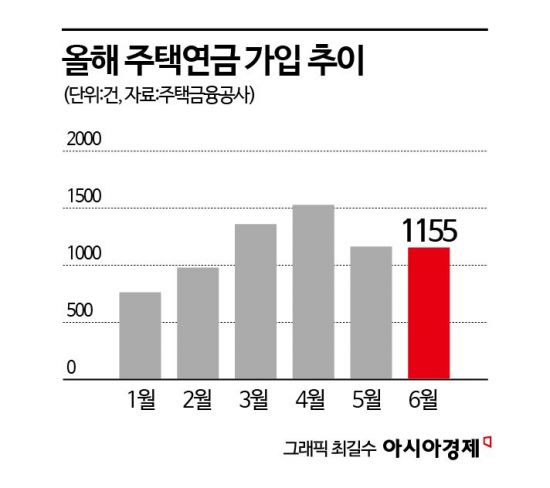

1,155 New Enrollments in June... Decline for Two Consecutive Months

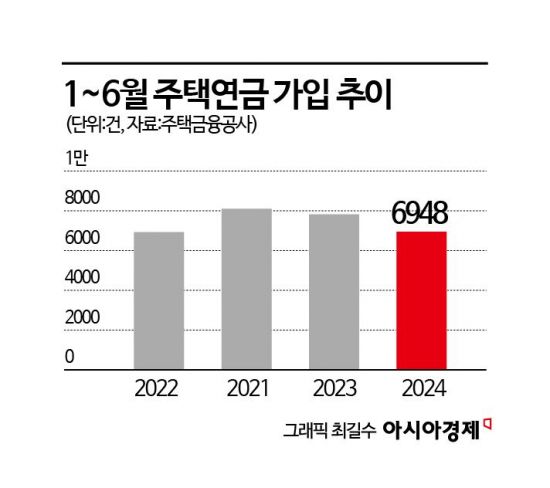

First Half Fails to Surpass 7,000... Down 11% from Last Year

Impact of Rising Home Prices in Seoul Metropolitan Area in Q2

This year's sharp rise in home prices in the Seoul metropolitan area during the second quarter led to a renewed decline in the popularity of reverse mortgages. This trend is interpreted as a reflection of the sentiment that it is more advantageous to realize profits by selling one's home, rather than using it as collateral to receive a pension.

According to the Housing Finance Statistics System of the Korea Housing Finance Corporation on August 6, the number of new reverse mortgage enrollments in June was 1,155, marking a decrease for the second consecutive month following 1,164 cases in May.

The trend in reverse mortgage enrollments tends to lag behind the trend in home sale prices. When expectations for rising home prices increase, the number of new enrollments typically declines. This is especially influenced by the real estate atmosphere in the Seoul metropolitan area, which accounts for a large portion of enrollments. Reverse mortgages allow homeowners aged 55 or older to receive a fixed monthly pension by using their home as collateral. However, when it is widely expected that home prices will rise further, there is a stronger sentiment to sell the property later for cash instead of enrolling in the program.

In fact, new reverse mortgage enrollments fell from 1,507 cases in December 2024 to 762 cases in January 2025, nearly halving. This was due to the revival of expectations for rising home prices, as evidenced by the Seoul home sales market consumer sentiment index turning upward for the first time in six months at the time.

Subsequently, as home prices stagnated, enrollments increased month by month to 979 in February, 1,360 in March, and 1,528 in April. However, the trend reversed again in May. This was due to a combination of factors, including the lifting of land transaction permit zones in the Gangnam area of Seoul and a cut in the base interest rate, which led to a sharp increase in apartment transaction volume and signs of overheating in the real estate market. According to the Bank of Korea's Economic Statistics System, the home sales price index for apartments in Seoul reached 95.534 in May, surpassing the 95 mark for the first time in two years and five months.

With new reverse mortgage enrollments declining for two consecutive months in May and June, the number of enrollments in the first half of this year totaled 6,948, a decrease of about 11% compared to 7,827 in the previous year. On a half-year basis, the number of enrollments has declined for the second consecutive year since peaking at 8,109 in 2023.

After the government announced strong household loan regulations on June 27, expectations for further home price increases have subsided. According to Korea Real Estate Board data, as of July 28, the sale price of apartments in Seoul rose by 0.12% from the previous week, but the pace of increase has slowed for five consecutive weeks. The Bank of Korea's Housing Price Outlook Consumer Sentiment Index (CSI), which reflects sentiment, also dropped sharply from 120 in June to 109 in July.

However, some point out that it remains to be seen whether reverse mortgage enrollments will rebound as a trend. There are also negative factors, such as the recent findings by the Board of Audit and Inspection during a regular audit that the main variables used to calculate monthly pension payments for reverse mortgages are somewhat disadvantageous to subscribers, and a call for system improvements. In response to these findings, the Korea Housing Finance Corporation has urgently commissioned a related research project and plans to carry out the work through the end of the year. An official in the financial sector said, "In order to prevent performance from being swayed by the real estate market atmosphere, the product itself must become more attractive."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.