Down 4.94% This Month... Rebound Hopes Rise with Two Days of Gains

Institutional Buying Continues; Signs of Foreign Investor Turnaround

Focus on Nvidia's Earnings Announcement Scheduled for This Week

SK Hynix has shown a strong rebound over the past two days, recording significant gains. Whether this rebound will continue is expected to be determined by Nvidia's earnings, which are scheduled to be announced this week.

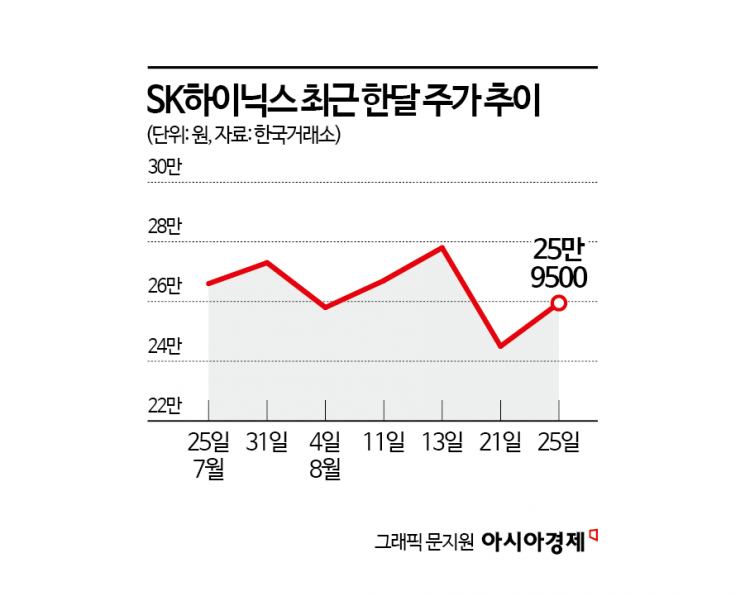

According to the Korea Exchange on August 26, SK Hynix closed at 2,590,000 won, up 3.39% from the previous day. This followed a 2.45% increase on August 22, marking two consecutive days of substantial gains.

Institutional investors drove the rebound in SK Hynix shares. Over the past week, institutions made net purchases of SK Hynix worth 253.1 billion won, making it the most bought stock by institutions. Foreign investors also joined in. Although foreign investors, who were the largest buyers of SK Hynix in the first half of the year, had shifted to net selling in the second half, they made a rare net purchase of 105.1 billion won on this day.

The announcement of mass production of a new product with the highest density in existence served as a catalyst for the stock price increase. On the previous day, SK Hynix announced that it had completed development and begun mass production of its 321-layer 2TB Quad-Level Cell (QLC) NAND product. NAND is a type of non-volatile memory semiconductor that retains data even when the power is off. Depending on how many bits of information are stored in a single cell, the standards are divided into Single-Level Cell (SLC, 1 bit), Multi-Level Cell (MLC, 2 bits), Triple-Level Cell (TLC, 3 bits), Quad-Level Cell (QLC, 4 bits), and Penta-Level Cell (PLC, 5 bits).

This new product is optimized for ultra-high-capacity enterprise solid-state drives (eSSD) used in artificial intelligence (AI) servers. SK Hynix stated, "For the first time in the world, we have implemented NAND with more than 300 layers using QLC technology, once again breaking through technical limitations," adding, "With this product, which has the highest density among existing NAND products, we will target the AI data center market in earnest starting in the first half of next year after obtaining global customer certification."

SK Hynix's stock price had been sluggish since hitting 3,000,000 won last month. Concerns over next year's earnings due to changes in the high bandwidth memory (HBM) market share had an impact, and more recently, as speculation about an AI bubble emerged and Nvidia saw a sharp decline, SK Hynix also experienced a significant drop. However, securities analysts predict that SK Hynix will maintain its dominant market share through next year. Son Injun, a researcher at Heungkuk Securities, said, "Concerns about intensifying competition among suppliers persist due to uncertainties in next year's HBM supply contracts, which in turn leads to worries about SK Hynix's 2026 earnings due to potential changes in market share. While a decrease in market share compared to this year is expected, the decline is not likely to be significant, and SK Hynix is expected to maintain its dominant market share in the HBM market next year while also benefiting from strong AI demand."

Park Yuak, a researcher at Kiwoom Securities, commented, "SK Hynix's HBM sales next year are expected to grow by 14% year-on-year to 40.3 trillion won, continuing its growth trend. Although HBM4's market share within Nvidia is expected to decline compared to this year's HBM3e, its market share within the application-specific integrated circuit (ASIC) sector is projected to rise significantly. In addition, the supply price of HBM4 will increase substantially, contributing to earnings growth next year."

In the short term, whether SK Hynix can continue its rebound will likely depend on Nvidia's second-quarter (May-July) earnings, which are scheduled for August 28. Han Jiyoung, a researcher at Kiwoom Securities, said, "Nvidia's quarterly earnings have typically exceeded market expectations, so for this second quarter, the focus will be on profitability improvements, AI chip demand outlook, and any changes in guidance. Nvidia's results will have an impact across the domestic semiconductor sector, including SK Hynix and Samsung Electronics, so later in the week, these companies' earnings events will be at the center of the stock market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.