Growth in Household Loans Slows After June 27 Lending Restrictions

Government: "No Significant Change in Jeonse Prices, Temporary Increase in Credit Loans"

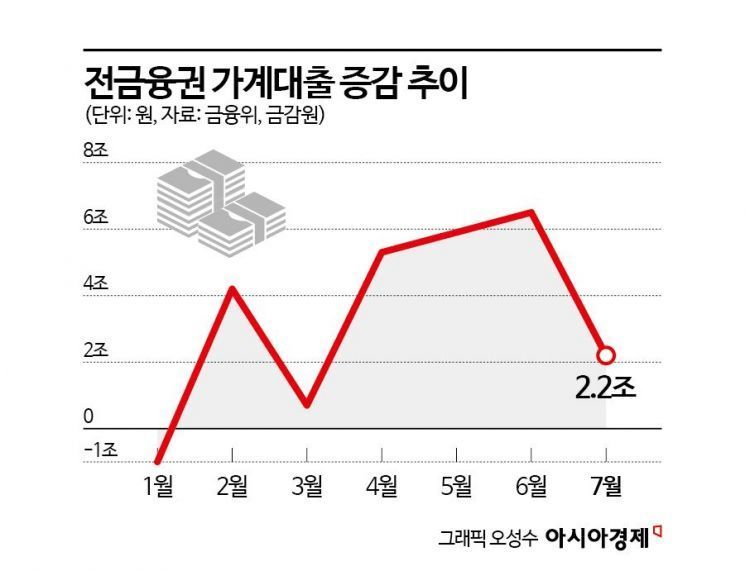

Last month, household loans across all financial sectors increased by 2.2 trillion won compared to the previous month. After the government announced strengthened household debt management measures on June 27, 2025, and imposed stricter lending regulations, the growth rate of household loans has slowed somewhat.

Growth in Household Loans Slows After June 27 Lending Restrictions

The Financial Services Commission held a household debt review meeting at the Seoul Government Complex on August 13, 2025, and announced that household loans across all financial sectors increased by 2.2 trillion won last month compared to the previous month. This represents a significant decrease in the growth rate compared to the 6.5 trillion won increase recorded in the previous month.

Household loans in the financial sector had previously decreased by 900 billion won in January, but then surged by 4.2 trillion won in February, 5.3 trillion won in April, and 6.5 trillion won in June. This sharp increase was largely due to a spike in apartment prices in Seoul, which led to a surge in demand for borrowing to purchase homes.

To curb the overheating of housing prices, the government introduced strengthened household debt management measures on June 27, 2025, which included tighter lending regulations. According to the government, this has led to a clear slowdown in the growth of household loans.

Breaking down last month's household loans by category, mortgage loans increased by 4.1 trillion won compared to the previous month, which is a smaller increase than the 6.1 trillion won rise in June. Other loans, including credit loans, decreased by 1.9 trillion won, returning to a decline for the first time in four months since March.

By sector, household loans from banks increased by 2.8 trillion won in July, a significant reduction from the 6.2 trillion won increase in the previous month. Specifically, the increase in bank-originated mortgage loans shrank from 3.8 trillion won to 2.2 trillion won compared to the previous month. Policy loans also saw a slight reduction in growth, from 1.3 trillion won to 1.2 trillion won. Other loans shifted to a decrease, from an increase of 1.1 trillion won to a decrease of 600 billion won compared to the previous month.

Last month, household loans from the secondary financial sector decreased by 600 billion won, reversing from a 300 billion won increase in the previous month. Mutual finance institutions saw their loan growth shrink from 1.2 trillion won to 300 billion won, while savings banks (from -40 billion won to -300 billion won) and insurance companies (from -300 billion won to -400 billion won) both saw their declines widen compared to the previous month.

Participants at the meeting evaluated that the growth in household loans in July was at its lowest level since March, when loans increased by 700 billion won, and was also significantly lower than the year-on-year increase of 5.2 trillion won in the same month last year.

They diagnosed that, despite the seasonal factors in July that typically drive up demand for funds, the slowdown in both mortgage and other loan growth was due to the effects of the strengthened household debt management measures and the implementation of the three-stage stress Debt Service Ratio (DSR). However, they also forecast that, considering already completed housing transactions and approved loan amounts, the upward trend in household loans-especially mortgage loans-could continue for the time being.

No Significant Change in Jeonse Prices and Temporary Increase in Credit Loans

Additionally, participants addressed concerns that the implementation of strengthened household debt management measures is causing Jeonse prices to rise, stating that recent trends in Jeonse prices have shown little change and that the current measures are not causing significant instability in the Jeonse market. However, they noted that volatility in Jeonse prices could increase in the second half of the year due to moving season demand, and emphasized the need for close monitoring.

A government official stated, "It is true that the growth in household loans stabilized significantly in July due to the effects of strengthened household debt management measures." However, the official also explained, "August is typically a period when household loan growth expands due to seasonal factors such as moving demand and vacation-related funding needs."

The official continued, "We will continue to closely monitor market conditions until the growth in household loans remains consistently stable, and, if necessary, immediately and proactively implement available measures such as further tightening the Loan-to-Value (LTV) ratio in regulated areas and adjusting macroprudential regulations (e.g., risk weightings for mortgage loans)."

The official also added, "The recent rapid increase in credit loans reported in August is a temporary phenomenon driven by demand for public offering subscriptions. As subscription deposits are being refunded, the scale of household loan growth this month has so far remained at a stable level."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.