KOSPI and KOSDAQ End Slightly Higher

Individuals and Foreign Investors Turn Net Sellers

Samsung Electronics and SK Hynix Decline

On August 14, the domestic stock market closed slightly higher. As investors adopted a wait-and-see attitude ahead of the holiday, the market appeared to lose clear direction. The KOSPI continued its sideways movement around the 3,200 level for the fourth consecutive week.

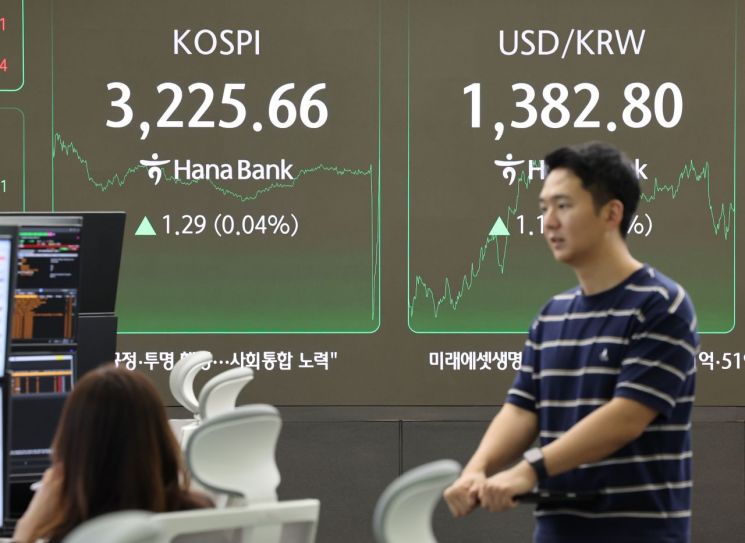

On this day, the KOSPI finished trading at 3,225.66, up 1.29 points (0.04%) from the previous session, remaining above the 3,220 mark for the second consecutive day. The index initially opened at 3,226.52, up 2.15 points (0.07%), and climbed as high as 3,239.55 in early trading, but gradually pared gains and fluctuated within a narrow range. While individuals and foreign investors sold a net 52.6 billion won and 79.9 billion won respectively, institutions were net buyers of 16.8 billion won.

Kim Ji-won, a researcher at KB Securities, commented, "Overall, the index closed flat as sector performances contrasted with the previous day," adding, "Notably, domestic large-cap semiconductor stocks weakened due to concerns over the sustainability of AI infrastructure investments, following a sharp decline in CoreWeave-a major AI infrastructure company-caused by deteriorating profitability."

Among large-cap stocks by market capitalization, results were mixed. HD Hyundai Heavy Industries (up 2.14%), LG Energy Solution (up 1.16%), Hyundai Motor (up 0.69%), Hanwha Aerospace (up 0.57%), and Kia (up 0.48%) rose, while Doosan Enerbility (down 1.50%), KB Financial Group (down 1.22%), Samsung Biologics (down 0.67%), Celltrion (down 0.57%), and SK Hynix (down 0.54%) declined.

On the same day, the KOSDAQ index closed at 815.26, up 1.16 points (0.14%) from the previous session. The index opened at 814.48, up 0.38 points (0.05%). Individuals were net sellers of 31.5 billion won, while foreign investors and institutions bought a net 53.2 billion won and 1.1 billion won, respectively.

Among the top KOSDAQ stocks by market capitalization, performances were also mixed. ABL Bio surged more than 7% on the back of a surprise second-quarter earnings announcement, followed by Pharmaresearch (up 2.86%), Ecopro (up 2.45%), Ecopro BM (up 1.68%), Peptron (up 1.29%), and Rainbow Robotics (up 0.93%). In contrast, Alteogen (down 2.67%), HLB (down 1.08%), and Samchundang Pharm (down 0.48%) ended lower.

By industry, internet retail (+3.00%), electrical products (+1.53%), transportation and logistics (+1.52%), entertainment (+1.51%), and IT services (+1.47%) closed higher. On the other hand, the display panel sector saw LG Display, which had surged the previous day, plunge more than 9% as profit-taking occurred following reports that the United States may ban imports of Chinese OLED panels. Office electronics (down 4.66%), display equipment and components (down 2.17%), and auto parts (down 2.11%) also closed lower.

As the second-quarter earnings season comes to a close, market attention is shifting back to economic indicators and interest rates. U.S. Producer Price Index (PPI) figures are set to be released tonight, with retail sales, industrial production, and the University of Michigan Consumer Sentiment Index scheduled for tomorrow. Lee Jaewon, a researcher at Shinhan Investment Corp., noted, "It is important to continuously monitor macroeconomic indicators until the September FOMC meeting," and added, "It is also necessary to watch for policy momentum, such as the proposed amendment to the Commercial Act mandating treasury share cancellation and the budget bill."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.