Fines for Hong Kong ELS and More to Surpass 9 Trillion Won This Year

Additional Tax Burdens from Education Tax and Bad Bank Contributions

Inevitable Weakening of Shareholder Return Momentum

As banks face the likelihood of being hit with fines amounting to trillions of won this year, concerns are mounting over shareholder returns. This is due to a combination of various cost factors, including fines related to Hong Kong H-Index equity-linked securities (ELS) and loan-to-value (LTV) collusion, an increase in the effective corporate tax rate, additional education tax burdens, contributions to a bad bank, higher risk weights for mortgage loans, and investments in the National Growth Fund. Industry analysts note that such massive fines will inevitably lead to a decline in banks' Common Equity Tier 1 (CET1) ratios, restricting policies such as dividend increases and other shareholder return measures.

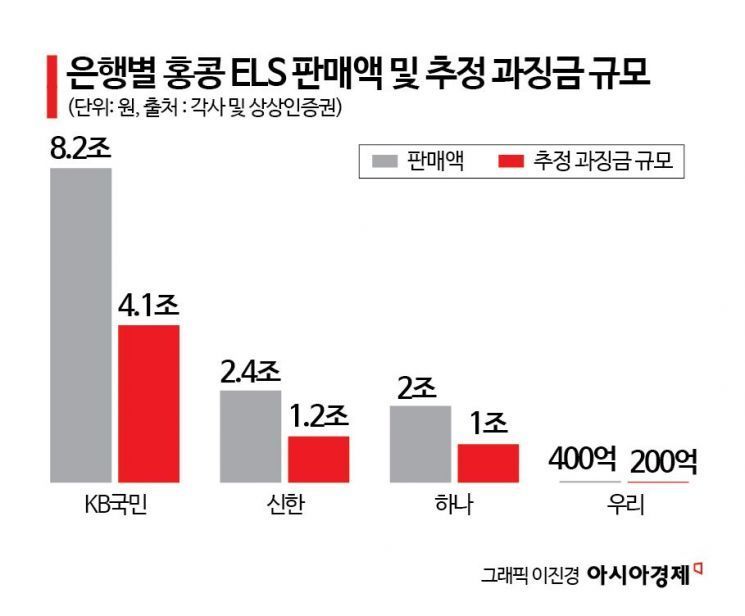

According to the financial sector on September 8, the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) are expected to be fined by financial authorities and the Fair Trade Commission by up to over 9 trillion won within this year. The largest portion of this is the fine for the misselling of Hong Kong ELS products. The Financial Services Commission plans to calculate fines based on sales volume, and under the Financial Consumer Protection Act, up to 50% of the sales amount can be imposed as a penalty if misselling is recognized.

For KB Financial, which sold 8.2 trillion won worth of Hong Kong ELS, the fine alone could reach 4.1 trillion won-about 80% of its net profit last year. Shinhan Financial Group is expected to face a fine of 1.2 trillion won, Hana Financial Group 1 trillion won, and Woori Financial Group about 200 billion won.

In addition to the Hong Kong ELS misselling fines, the four major banks (Kookmin, Shinhan, Hana, and Woori) are also implicated in the Fair Trade Commission's LTV collusion investigation. The market estimates that fines related to LTV collusion could reach up to 2 trillion won. Kookmin, Hana, and Nonghyup Banks are also involved in collusion among primary dealers of government bonds, which is expected to result in additional fines amounting to several hundred billion won.

Beyond fines, tax burdens are also expected to increase. With the rise in the effective corporate tax rate, the net profit of financial companies is projected to decline by about 1% on a pre-tax basis. Contributions to the bad bank are estimated to cost each bank several hundred billion to 1 trillion won. Although the specific amount for contributions to the National Growth Fund has not yet been determined, it is expected to reach the trillion-won range.

There are also projections that changes in the calculation of banks' additional interest rate margins could reduce their earnings by about 3 trillion won. Currently, banks include various statutory costs, such as contributions to guarantee institutions, in their additional interest rates, but financial authorities are pursuing legal revisions to prevent these costs from being passed on to borrowers. Education tax has also been reflected in additional interest rates; however, with the tax rate increase, banks will face an additional annual burden of over 100 billion won, which they will no longer be able to offset through pricing.

The main issue is that fines in the trillion-won range directly translate into a decline in CET1 ratios. The entire fine amount, as well as 600% of the fine, is classified as additional risk-weighted assets (RWA). As RWA increases, the CET1 ratio-a key indicator of financial soundness-automatically declines, reducing the banks' capacity to pay dividends.

Kim Hyunsoo, a researcher at SangSangIn Securities, analyzed, "If fines amounting to several trillion won materialize, plans to expand shareholder returns at major financial holding companies next year will likely be scrapped. As banks must recognize operational risk six times the amount of the fines imposed, a weakening of shareholder return momentum is inevitable."

An industry insider also expressed concern, stating, "Aside from the burden of fines, the responsibilities required of banks, such as inclusive finance and productive finance, have increased under the new administration. However, due to various regulations and legal amendments, the business environment is actually becoming more restrictive. Banks are among the few growth industries in Korea, but if this trend continues, not only could shareholders leave, but the growth engine itself could be weakened."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.