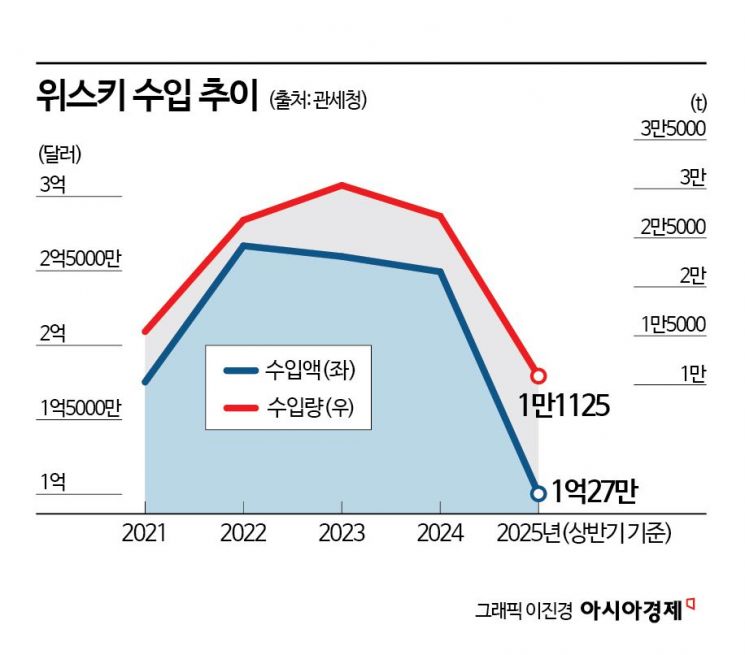

First-half Imports Reach $100.27 Million, Down 15% Year-on-Year

Nightlife Market Shrinks... Local Whisky Consumption Declines

Shift from Nightlife to Home Consumption, Noticeable Diversification of Import Sources

The aftermath of the economic recession has also impacted alcoholic beverage consumption, resulting in a reduction in domestic whisky imports in the first half of this year. However, the recent contraction of the whisky market is interpreted as a kind of growing pain occurring during the transition from a local whisky market centered on traditional nightlife establishments to one focused on home channels. As a result, the overall market size is shrinking, but there are projections that long-term demand will actually become more robust as the purpose of whisky consumption shifts from company gatherings and business entertainment to personal socializing and hobbies.

According to export and import trade statistics from the Korea Customs Service on August 5, whisky imports in the first half of this year amounted to $100.27 million (approximately 140 billion won), a 14.9% decrease compared to the same period last year ($117.81 million). During the same period, the volume of whisky imports also fell by 12.1%, from 12,663 tons in the first half of last year to 11,125 tons this year. After a rapid increase in whisky imports following the COVID-19 pandemic, the value peaked in 2022 and has been gradually declining since. The import volume also reached its highest point in 2023 (30,586 tons) and has continued to decrease last year and this year.

While the overall contraction in consumption due to the economic downturn is affecting alcoholic beverage consumption, the weakness of on-trade channels such as bars and restaurants is also seen as a factor contributing to the decline in whisky imports and consumption. In fact, according to global alcoholic beverage market analysis firm IWSR, the share of whisky consumption in Korea’s on-trade market last year was 35.9%, down more than 10 percentage points from 48.5% a year earlier.

Among these factors, the contraction of local whisky, most of which is consumed at nightlife establishments, appears to be decisive. Local whisky refers to “domestic brand whisky” produced by importing whisky base from countries like Scotland and bottling it domestically. In the past, it was mainly consumed for company gatherings and business entertainment, accounting for most of the domestic whisky market. However, with changing times and the spread of home drinking and solo drinking cultures after the pandemic, consumption has rapidly shifted to home channels. As a result, demand for local whisky, which relied on specific sales channels, has plummeted, impacting the overall market decline.

The industry believes that although the rapid contraction of local whisky is shrinking the overall market, the basic demand for whisky is actually being solidified, particularly through home channels and whisky specialty bars. An industry insider said, "In the past, local whisky brands such as Windsor and Imperial were considered premium brands and formed the backbone of the domestic whisky market. Now, however, they are seen as outdated brands facing a crisis of survival." The insider added, "Demand for local whisky will continue to decline due to the decrease in traditional nightlife consumption, but consumption of global brands will continue to grow as awareness and understanding increase."

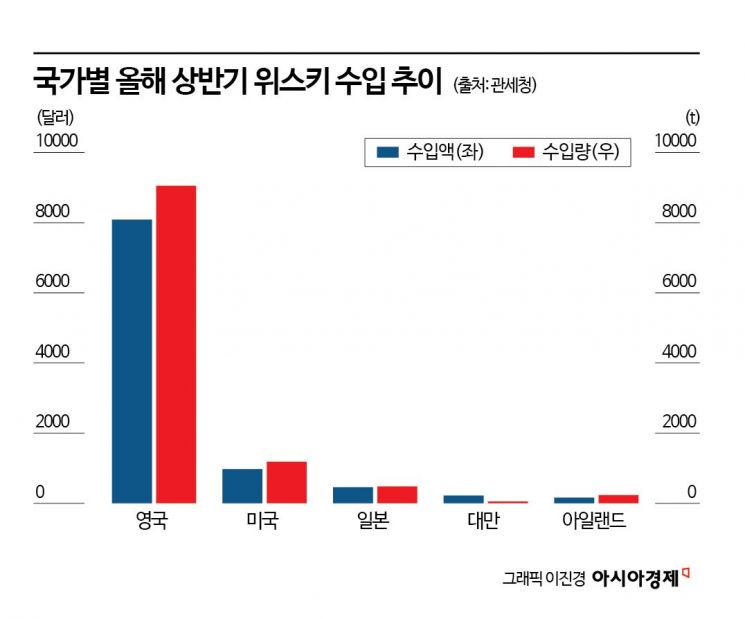

The recent increase in demand for whiskies from so-called third world countries such as Japan and Taiwan, in addition to traditional whisky powerhouses like Scotland and the United States, is also seen as a result of the shift in sales and consumption to home channels and whisky specialty bars. As the purpose of whisky consumption shifts from company gatherings and business entertainment to personal socializing and hobbies, the range of import countries is also becoming more diversified than before.

In fact, in the first half of this year, Taiwan whisky imports reached $2.17 million (about 3 billion won), up 58.8% from the same period last year, overtaking Ireland to become the fourth largest import source. A representative from Golden Blue International, which imports and distributes Taiwan whisky Kavalan, said, "Consumer interest in emerging whisky-producing countries is rising rapidly," adding, "Having more than 50 different products is helping to meet the broad needs of consumers." The representative also noted, "Although duty-free shops are still the main channel for Kavalan, this year, sales for home consumption have noticeably increased, so we are analyzing market trends and consumer needs to consider expanding our lineup."

Although the volume of Japanese whisky imports decreased this year, this is due to last year's surge in import volume, and Japanese whisky remains highly popular in actual sales channels. Despite the overall contraction in whisky consumption last year, Japanese whisky recorded a high consumption growth rate of 60.7%, mainly driven by izakaya and highball consumption. As interest in Japanese whisky rises, activity in the alcoholic beverage industry is also increasing. Nikka, one of Japan's two major whisky companies alongside Suntory, officially launched its products in the domestic market in March this year. Hite Jinro also expanded its lineup of Kirin Group's Fuji whisky, intensifying its efforts in the market.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.