Record Surge in Overseas Securities Investments by Korean Institutions

Valuation Gains Boosted by U.S. Stock Rally,

Continued Investment Driven by Rate Cut Expectations

The overseas securities investment balance of major Korean institutional investors, such as asset management companies and securities firms, increased by nearly 35 billion dollars over the past three months, marking the largest quarterly increase on record. This surge was driven by a significant expansion in valuation gains as U.S. stock prices soared, as well as increased investments fueled by ongoing expectations of U.S. interest rate cuts. The balance also set a new all-time high for the second consecutive month.

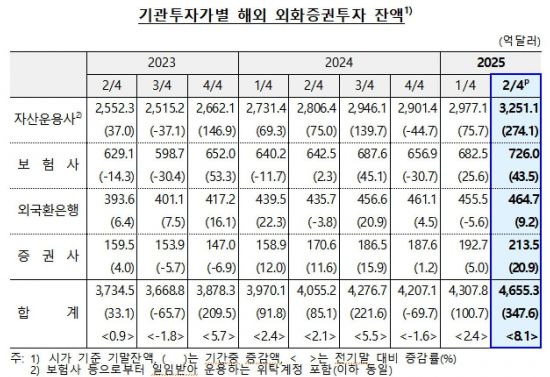

According to the "Trends in Foreign Currency Securities Investments by Major Institutional Investors in the Second Quarter" released by the Bank of Korea on August 29, the foreign currency securities investment balance (based on market value) of major institutional investors-including asset management companies, insurance companies, foreign exchange banks, and securities firms-stood at 465.53 billion dollars as of the end of June 2025. This is the highest quarter-end balance ever recorded. The increase was also the largest on record, rising by 34.76 billion dollars (8.1%) compared to the first quarter of this year.

The foreign currency securities investment balance had expanded from 387.83 billion dollars in the fourth quarter of 2023 to 427.67 billion dollars in the third quarter of last year, before briefly dipping to 420.71 billion dollars in the fourth quarter of last year. It rebounded to 430.78 billion dollars in the first quarter of this year. Despite valuation losses caused by a decline in U.S. stock prices, institutional investors increased their investments through bargain buying, leading to the rebound.

The Bank of Korea explained that the record increase in the second quarter was due to expanded valuation gains from a strong U.S. stock market, as well as continued expectations of U.S. interest rate cuts, which led to increased net investments in both foreign stocks and foreign bonds. A Bank of Korea official stated, "The expansion in the balance is largely attributable to stock price factors. As U.S. stocks rose significantly, the valuation of stocks held by asset management companies-which account for the largest share of the balance-also increased substantially." In fact, the U.S. S&P index fell by 4.6% in the first quarter of this year but rose by 10.6% in the second quarter.

By product, the balance of foreign stocks rose by 24.29 billion dollars from the previous quarter to 257.16 billion dollars. The increase was driven by valuation gains from rising stock prices in major countries, including the U.S., and by expanded net investments by asset management companies.

The balance of foreign bonds increased by 9.19 billion dollars during the same period to 176.02 billion dollars. Continued expectations of interest rate cuts by the U.S. Federal Reserve led to increased net investments by insurance companies and asset management companies. Korea Paper, which refers to foreign currency-denominated securities issued overseas by domestic companies, increased by 1.28 billion dollars, mainly through foreign exchange banks and securities firms.

By investor type, the investment balance of asset management companies rose by 27.41 billion dollars from the previous quarter to 325.11 billion dollars. Insurance companies also saw an increase of 4.35 billion dollars, reaching 72.6 billion dollars. Securities firms increased their balance by 2.09 billion dollars to 21.35 billion dollars, while foreign exchange banks saw a rise of 920 million dollars to 46.47 billion dollars. All investor types recorded increases in their investment balances.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.