group

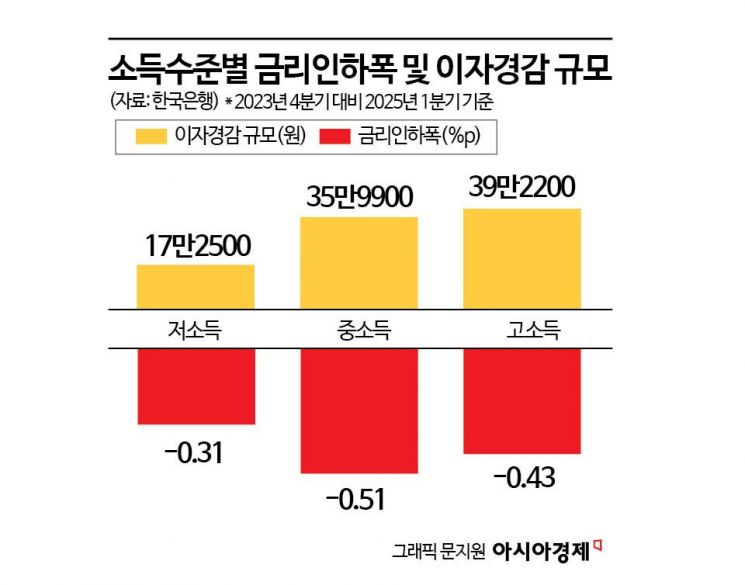

Interest Burden Down 172,500 Won for Low-Income Households... 392,200 Won for High-Income Households

Biggest Interest Relief Seen

Following the policy pivot in October last year, the benchmark interest rate was lowered by 1 percentage point, significantly reducing household interest burdens. The effect of this interest relief was especially pronounced among high-income earners and those in their 20s and 30s. In particular, high-income borrowers saw their average interest payments decrease by about 390,000 won, which is roughly double the reduction experienced by low-income groups. This is believed to have had some impact on consumption trends as well.

On September 12, the Bank of Korea released its Monetary and Credit Policy Report, reviewing the "Spillover Effects by Household and Corporate Sectors." The report found that both households and businesses experienced direct relief in interest burdens following the rate cuts. The Bank of Korea lowered the benchmark rate from 3.5% to 2.5%-a total reduction of 1 percentage point (100 basis points)-over four rounds from October last year to May this year.

For households, the average interest rate in the first quarter of this year stood at 3.94%, down 0.44 percentage points from 4.38% in the fourth quarter of 2023. By income level, middle-income borrowers saw the largest drop in rates, with a 0.51 percentage point decrease, compared to low-income borrowers (-0.31 percentage points) and high-income borrowers (-0.43 percentage points). However, in terms of the actual amount of interest reduced, high-income groups benefited the most due to their larger loan sizes. High-income borrowers saw their interest payments decrease by an average of 392,200 won, while low-income and middle-income groups saw reductions of 172,500 won and 359,900 won, respectively. When measured as a percentage of income, the reduction rates were -1.12% for the middle-income group, -1.02% for the low-income group, and -0.70% for the high-income group.

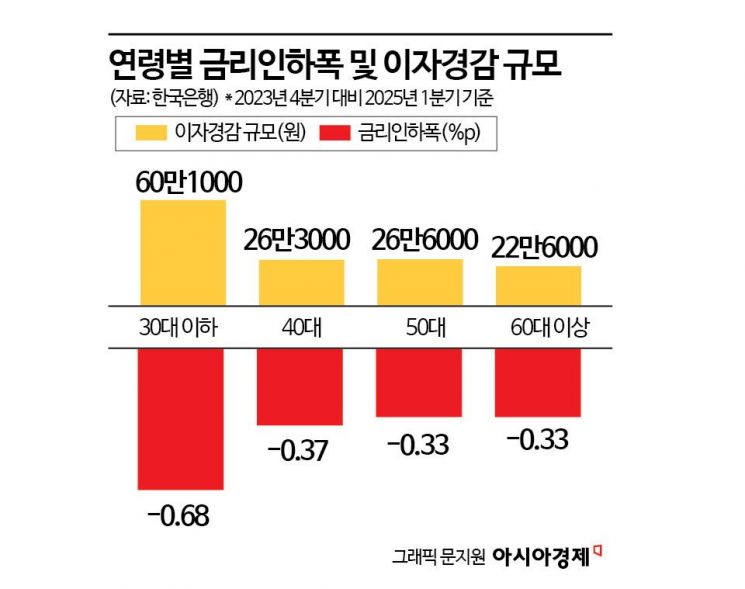

By age group, those in their 20s and 30s experienced the greatest reduction in interest burdens. For this demographic, interest rates fell by 0.68 percentage points during the same period, significantly higher than the overall average decline of 0.44 percentage points. The average amount of interest reduced was also the highest at 601,000 won, and the reduction as a percentage of income was also the largest at -1.4%. In contrast, those in their 40s, 50s, and 60s or older saw interest rates fall by about 0.3 percentage points, resulting in a reduction of only about 220,000 to 260,000 won in their interest burdens.

However, the reduction in interest payments did not lead to an increase in consumption. Although high-income households, who benefited the most from lower interest rates, managed to maintain a consumption growth rate in the 1% range (year-on-year) since the third quarter of last year, consumption among low-income households actually slowed. The consumption growth rate for low-income groups fell from 3.1% in the first quarter of last year to 1.7% in the second quarter, and remained in the 0% range for three consecutive quarters through the first quarter of this year.

Similarly, while businesses also saw their interest burdens decrease, this did not translate into increased investment. The investment growth rate for large corporations slowed from 16.8% in the fourth quarter of last year to 9% in the first quarter of this year, while for small and medium-sized enterprises, it improved from -36.4% to -24.4% over the same period.

The Bank of Korea analyzed that, due to both domestic and external uncertainties, households and businesses postponed consumption and investment, so even with a significant cut in the benchmark interest rate, the effect on economic growth was limited. According to an analysis using a macroeconomic model, a 1 percentage point cut in the benchmark rate only raised the growth rate by 0.02 percentage points in the first quarter and 0.08 percentage points in the second quarter of this year. This is about half the average effect seen in the past.

However, since domestic and external uncertainties have somewhat eased since June, and considering that the effects of rate cuts typically appear with a two- to three-quarter lag, the Bank of Korea expects the impact on growth to become more pronounced from the second half of this year. The Bank forecasts that, from the third quarter of this year to the second quarter of next year, the interest rate cuts will boost South Korea's economic growth rate by 0.27 percentage points over the coming year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)