Restructuring Time Bomb:

NCC Faces Crisis with Production Cuts and Workout Talks

Labor Disputes over Workforce Restructuring at Daesan Petrochemical Complex

NCC Competitiveness Continues to Decline... Korea's Market Share at 5.7%

Yeocheon NCC, currently facing a liquidity crisis, has requested support from its parent companies. The company states that it immediately needs 36 billion won and will require an additional 300 billion won by the end of the year due to various costs. Furthermore, discord over restructuring is intensifying across domestic petrochemical companies, not just at Yeocheon NCC. There are growing concerns that leaving the situation to voluntary industry efforts is no longer feasible.

In an interview with Asia Economy on August 11, a senior official at Yeocheon NCC said, "We have secured emergency funds through naphtha resale and early collection of accounts receivable, but starting from the 21st, we will face a shortfall of about 36 billion won. If we cannot resolve this, we will be at risk of default." Previously, Yeocheon NCC announced it would need an additional 300 billion won by the end of this year. Regarding this, the official added, "By the end of August alone, we will need a total of 180 billion won to cover card payments, letters of credit (LC), raw material purchases, corporate bond repayments, and payroll."

Yeocheon NCC was established in 1999 as a joint venture between Hanwha Solutions (then Hanwha Petrochemical) and DL Chemical (then Daelim Industrial), each holding a 50% stake. It is a key player, ranking third in domestic ethylene production capacity and accounting for 14% of total output. Hanwha Solutions has officially expressed its willingness to provide additional financial support, but DL Chemical has stated that it must first review the company’s management status before making a decision. On the morning of August 11, DL Chemical is holding a board meeting to discuss whether to provide financial support.

The liquidity crisis at Yeocheon NCC is just one example of the conflicts currently unfolding in Korea’s petrochemical industry.

At the Daesan Petrochemical Complex, Lotte Chemical and HD Hyundai Oilbank have been unable to narrow their differences for several months regarding the integration of their naphtha cracking centers (NCC), resulting in slow progress. Disagreements stem from how to allocate responsibilities based on shareholding structure during the process of reducing redundant facilities and personnel. The two companies are discussing a plan to merge their respective Daesan NCC facilities?Lotte Chemical (1.1 million tons annual capacity) and HD Hyundai Chemical (850,000 tons annual capacity)?into a single entity.

Currently, the most likely scenario is to transfer Lotte Chemical’s facilities to HD Hyundai Chemical, with HD Hyundai Oilbank making additional capital contributions to operate the integrated entity. However, it is reported that HD Hyundai Oilbank insists on completing layoffs before joining the integration, while Lotte Chemical argues that HD Hyundai Oilbank, holding a 60% stake, should take the lead. An official from HD Hyundai Oilbank stated, "Nothing has been decided concretely regarding the integration discussions." The scope of workforce reductions and responsibility allocation has thus emerged as the core issue of the integration, going beyond simple facility efficiency improvements.

Yeocheon NCC, which is on the brink of default, is also struggling with workforce redeployment. Recently, Yeocheon NCC halted operations at its Yeosu Plant 3 (annual capacity of 460,000 tons). Of the company’s 1,050 employees, there have been no layoffs or redeployments; instead, the company suspended three-shift operations, switching to a daytime management system and merely reducing night shift allowances. Industry experts point out that "to resolve the oversupply structure, workforce redeployment must accompany physical production cuts."

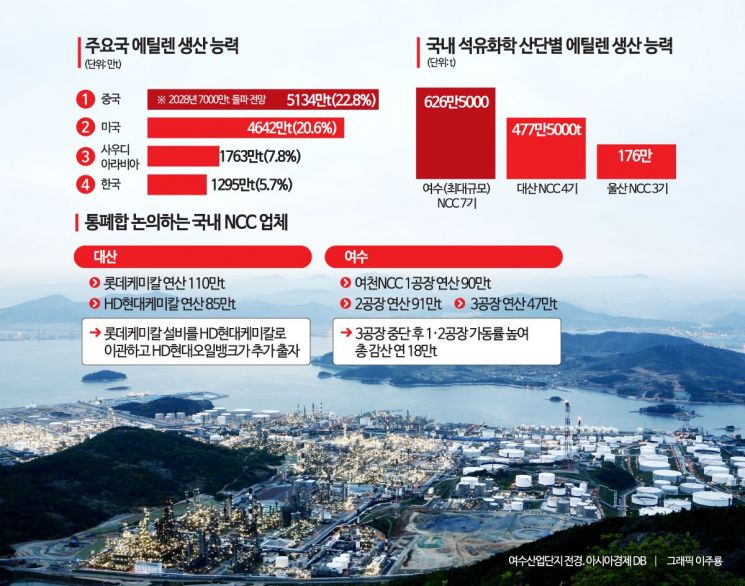

Experts emphasize that restructuring is an urgent and critical issue, as changes in the global supply structure are intensifying pressure. As of 2024, global ethylene production capacity ranks as follows: China leads with 51.34 million tons (22.8% market share), followed by the United States with 46.42 million tons (20.6%), Saudi Arabia with 17.63 million tons (7.8%), and Korea with 12.95 million tons (5.7%). Since reclaiming the top spot from the United States in 2022, China has been expanding by several million tons annually and is expected to surpass 70 million tons by 2028.

Korea is also at a disadvantage in terms of cost competitiveness. With an 83% dependence on naphtha, Korea is more vulnerable to cost fluctuations compared to China (50% naphtha + 22% coal-based chemicals) and the United States (77% ethane). When international oil prices rise, the cost burden is immediately reflected, widening the gap with competitors that use low-cost ethane or coal-based chemicals.

The delay in restructuring Korea’s petrochemical industry is not only due to corporate interests but also because the industry is a pillar of regional economies. The sector employs a total of 440,000 people: 39,000 in direct employment, 12,000 in supporting industries, and 388,000 in downstream industries. Ethylene production capacity is concentrated in Yeosu (6.265 million tons), Daesan (4.775 million tons), and Ulsan (1.76 million tons). If all three hubs face restructuring pressure simultaneously, a severe shock to the regional economies is inevitable.

Experts agree that both the government and companies must address the dual challenges of "minimizing employment shocks" and "improving facility efficiency." Jihoon Kim, Managing Partner at Boston Consulting Group (BCG), stated at the National Assembly Future Industry Forum in June, "The government must provide sufficient financial incentives for workforce redeployment during the restructuring process so that companies can take proactive measures," adding, "A tailored restructuring approach is needed for each industrial complex."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.