KAMCO to Hold Bad Bank Briefings in August

Bad Bank May Launch as Early as Late August

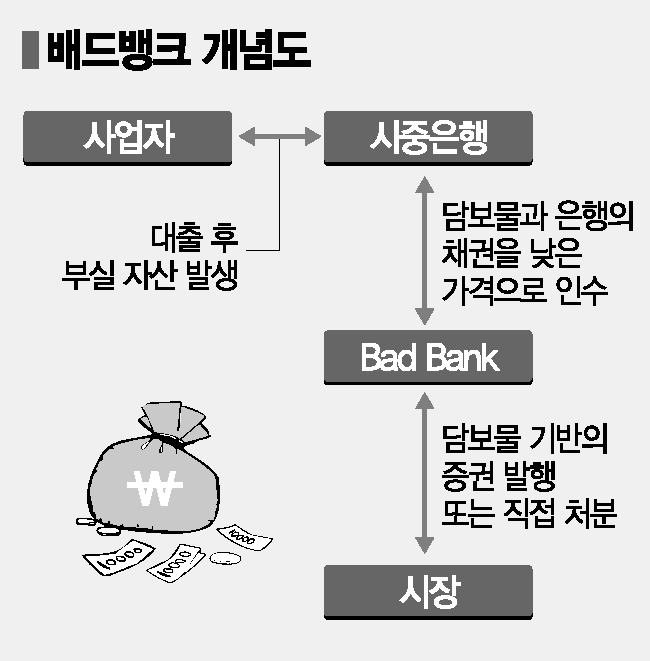

As all sectors of the financial industry are engaged in a standoff over the allocation ratio for the long-term delinquent loan debt restructuring program (bad bank), attention is focused on the results of the due diligence conducted by Korea Asset Management Corporation (KAMCO). Since financial institutions are required to contribute part of the funding for the bad bank, the loss ratio may vary depending on the purchase price ratio of the delinquent loans.

According to financial authorities on August 6, KAMCO has selected a law firm and an accounting firm and has begun due diligence on long-term delinquent loans. KAMCO is currently preparing a standard table for purchase price ratios based on factors such as whether the delinquent loans are secured and the duration of delinquency. Based on this, KAMCO plans to hold explanatory sessions for each financial sector regarding the bad bank during August and aims to launch the bad bank in early September.

Previously, the Financial Services Commission announced a plan to establish a bad bank to write off debts of less than 50 million won for debtors with delinquencies lasting seven years or longer. The total amount of non-performing loans is 16.4 trillion won. The actual budget for the bad bank is set at approximately 800 billion won, as the government calculated the average purchase price ratio for delinquent loans at 5%.

Currently, each financial industry association has not reached a conclusion regarding the allocation ratio, and there are observations that the atmosphere may change depending on the purchase price ratio. This is because the sector holding the largest amount of target loans, the private lending industry, has expressed dissatisfaction with the purchase price ratio and is taking a passive stance.

Excluding the loans held by the Korea Inclusive Finance Agency, the size of the delinquent loans subject to the bad bank is as follows: private lenders 2.0236 trillion won, credit card companies 1.6842 trillion won, banks 1.0864 trillion won, insurance companies 764.8 billion won, mutual finance 540 billion won, savings banks 465.4 billion won, capital companies 276.4 billion won, and financial investment companies 1.7 billion won. The cooperation of the private lending industry, which holds the largest share, is therefore essential.

The reason for the private lending industry's passive stance is that the average purchase price ratio for delinquent loans is 29.9% as of 2024. For example, if a 1 million won debt is purchased for 299,000 won, a profit can be made even if only 300,000 won is collected. However, if only the most problematic delinquent loans are purchased at 5% by the bad bank, the losses would be significant.

This is why the results of KAMCO's due diligence and the explanatory sessions for each sector are important. A financial authority official explained, "The Financial Services Commission has never announced that the purchase price ratio would be up to 5%," and added, "Since the purchase price ratio was announced as an 'average' of 5%, it may be adjusted based on the results of the due diligence and KAMCO's explanatory sessions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.