Stock Price Drops 30% in the Second Half of the Year

Second-Quarter Operating Profit Falls Short of Market Expectations

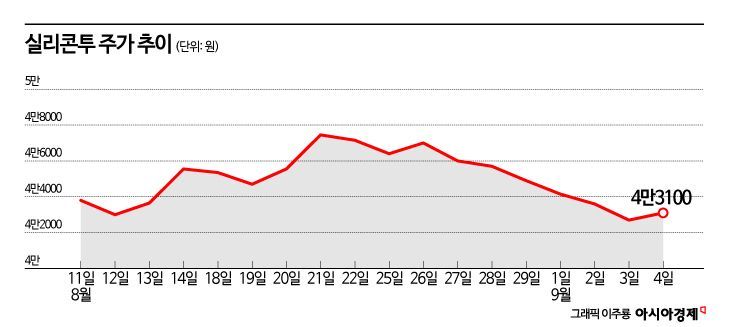

Silicontwo's stock price, which reached an all-time high in the first half of this year, has been retreating in the second half. This appears to be the result of second-quarter earnings falling short of investor expectations. However, stock market experts predict that Silicontwo will continue to grow in the second half of this year.

According to the financial investment industry on September 5, Silicontwo's stock price has fallen by 30.1% compared to the end of June. Considering that it had risen by 88.7% from the beginning of the year to the end of June, this decline can be attributed to profit-taking sales. In the second half of this year, foreign investors were mainly selling Silicontwo shares, with a cumulative net sale of 39 billion won. During the same period, individual investors and institutional investors showed net purchases of 7.6 billion won and 30.6 billion won, respectively, but this was not enough to prevent the stock price from falling.

In the second quarter of this year, Silicontwo posted consolidated sales of 265.3 billion won and operating profit of 52.2 billion won. These figures increased by 46.3% and 34.0%, respectively, compared to the same period last year. Kim Myoungjoo, a researcher at Korea Investment & Securities, explained, "Operating profit was 9.2% below market expectations," adding, "Selling and administrative expenses increased significantly more than the market anticipated."

The proportion of shipping expenses to sales rose from 2.3% in the first quarter of this year to 2.9% in the second quarter. This was influenced by an increase in air express shipments in certain countries and a temporary rise in freight costs due to U.S. tariffs.

Lee Seungeun, a researcher at Yuanta Securities, analyzed, "Salaries increased by 35.7% year-on-year due to workforce expansion," and added, "Strengthened influencer marketing also contributed to the rise in expenses."

Yuanta Securities revised down its earnings forecast for Silicontwo for the second half of this year, taking into account the company's cost structure. Researcher Lee said, "In the short term, profitability is likely to remain under pressure due to the burden of marketing and logistics expenses," but also noted, "However, in the mid- to long-term, these investments in costs can contribute to enhancing brand awareness and expanding overseas channels."

Although the temporary deterioration in profitability is affecting the stock price, there is also the view that a rebound is possible given the company's growth potential. Park Jongdae, a researcher at Meritz Securities, advised, "There are concerns about a decline in gross profit margin, but an increase in promotional activities during a period of business expansion is natural," and added, "Given Silicontwo's unique business model and potential for overseas expansion, the stock is undervalued."

He explained, "With expansion in Europe and recovery in the United States, third-quarter sales are expected to increase by more than 60% year-on-year," and added, "Silicontwo's growth potential remains difficult to fully gauge at this point."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.