KKR Acquires Samhwa Following SK Ecoplant Subsidiaries

Blackstone Closes Juno Hair Deal for 800 Billion Won

Armed with Strong Financial Power and Global Networks

Global private equity funds (PEFs) are ramping up their presence in the domestic mergers and acquisitions (M&A) market. As they make their mark in major deals, local PEFs are finding fewer opportunities to compete.

According to the investment banking (IB) industry on September 10, Kohlberg Kravis Roberts (KKR), one of the world’s top three private equity funds, has shaken up the domestic M&A market by closing two deals in a short period. Alongside KKR, other global PEFs such as Blackstone and Carlyle have also entered the market, pushing local PEFs out of the competition.

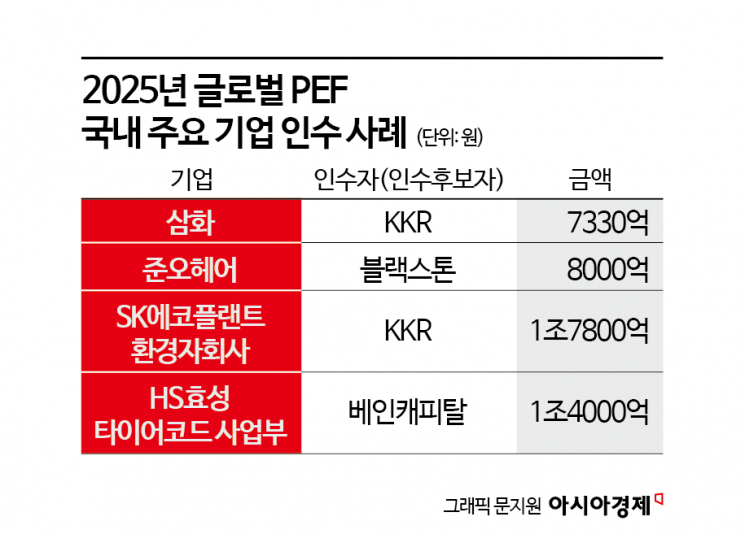

Recently, KKR announced that it would acquire a controlling stake in Samhwa, a domestic cosmetics packaging manufacturer, for 733 billion won. It is reported that global PEFs, including KKR, Blackstone, and Carlyle, participated in the bidding. With the participation of global PEFs backed by ample capital, Samhwa’s valuation soared, making it difficult for domestic PEFs to step forward.

KKR decided on the acquisition, judging that Samhwa is at the center of the K-beauty ecosystem. This is because Samhwa reliably supplies differentiated cosmetic packaging to various brands. The rapid overseas growth of the domestic cosmetics industry was also a major factor in the decision.

Last month, KKR also signed a stock purchase agreement (SPA) to acquire 100% stakes in three environmental subsidiaries of SK Ecoplant: Renewus, Renewon, and Renew Energy Chungbuk. The deal is valued at approximately 1.78 trillion won. KKR competed against domestic PEF Stick Investment, but secured the deal by offering a relatively higher price.

Blackstone acquired the domestic hair salon franchise company Juno Hair for about 800 billion won. While Juno Hair’s initial sale price was discussed in the 500 billion won range, its valuation surged as global PEFs began to show interest.

Previously, Bain Capital was selected as the preferred bidder for the HS Hyosung tire cord business unit and is in the process of acquisition. While JKL Partners and Stick Investment each offered around 800 billion won, Bain Capital reportedly proposed a higher price in the 900 billion won range, about 100 billion won more than its competitors.

Global PEFs are also flocking to major ongoing deals. For the sale of SK Innovation’s stake in the Boryeong LNG terminal in South Chungcheong Province, Macquarie Asset Management and Caisse de depot et placement du Quebec (CDPQ) of Canada have been named as potential buyers. With their formidable financial resources and global networks, global PEFs are expected to further intensify their offensive going forward.

A senior official at a domestic mid-sized PEF commented, “Global PEFs are lowering the threshold by participating in deals under 1 trillion won, which has dramatically increased the difficulty of deals. Domestic companies are also increasingly imposing stricter conditions on local PEFs, expecting that global PEFs can drive overseas growth, so the space for local PEFs is likely to continue shrinking.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.