All Top 10 Conglomerates Declare Value-Up Participation

Large-Cap Companies with Over 1 Trillion Won Market Cap Lead the Way at 61.7%

Stock Prices Expected to Diverge Depending on Treasury Share Management

All of South Korea's top 10 conglomerates have now joined the value-up (corporate value enhancement) initiative. As the "third amendment to the Commercial Act," which centers on the mandatory cancellation of treasury shares, is anticipated, attention is focused on whether these major corporations, taking the lead in expanding shareholder returns, can help the market break out of the so-called "Boxpi" stagnation.

All Top 10 Conglomerates Declare Value-Up Initiatives

According to the Korea Exchange on September 4, GS, the holding company of GS Group, announced its corporate value enhancement plan last month, completing the participation of all top 10 conglomerates (Samsung, SK, Hyundai Motor, LG, Lotte, POSCO, Hanwha, HD Hyundai, GS, Shinsegae). Since the system was introduced in May last year, a total of 162 companies have disclosed their participation, accounting for 43.5% of the total market capitalization.

The expansion of value-up disclosures is highly regarded, particularly because it is being led by large corporations. Among the 162 companies that have disclosed participation, 61.7% are large-cap listed companies with a market capitalization of over 1 trillion won, more than 12 times the proportion of small-cap companies with a market capitalization below 100 billion won (5.0%). Thanks to the strong performance of these major players, the value-up index surged by 33.2% from the beginning of the year through August, outpacing the KOSPI's rise of 32.78%.

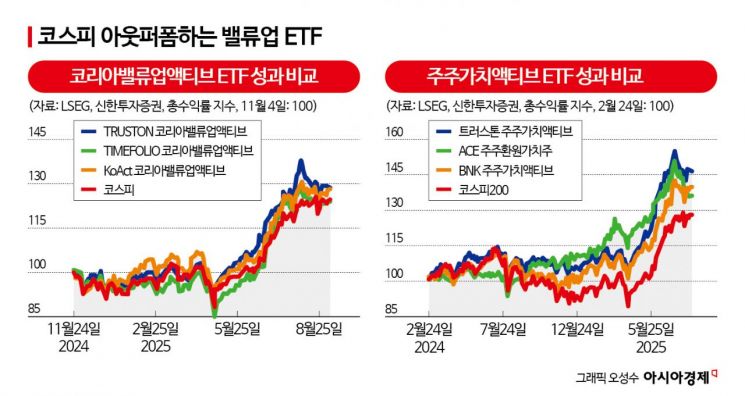

Park Wooyeol, a senior researcher at Shinhan Investment & Securities, explained, "After the value-up exchange-traded fund (ETF) was listed in November last year, its 10-month performance was measured at 24.6%, surpassing the KOSPI. The fact that the value-up index, which also includes underperforming KOSDAQ stocks, outperformed the KOSPI indicates that the program and participating stocks are delivering solid results." As of the end of last month, the total net assets of the 12 value-up ETF products stood at 829.4 billion won, a 67% increase from the initial amount of 496.1 billion won in November last year.

Will the "Third Amendment to the Commercial Act" Trigger a Boxpi Breakout?

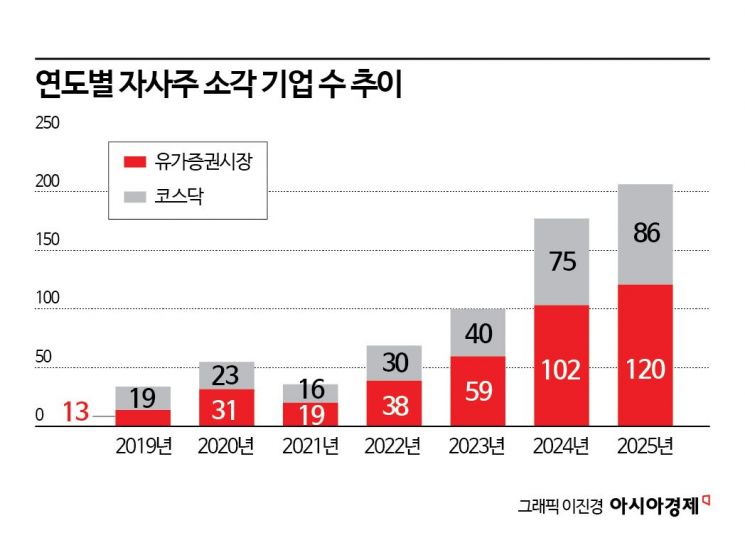

With the regular National Assembly session kicking off on September 1, discussions on the "third amendment to the Commercial Act," which includes the mandatory cancellation of treasury shares, are expected to intensify, raising expectations that this could serve as a catalyst for a KOSPI rebound. In fact, from August 25, when the amendment was announced, to September 1, holding companies with a high proportion of treasury shares such as SK (+14.0%), LS (+9.5%), and HD Hyundai (+7.0%) saw notable gains.

Kim Jangwon, a researcher at BNK Investment & Securities, stated, "In September, as the issue of handling treasury shares comes to the fore, stock prices will diverge depending on the proportion of treasury shares and the willingness to execute shareholder returns. I recommend focusing on SK, which is expected to benefit from asset securitization and rebuilding effects; LS and CJ, which have high proportions of unlisted subsidiaries and are expected to improve their value; and small and mid-sized holding companies with policy support and business competitiveness."

However, there are warnings that even among companies that have carried out large-scale treasury share cancellations, stock price trends have diverged depending on individual supply and demand, so caution is needed. For example, HMM (2.1 trillion won), Meritz Financial Group (551.4 billion won), and NAVER (368.4 billion won) decided on large-scale treasury share cancellations last month, but their stock price changes over the month were -5.76%, +9.24%, and -8.72%, respectively. Meanwhile, disclosures of exchangeable bonds (EB) targeting treasury shares, which are viewed negatively for stock prices, have reached 26 cases since May this year alone, double last year's total of 13, but there have also been cases like SNT Holdings where the stock price actually rose, making this a variable to watch.

Shin Hyonyong, a researcher at Yuanta Securities, emphasized, "Before the mandatory cancellation of treasury shares is implemented, companies are likely to begin actively reducing their treasury share holdings, possibly through disposals. It is important to conservatively select companies that are likely to cancel treasury shares for the purpose of shareholder returns that meet market expectations, rather than for management control."

Han Jiyeong, a researcher at Kiwoom Securities, predicted, "The KOSPI in September will remain in a phase of searching for direction. Governance improvement measures such as the passage of the first and second amendments to the Commercial Act and the third amendment centered on mandatory treasury share cancellation will provide downside rigidity to the index."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.