Why Is the Hydrogen Vehicle Market So Challenging?

How Hyundai Motor Expands Its Hydrogen Business

Hydrogen's Market Potential: Strengths in Long-Distance Transport

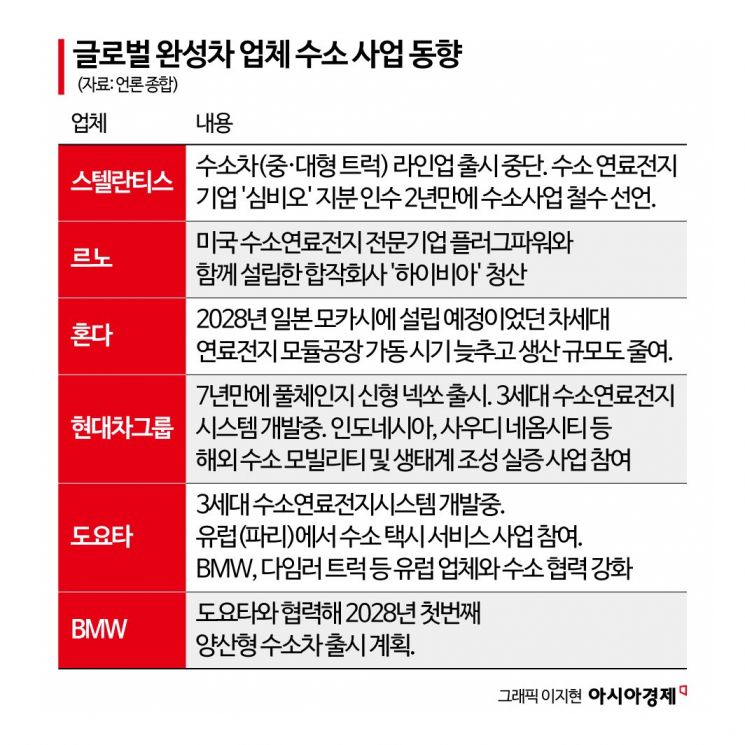

Last month, multinational automaker Stellantis announced it would halt its hydrogen business. Stellantis, which owns 14 brands including Peugeot, Fiat, Chrysler, Jeep, and Maserati, had planned to produce medium- and large-sized hydrogen fuel cell (hydrogen vehicle) vans at its factories in France and Poland in the second half of the year. The company canceled the launch of new vehicles and reassigned its development staff to other projects.

This decision comes just two years after Stellantis entered the hydrogen commercial vehicle business by acquiring a 33% stake in French hydrogen fuel cell system specialist Symbio in 2023. Stellantis's abrupt withdrawal from a business it had entered with high ambitions has fueled skepticism about hydrogen vehicles in Europe. Jean-Philippe Imparato, Chief Operating Officer of Stellantis, explained that the withdrawal was a "responsible decision" necessary to secure competitiveness in the electric and hybrid markets and to meet customer expectations.

French automaker Renault is also facing setbacks in its hydrogen business. In 2021, Renault Group established a joint venture called "HYVIA" with U.S. hydrogen fuel cell specialist Plug Power, marking its full-scale entry into the hydrogen vehicle market. However, in its fourth year, HYVIA decided to undergo legal liquidation in February this year. This was because demand for hydrogen vehicles in Europe did not grow as quickly as expected, resulting in no revenue, while massive development costs continued to mount. The company tried to find a buyer or new investor during the rehabilitation process, but this proved difficult. With heavy losses from large-scale investments, it became impossible to continue funding. Although Renault Group maintains that it will continue its hydrogen business, considering that its key partner has been pushed to liquidation, it seems unlikely that the company will pursue the business with the same determination as before.

Honda is also slowing down its hydrogen business more than expected. Honda has decided to delay the start of operations at its next-generation fuel cell module factory, which was scheduled to be established in Moka, Tochigi Prefecture, Japan, by 2028. The production scale will also be reduced from the originally planned 30,000 units, and as a result, Honda was excluded from the Japanese Ministry of Economy, Trade and Industry's green transition subsidy program. Honda, along with Toyota, is a leading company in Japan's hydrogen fuel cell business. The company has expanded the use of hydrogen fuel cells not only in passenger cars but also in commercial vehicles, generators, and construction machinery. Last year, Honda launched the "CR-V e:FCEV," a hydrogen vehicle with plug-in hybrid functionality, making a full-fledged entry into the U.S. hydrogen vehicle market, but this year, the company is scaling back its business plans.

Why Is the Hydrogen Vehicle Market So Challenging?

Why are these automakers pulling out of the hydrogen vehicle market? There is no simple answer. Let's look at it from a business perspective. Stellantis and Honda have recently faced unfavorable financial conditions. They have no choice but to prioritize and invest in businesses that can yield short-term profitability. Renault Group also recently replaced its CEO. For these companies, transitioning to hybrids and electric vehicles takes precedence over hydrogen vehicles. At a critical moment where each step determines their survival, they cannot bet on a business with uncertain prospects for success. Hydrogen vehicles are not a business that can generate profits in the short term. Currently, it is impossible to sell hydrogen vehicles in any global market without subsidies. Without government assistance, selling more hydrogen vehicles only leads to greater losses.

So why can't hydrogen vehicles be profitable? From an industrial and technological standpoint, hydrogen vehicles face a formidable competitor in electric vehicles within the eco-friendly vehicle sector. As the eco-friendly vehicle market has shifted to focus on electric vehicles, it seems unlikely that hydrogen vehicles can reclaim leadership unless they offer breakthrough innovation.

Technologies that can secure cost competitiveness are needed across the entire value chain, from vehicle development to hydrogen production and refueling. Either the launch price of hydrogen vehicles must become lower than that of electric vehicles, or the efficiency and convenience of hydrogen refueling infrastructure must improve, or the price of hydrogen must fall to around 3,000 won per kilogram. Otherwise, consumers have no reason to choose hydrogen vehicles over electric vehicles.

Considering the current technology level and economies of scale, hydrogen vehicles are still more than 50% more expensive than electric vehicles. Before subsidies, the domestic launch price of Hyundai's Nexo is 76.44 million won, while Hyundai's comparable electric vehicle, the Ioniq 5, starts at 49.33 million won. Hydrogen vehicles are inevitably more expensive due to costly fuel cell stacks and hydrogen storage tanks. Government support is essential to accelerate technological development and open up the initial market. By relying on government support to expand distribution and achieve economies of scale, component costs can be reduced and further technological development becomes feasible. However, even this process is lagging behind electric vehicles. This is because governments around the world are allocating a larger portion of their carbon neutrality budgets to electric vehicles rather than hydrogen vehicles.

How Hyundai Motor Expands Its Hydrogen Business

Even within Hyundai Motor Group, questions about the feasibility of hydrogen vehicles have been consistently raised. For the company's main profit-generating divisions (internal combustion engines and hybrids), the hydrogen division is seen as a money sink with little to show for it. Meanwhile, the hydrogen division bears the responsibility and burden of solving difficult problems to secure the company's future. Therefore, it is crucial for management to present a clear vision and resolve internal conflicts, and Chairman Euisun Chung's stance on this matter is unwavering. At CES 2024, Chairman Chung declared, "The hydrogen business is for future generations." He made it clear, both internally and externally, that the company would continue to invest steadily in hydrogen, even if it does not generate immediate profits.

Furthermore, the group underscored the importance of the hydrogen business by assigning Vice Chairman Jaehoon Chang, the group's second-in-command, overall responsibility for it. Earlier this year, Hyundai Motor Group established the Energy Hydrogen Business Division under the Planning and Coordination Office overseen by Vice Chairman Chang, designating it as the control tower for hydrogen business across affiliates. Last year, the company expanded its hydrogen fuel cell brand "HTWO" into a hydrogen value chain business brand, signaling its intent to cover the entire process from hydrogen production, storage, and transportation to utilization, rather than simply manufacturing fuel cells. Hyundai Motor also decided to build its first domestically operated fuel cell plant in Ulsan, with construction starting this year and mass production targeted for 2028.

At CES 2024, the world's largest electronics and IT exhibition, Jaehoon Chang, Vice Chairman of Hyundai Motor Group (center in the photo), is seen presenting and discussing hydrogen solution content. Provided by Hyundai Motor Company. Photo by Hyundai Motor Company

At CES 2024, the world's largest electronics and IT exhibition, Jaehoon Chang, Vice Chairman of Hyundai Motor Group (center in the photo), is seen presenting and discussing hydrogen solution content. Provided by Hyundai Motor Company. Photo by Hyundai Motor Company

What are the realistic reasons Hyundai Motor Group can continue to invest in the hydrogen business? First, the company believes it is ahead in the transition to electrification, including hybrids and electric vehicles. Having already addressed the most urgent challenges, Hyundai Motor Group now has room to take a long-term view of the future.

In the first half of this year, Hyundai Motor Group overtook Volkswagen Group to become the world's second most profitable automaker. Hyundai Motor and Kia posted operating profits of 13 trillion won, surpassing Volkswagen Group's 10.8 trillion won during the same period. This was largely due to increased profits from recognized technological prowess in hybrids, where market demand is surging. Although unexpected variables such as tariffs imposed by the Trump administration in the United States emerged this year, Hyundai Motor Group is considered to be in a better position than competitors struggling with the transition to electric vehicles and a lack of hybrid technology.

Another reason is that hydrogen has already become the most important "heritage" for Hyundai Motor Group. Compared to German, American, and Japanese companies, Hyundai Motor Group has a shorter history in the automotive industry and has always felt a sense of inferiority as a latecomer lacking heritage. However, as technology has shifted from internal combustion engines to electric vehicles, and from electric vehicles to hydrogen vehicles, Hyundai Motor has been able to write a new chapter in its own history. Hyundai Motor established its hydrogen fuel cell R&D organization in 1998, about 30 years ago. Around the same time, many automakers such as DaimlerChrysler, GM, BMW, Toyota, and Ford began researching hydrogen vehicles, but to this day, only Hyundai Motor and Toyota have consistently released mass-produced hydrogen vehicles.

Finally, Hyundai Motor is expanding its business based on a strong belief in the future growth potential of the hydrogen vehicle market. Without this confidence in market potential, long-term investment would not have been possible. In particular, the company is focusing on the commercial vehicle markets in the United States and China, where long-distance operation is common and government support is strong.

Hydrogen's Market Potential: Strengths in Long-Distance Transport

Hydrogen has significant value as a complementary energy source to electric vehicles and batteries, rather than as a replacement. Its advantages become more pronounced as travel distances increase. Demand for hydrogen energy is expected to grow rapidly, especially in long-distance transport. The International Energy Agency (IEA) projects that global hydrogen consumption will increase more than sixfold from 85 million tons in 2020 to 530 million tons in 2050, and that hydrogen's share of total energy consumption will rise from 1.7% in 2020 to 5% in 2040 and 14% in 2050.

In Korea, hydrogen utilization is essential for achieving carbon neutrality. The country has limited land and mountainous terrain, which restricts the large-scale installation of solar and wind power facilities, and densely populated urban areas are far from potential power plant sites. As a result, building long-distance transmission networks could incur enormous costs. In this context, hydrogen can serve as an alternative for storing and transporting renewable energy. In particular, when power plants and demand centers are far apart or when the power grid infrastructure is weak, converting renewable energy into hydrogen for storage and transport can reduce the cost of building transmission networks.

However, this scenario is only possible once the technology has matured sufficiently. At present, it is difficult to achieve both energy efficiency and economic viability in the process of converting and storing renewable energy as hydrogen. While hydrogen may be more economical than electricity for long-distance transport, the processes of conversion, storage, and transportation still entail high costs. To address this, ongoing technological development is focusing on liquid hydrogen storage, ammonia cracking, and other related technologies. Governments around the world are also implementing roadmaps to promote the hydrogen economy.

Korea, Japan, and China have enacted hydrogen support policies and are actively working to build hydrogen ecosystems by expanding hydrogen mobility and refueling infrastructure. In particular, hydrogen's advantages are highlighted in the commercial vehicle market, such as trucks, buses, and special-purpose vehicles. For long-distance travel, hydrogen vehicles store fuel as a gas, so even with increased fuel capacity, weight is less of a burden and refueling times are short. For example, to achieve a driving range of over 700 km per charge in a long-distance commercial vehicle using electricity, a large-capacity battery pack would be needed, significantly increasing vehicle weight and charging time. In contrast, hydrogen vehicles can be refueled quickly with high-pressure gas, and the weight of the fuel storage system is relatively light. This is why hydrogen vehicles attract more attention than electric vehicles in the commercial vehicle sector.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.