Why Hyundai Motor Group Acquired Boston Dynamics

Humanoid Robots: The Key to Reducing Labor Costs in Auto Manufacturing

Freedom from Labor and Tariff Risks

Humanoid Robot Operating Costs Comparable to Labor Costs in China

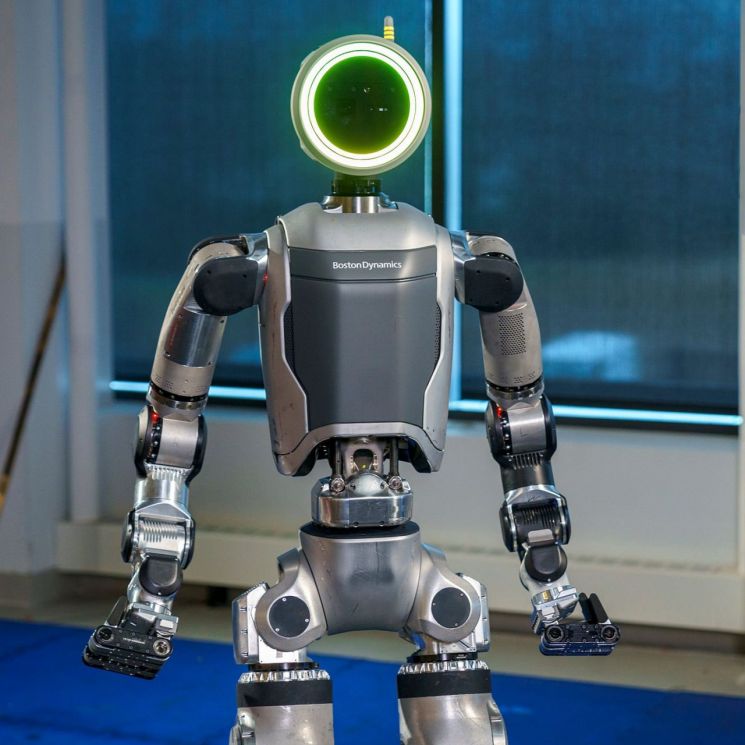

Boston Dynamics' humanoid robot Atlas is picking up an object in a crouching position. Photo by Boston Dynamics

Boston Dynamics' humanoid robot Atlas is picking up an object in a crouching position. Photo by Boston Dynamics

#. The year is 2035, at Hyundai Motor's Ulsan plant assembly line. The humanoid robot Atlas, which looks just like a human, is crouched down, holding bundles of wires in various colors and working on the line. This task-installing wiring harnesses into car bodies-is known as one of the most challenging processes in automobile manufacturing. This is because the length and arrangement of the electrical and electronic wiring must vary depending on the model and options. To deploy robots in this process, artificial intelligence (AI) technology capable of complex human-like thinking, judgment, and control is essential.

Equipped with AI, the humanoid robot connects wires one by one on the conveyor belt with dexterous, human-like hands. Another robot is responsible for the final inspection of the finished product. Human workers only need to walk around the factory and check the software of any robots that have issues. When a problem arises, the robots recognize it themselves and request inspections via the factory's automation network. Robots operate around the clock, 24 hours a day, even at night and on weekends, with no concerns about wage increases or strikes. When a new model is launched or a process is added or changed, all that is needed is to install a new program.

This is an imagined depiction of Hyundai Motor's factory ten years from now. While it may seem like a distant future of automation, technological progress always moves faster than the public expects. As early as the end of this year, Hyundai Motor Group plans to pilot Boston Dynamics' humanoid robot Atlas-developed by its affiliate Boston Dynamics (BD)-at its new U.S. plant, Hyundai Motor Group Meta Plant America (HMGMA). Initially, Atlas will be deployed for simple tasks such as designating the order of parts, but as robot technology advances, its role in the manufacturing process is expected to expand.

Why Did Hyundai Motor Group Acquire BD?

In 2021, Hyundai Motor Group acquired the American robotics company Boston Dynamics (BD), investing approximately 1 trillion won to purchase 80% of the shares previously held by Japan's SoftBank. This amount included personal funds from Hyundai Motor Group Chairman Euisun Chung. Why did Chairman Chung go so far as to use his own money to acquire BD? It was because he saw the potential of BD in the rapidly growing robotics market.

The company possessed unrivaled, industry-leading technology in robotics hardware. At the time of the acquisition, BD was famous for videos showcasing robots with agile movement capabilities, such as somersaulting, traversing sloped stepping stones, and jumping over obstacles. Superior robot movement means advanced actuators and control capabilities, sophisticated sensors, and real-time object recognition through AI-all working seamlessly together. Recognizing BD's technological prowess, Hyundai Motor Group anticipated the growth of the future robotics market and made a bold investment. Prior to the acquisition, Chairman Chung had outlined a vision at a 2019 town hall meeting to allocate the group's future revenue as 50% from automobiles, 30% from urban air mobility (UAM), and 20% from robotics.

After acquiring BD, Hyundai Motor Group's top priority was to preserve the company's identity as an American enterprise. Massachusetts, where BD is headquartered, is a global robotics R&D hub with over 400 robotics companies and more than 70 research institutions. The world's top robotics talent gathers here. Typically, when Korean companies acquire foreign firms, they try to impose Korean corporate culture, but this often leads to the departure of overseas talent unaccustomed to Korea's hierarchical, organization-centric culture.

To avoid such side effects, Hyundai Motor Group adopted a strategy of respecting local culture as much as possible. For example, 42dot, Hyundai Motor Group's global software center, established overseas branches to attract top software talent worldwide, and Supernal, its UAM development division, was spun off as an independent U.S. entity-all in line with this approach. BD now serves as a global R&D hub for Hyundai Motor Group's robotics division. Going forward, BD will focus on developing humanoid robots powered by AI, while Hyundai Motor Group will leverage its world-class manufacturing capabilities to handle mass production, creating strong synergy between the two.

Why Are Automakers Investing in Robotics?

Recently, automakers have begun introducing humanoid robots into production sites and, in some cases, directly investing by acquiring stakes in robotics companies. In addition to Hyundai Motor Group, Tesla is developing its own humanoid robot, Optimus, while BMW is testing the potential of the Figure 02 humanoid robot-created by U.S. startup Figure AI-at its American plant. Mercedes-Benz has invested in U.S. robotics company Apptronik and is trialing its humanoid robots at its digital factory in Germany and its plant in Hungary.

Chinese companies are even more proactive. Guangzhou Automobile Group (GAC) unveiled its intelligent humanoid robot "GoMate" last year and has been applying it across various industries since this year. Geely has partnered with Chinese humanoid specialist UBTECH to deploy the "Walker S" robot series at its premium Zeekr plant. XPeng has also been operating its self-developed "Iron" robot in its electric vehicle production process since 2024.

At the end of this year, Hyundai Motor Group Meta Plant America (HMGMA) will conduct a trial deployment of Boston Dynamics' humanoid robot Atlas. Provided by Hyundai Motor Group

At the end of this year, Hyundai Motor Group Meta Plant America (HMGMA) will conduct a trial deployment of Boston Dynamics' humanoid robot Atlas. Provided by Hyundai Motor Group

The reason the automotive industry is deploying humanoid robots on production lines is to reduce costs. Global automotive plants are already highly automated. For instance, Tesla's Shanghai Gigafactory, considered the most automated among automakers, boasts an automation rate of 95%. This means robots are already handling most of the production process, with minimal human intervention. However, the remaining 5% remains a challenge. This last 5%-which still requires human touch-is mainly concentrated in the assembly process. Assembly involves fitting about 30,000 parts, such as doors, seats, interior materials, electronic components, and wiring, to the vehicle, and the number of possible combinations varies widely depending on the model and options.

Moreover, assembly parts differ in size, shape, and assembly order, requiring highly advanced judgment from workers. Because there are many small parts and the final quality is directly affected by the strength and precision of assembly, careful handling is essential. This is why humanoid robots-capable of thinking like humans and picking up even the smallest parts with human-like hands-are needed. If automakers achieve full automation of the assembly process, they can significantly reduce labor costs, which account for up to 10% of production costs. Considering that the current operating margin for global automakers is up to 10%, reducing production costs by 10% is highly significant.

Freedom from Labor and Tariff Risks

Achieving 100% automation would also free manufacturers from labor risks. Robots do not require wage increases and are not subject to production stoppages due to strikes. Manufacturers can freely adjust factory operating speeds without negotiating with unions and can operate 24 hours a day, including weekends and nights. For this reason, traditional automakers are actively adopting humanoid robots, even as they remain mindful of union concerns. Labor cost reduction is a key card for competing with Chinese companies on cost.

Reducing labor costs through robot adoption also mitigates tariff risks. The reason global automakers have built production bases primarily in emerging markets is to save on labor costs. By manufacturing parts or finished vehicles in low-wage countries and exporting them to developed markets, manufacturers have been able to increase profits. However, this supply chain value chain has recently been disrupted. The Trump administration in the U.S. raised tariff barriers on finished vehicles and parts imported into the U.S. as part of its protectionist policies. In the past, China was the global production base for the automotive market. Manufacturers produced parts in China at low cost, shipped them to plants in the U.S. and Europe for final assembly, and sold the finished vehicles in those markets. Now, with the U.S. imposing a 15% tariff on imported finished vehicles and parts, this old formula no longer works. The U.S. has also announced even higher tariffs on Chinese products, prompting the need to restructure supply chains in the auto parts industry, which has a high dependency on China.

However, if labor cost savings from humanoid robot adoption can reduce production costs by 10%, there is no longer a need to build factories in emerging markets. Cars sold in the U.S. can be produced in U.S. factories, and those sold in Europe can be produced in European factories, reducing not only labor costs but also logistics and transportation expenses. With this in mind, traditional automakers are treating the adoption of humanoid robots as a foregone conclusion in the near future. According to Samsung Securities, the hourly maintenance cost of a humanoid robot is about $3.4. This figure assumes deploying a $100,000 robot in a factory for five years, 24 hours a day, and includes the cost of full self-driving (FSD) software subscriptions, battery replacements, and other maintenance expenses.

So, what is the current hourly labor cost for Chinese automakers? According to the Harbor Report published by global consulting firm Oliver Wyman, the average labor cost per vehicle for Chinese automakers is $585. Assuming a total labor input of 160 to 190 hours per vehicle, the hourly labor cost comes out to $3.6 to $3.7. In the end, deploying humanoid robots at $3.4 per hour is comparable to, or even less than, labor costs in China.

Hyundai Motor Group Has the Ingredients for Success in the Humanoid Market

Hyundai Motor Group's humanoid robot business is well-positioned for success. First, once robots are commercialized, there is a clear customer base for direct sales. They can be deployed first at Hyundai and Kia's overseas plants, and even considered for domestic factories. Additionally, with current alliances and joint production strategies being discussed with GM, and Toyota-which has announced joint AI robot development with BD-Hyundai Motor Group can consider supplying to factories worldwide. In 2024, BD announced a partnership with Toyota Research Institute (TRI) to develop robots using generative AI. According to consulting firm McKinsey, the humanoid market, which was only $1.6 billion in 2023, is expected to grow to over $10 billion by 2030. With an expected compound annual growth rate of 25%, Hyundai Motor Group is ready to enter a market with limitless potential.

To this end, Hyundai Motor Group is building a robust supply value chain. Its key affiliate, Hyundai Mobis, is responsible for developing and manufacturing actuators-the core technology for humanoid robot hardware. The core chip powering BD's humanoid robots will be supplied by Nvidia. In March 2025, BD announced plans to enhance next-generation AI technology using Nvidia's high-performance computing platform, Jetson Thor. Jetson Thor is a high-performance computing system specially designed for physical robotics, integrating CPU, GPU, AI memory, and accelerators.

Additionally, Hyundai Motor Group is developing custom batteries for robots with Samsung SDI. The goal is to create batteries that are lightweight, have high energy density, and can be installed in various robot designs. Hyundai Motor Group is also preparing for BD's Nasdaq listing and planning large-scale fundraising. Securing significant capital through the financial markets will greatly reduce Hyundai Motor Group's direct investment burden. Continuous research and development will become possible, which is expected to have a positive impact on securing new growth engines.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.