"America's Golden Age Has Not Even Begun"

"Long-Term Holding of U.S. ETFs Like the S&P 500" Advised

'The Oracle of Omaha,' Warren Buffett (95), has presented an optimistic outlook on investing in the U.S. market. In his recently published book, "The Warren Buffett Bible," he stated, "America's golden age has not even begun," emphasizing that "the vitality rooted in the U.S. market economy will continue to work like magic in the future." This reaffirms that his confidence in the U.S. market remains strong, even as global economic uncertainty increases.

"No Suitable Investment? Buy U.S. ETFs," Buffett Recommends

Along with his optimism about the U.S. economy, Buffett advised that if there are no suitable investment opportunities, one should buy and hold U.S. exchange-traded funds (ETFs) such as the Standard & Poor's (S&P) 500 Index for the long term. Rather than chasing individual stocks, he recommends investing in the entire U.S. market. U.S. benchmark index ETFs like the S&P 500 and Nasdaq focus on blue-chip stocks, so while there may be short-term volatility, they have consistently trended upward over the long term.

Direct Criticism of Bitcoin and Gold: "No Productive Value"

Buffett drew a clear line regarding unproductive assets such as Bitcoin and gold. He said, "Apartments generate rent, farmland produces food, but Bitcoin produces nothing," expressing his negative stance on virtual asset investments. Gold is no exception. He pointed out, "The 170,000 tons of gold circulating worldwide will not change in size even after 100 years and provide no productive value," adding, "No matter how carefully you stroke a gold bar, it will not react." Furthermore, he emphasized the value of assets that generate production and profits, stating, "With 170,000 tons of gold, you could buy all of America's farmland and 16 companies like ExxonMobil."

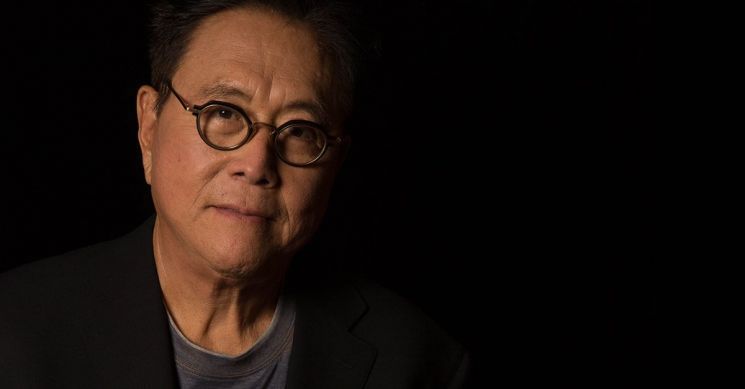

Buffett's optimistic outlook on the U.S. market stands in stark contrast to Robert Kiyosaki, who has been repeatedly emphasizing his confidence in gold and Bitcoin investments. Kiyosaki, author of the global bestseller "Rich Dad Poor Dad," has long advocated the "weak dollar theory" and highlighted gold, silver, and Bitcoin as alternative assets. In April, he warned, "The value of stocks, bonds, and the dollar will all be shaken," and said, "You need to protect your portfolio with investments in gold, silver, and Bitcoin." Recently, Kiyosaki also pointed out, "A major downturn signal in the stock market has already been detected," and especially noted that "baby boomers who have tied up their retirement assets in stocks will be hit hard." On the other hand, he predicted that investors holding gold, silver, and Bitcoin could actually benefit.

Meanwhile, Buffett offered several pieces of advice to investors in his book: ▲Do not invest with borrowed money ▲Buy when fear in the market is at its peak and be cautious during overheated periods ▲If you discover an excellent company, hold it for the long term ▲You do not need to know the entire market, but you must thoroughly understand the companies you invest in. These are messages he has repeated for decades and are also the philosophy that enabled Berkshire Hathaway to grow into the world's largest investment company even amid crises.

This book comprehensively covers Buffett's remarks at shareholder meetings, shareholder letters, and media interviews from 1983 to 2025. It addresses a wide range of topics, including stock investing, mergers and acquisitions, capital allocation, accounting and valuation, as well as bonds, foreign exchange, derivatives, corporate governance, corporate culture, and the insurance and financial industries.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.