Operating Cash Flow Turns Negative for the First Time in 10 Years

Accounts Receivable Soar 145% in a Year, Cash Assets Plunge 36%

Unsold Home Rates Near 50% in Icheon and Pyeongtaek

Vicious Cycle: Pre-Sale Shortfalls Lead to Uncollected Receivables and Cash Crunch

Vice President Embezzlement, Delisting Risk, and Special Prosecutor Probe Add External Pressure

Seohui Construction, the leading company in the regional housing cooperative (Ji-Ju-Taek) sector, is facing instability. For the first time in the past 10 years, its operating cash flow has turned negative. Outwardly, the company is recording the highest profit margins in the industry, but internally, cash is steadily leaking out. With suspicions of political favoritism and even a delisting warning, the company is now facing an unprecedented crisis due to these external pressures.

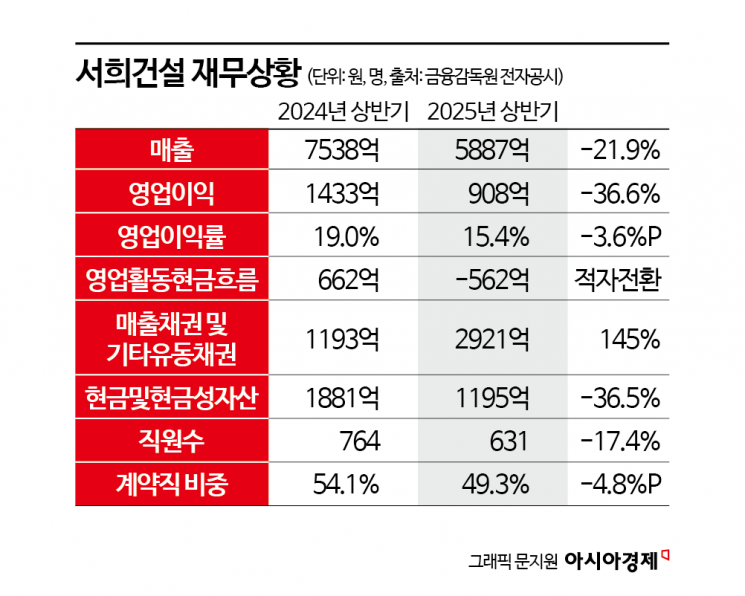

According to the Financial Supervisory Service's electronic disclosure on August 26, Seohui Construction recently reported consolidated sales of 588.7 billion won for the first half of the year. This represents a 21.9% decrease compared to the same period last year (753.8 billion won), and operating profit dropped by 36.6% to 90.8 billion won. The operating profit margin also declined from 19.0% to 15.4%. Although profitability has decreased, it still remains at the highest level in the industry.

Beneath the surface, however, cash is rapidly flowing out. In the first half of this year, operating cash flow turned negative at minus 56.2 billion won. This is an unprecedented figure in the past 10 years. Since 2015, Seohui Construction has never posted negative cash flow on a semiannual basis, making this an unusual occurrence.

The negative shift in cash flow is a red flag indicating a deterioration in the "quality of earnings." Operating profit is an accounting figure, whereas cash flow represents actual money received. This discrepancy demonstrates that a significant portion of the profits recorded on the books is not being realized as cash.

In particular, Seohui Construction's accounts receivable and other current receivables totaled 292.1 billion won, a 145% increase year-on-year. In the industry, if accounts receivable exceed 30% of sales, it is considered a liquidity warning. Seohui Construction's receivables accounted for 49.6% of sales. Meanwhile, cash and cash equivalents plunged by 36.5%, from 188.1 billion won to 119.5 billion won. In short, this means that "construction was completed, but payment was not received," resulting in an increase in outstanding receivables and a drying up of cash in the bank.

An official from a major accounting firm stated, "Operating profit is an accounting figure, while operating cash flow shows the actual cash received. The gap between these two figures means that most of the profits on the books have not been converted into cash." He added, "In particular, when the pre-sale rate is low and there are many uncollected receivables, liquidity deteriorates compared to the recognized profit."

Nearly 90% of Seohui Construction's total sales come from the regional housing cooperative business. If pre-sales fall short, a vicious cycle of delayed collections, increased receivables, and worsening cash flow repeats itself. Although Seohui Construction does not disclose pre-sale rates for each project in its business reports, these can be indirectly confirmed through local government data on unsold homes. According to Gyeonggi Province, as of the end of June, 214 out of 347 units at Icheon Seohui Star Hills remained unsold. Even after one year and five months since the start of sales, nearly 60% of the units remain uncontracted. Similarly, at Pyeongtaek Hwayang Seohui Star Hills Central Park Phase 2, supplied around the same time, 162 out of 390 units remain unsold. These low pre-sale rates directly translate into accounts receivable risk.

Seohui Construction is also facing red flags regarding management transparency. The company is under review for delisting due to embezzlement charges against a current vice president, and trading has been suspended. There is also a special prosecutor's investigation underway over allegations of political favoritism, specifically claims that luxury goods were sent to First Lady Kim Keonhee. The Ministry of Land, Infrastructure and Transport has launched a nationwide investigation into regional housing cooperative projects, with sites constructed by Seohui Construction among the main targets.

Amid these "triple risks," some point out that the true nature of Seohui Construction is being exposed. Liquidity risks hidden behind the illusion of profitability, the collapse of external trust, and the structural limitations of the cooperative project model are all at play simultaneously. An official from the investment banking industry commented, "This is an era where cash flow and risk management capabilities are valued more than accounting profits. If this continues, the company may face a vicious cycle in which it cannot raise funds, attract investment, or win new contracts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.