Bank of Korea Blog: "Why Do Central Banks Talk About Structural Reform?"

An Essential Measure for Sustainable Growth

Securing "Breathing Room" for Monetary Policy

"Structural reform is a 'prerequisite' for monetary policy to function properly."

On August 6, the Bank of Korea stated in its blog post titled "Why Do Central Banks Talk About Structural Reform?" that "without the support of structural reform, interest rate policy cannot function properly due to constraints." The Bank explained that structural reform plays a crucial role in giving monetary policy more flexibility.

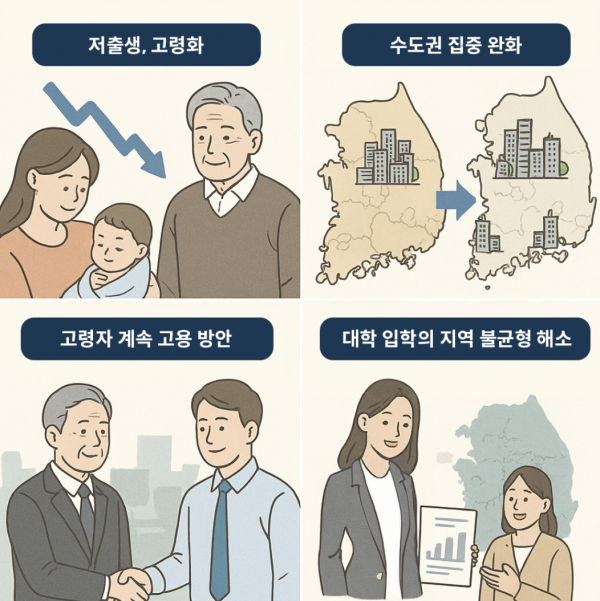

Main Topics of the Bank of Korea Structural Reform Report (Image Generated by ChatGPT). Bank of Korea Blog

Main Topics of the Bank of Korea Structural Reform Report (Image Generated by ChatGPT). Bank of Korea Blog

Hwang Indo, Director of the Financial and Monetary Research Division at the Bank of Korea Economic Research Institute, said, "If the birth rate recovers, if the elderly can work longer, if more women and young people participate in economic activities, and if productivity increases through technological innovation and efficient resource allocation, our economy can regain its fundamental strength." He added, "Only on that foundation can the central bank's interest rate policy operate flexibly and effectively."

If the Economy’s Fundamentals Weaken Further, the Damage Will Be Severe... Structural Reform Is the Solution

An economic downturn can be addressed to some extent through policy tools such as interest rate cuts. However, structural problems that weaken the economy's fundamentals cannot be solved with temporary measures. Hwang pointed out, "Korea's birth rate is around 0.7, the lowest in the world, and as of the end of 2024, the proportion of people aged 65 and over has surpassed 20%, marking the entry into a 'super-aged society.' Such demographic changes are rapidly weakening the fundamental strength of the economy."

He warned that if structural issues such as restoring the birth rate, expanding employment for the elderly, and boosting productivity through technological innovation are ignored and only short-term remedies are used, this could instead amplify side effects such as rising inflation, increasing debt, housing price bubbles, and greater exchange rate volatility. Hwang emphasized, "This is precisely why the Bank of Korea continues to stress the need for structural reform."

Also Necessary for Fulfilling Price Stability and Financial Stability Mandates

The Bank explained that structural reform is also necessary for the central bank to properly fulfill its core mandates of price stability and financial stability. Low birth rates and population aging are factors that gradually lower the 'equilibrium real interest rate.' In a super-aged society, the economy's growth engine weakens, reducing investment demand, while longer life expectancy leads households to save more for retirement. As the demand for borrowing declines and the supply of funds through savings increases, there is a relative surplus of money in the market, causing the value of money?i.e., interest rates?to fall.

If the equilibrium interest rate is structurally lowered, the central bank's capacity to respond to crises by cutting rates is reduced, because even a slight rate cut quickly approaches the zero lower bound. Hwang stated, "Even in situations where the economy is only temporarily slowing, the central bank's available policy options are steadily shrinking."

According to the Bank of Korea’s in-depth research report "Changes in Monetary Policy Conditions and Implications Due to Super-Aging," as of 2024, the real interest rate is estimated to have fallen by an additional 1.4 percentage points due to low birth rates and population aging. The report diagnoses that this downward trend is likely to continue. However, if structural reforms such as improved productivity or a rebound in the birth rate are achieved, the downward trend in real interest rates can be somewhat mitigated.

Low birth rates and population aging also become structural constraints that make it difficult to set the direction of monetary policy. As aging progresses, the number of retirees increases, the economy’s growth rate slows, and interest rates show a structurally downward trend. In this environment, the interest margin between deposits and loans narrows, loan demand decreases, and the overall profitability of financial institutions weakens. If some financial institutions begin to take on riskier assets to secure profits, the stability of the entire financial system could be threatened.

Hwang pointed out, "Korea has a loan structure centered on real estate and already faces a very high level of household debt. In this situation, if interest rates are lowered to stimulate the economy, household debt could increase even more rapidly, threatening financial stability." If the durability of the financial system itself is weakened due to population aging, these side effects could become even more pronounced. Ultimately, as the two policy objectives of economic and price stability and financial stability come into conflict, the Bank of Korea's room to maneuver monetary policy inevitably narrows.

Conversely, even in situations where the economy is overheating or inflation is rising and interest rates need to be raised, low birth rates and population aging can still constrain monetary policy. This is because government spending continues to increase. A prime example is 'rigid expenditures' such as pensions and health insurance, which are difficult to reduce. Hwang emphasized, "If such expenditures continue to rise, the government’s fiscal burden grows and national debt increases." According to the National Assembly Budget Office, if the birth rate remains at 0.75, the ratio of national debt to gross domestic product (GDP), currently about 50%, could soar to 173% in about 50 years. In such circumstances, raising interest rates would cause the government’s interest expenses to surge, increasing the risk of a vicious cycle of rising fiscal burdens and debt.

Hwang stressed, "Structural reform is an essential measure for sustainable growth and for securing 'breathing room' for monetary policy," adding, "Only by strengthening the muscle of structural reform can the tool of interest rates be effective."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.