Leading domestic botulinum toxin (Botox) companies Daewoong Pharmaceutical, Hugel, and Medytox continued their growth momentum in the second quarter. As sales expanded in major overseas markets such as the United States, Central and South America, Asia, and the Middle East, exports of toxin products surged in tandem with the global K-beauty trend. Industry experts predict that the three companies, whose competitiveness has been proven in the global market, will maintain their growth trajectory in the second half of the year.

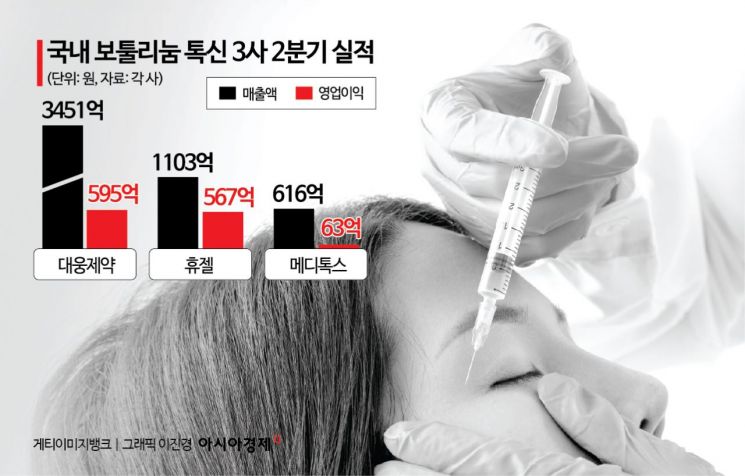

According to industry sources on August 12, Medytox surpassed 60 billion KRW in quarterly sales for the second consecutive quarter this year, marking a company first. In the second quarter, the company posted sales of 61.6 billion KRW and an operating profit of 6.3 billion KRW. While sales dipped slightly compared to the previous quarter, operating profit and net profit rose by 15.4% and 144.5%, respectively. Compared to the same period last year, sales, operating profit, and net profit all declined, but exports of botulinum toxin increased by 17% quarter-on-quarter and 16% year-on-year.

Medytox plans to further expand exports in the second half of the year by leveraging the domestic recognition of its flagship product, Neurux, and increasing the number of overseas markets where it is registered. The company is also accelerating new product development, including resubmitting its next-generation liquid toxin 'MT10109L' for FDA approval in the United States and obtaining approval for 'MT921,' the world's first cholic acid-based fat-dissolving injection. The mitigation of litigation risks is also a positive factor. As some long-standing legal disputes have concluded, the company's burden of legal expenses has eased, which is likely to improve profitability in the second half. Daewoong Pharmaceutical's botulinum toxin product Nabota achieved sales of 115.4 billion KRW in the first half of the year.

This represents approximately 28% growth compared to the same period last year, and at this pace, annual sales are expected to exceed 200 billion KRW. Nabota, which became the first Asian product to receive FDA approval in 2019, is currently sold in the U.S. under the brand name Jeuveau. It has demonstrated global competitiveness by capturing a 14% market share in the U.S., the world's largest aesthetic toxin market, ranking second overall.

The company is also expanding in South America and Southeast Asia. In Brazil, Nabota has grown more than tenfold since its initial entry in 2018, leading to an export contract worth 180 billion KRW. In Thailand, the company secured a renewed export contract worth 73.8 billion KRW, three times the size of its previous agreement.

Hugel reported consolidated sales of 110.3 billion KRW and an operating profit of 56.7 billion KRW in the second quarter of this year. These figures represent year-on-year increases of 15.5% and 33.6%, respectively, marking the company's highest-ever quarterly performance.

For the first half of the year, cumulative sales exceeded 200 billion KRW and operating profit surpassed 95 billion KRW. Hugel's flagship botulinum toxin product, Botulax (export name Letibot), generated 61.2 billion KRW in second-quarter sales, growing more than 20% year-on-year. Notably, Hugel is the only domestic company to have entered all three of the world's top toxin markets-the United States, China, and Europe. In the U.S., the company began full-scale shipments after its initial launch in March, rapidly increasing its market share.

The outlook for these three companies in the second half of the year remains bright. The global rise of K-beauty as a premium brand is driving increased demand for cosmetic and aesthetic procedures worldwide.

In particular, North America, Central and South America, and the Middle East are seeing significant growth potential for the toxin market, as economic development leads to increased spending on aesthetic medical services. An industry insider commented, "The three companies are expanding their share of the global toxin market through differentiated technology, quality, and localization strategies. If new approvals, distribution network enhancements, and new product launches continue in the second half, it is highly likely that this year's total sales will reach an all-time high."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.