Bio Association Releases Issue Briefing on U.S. Drug Prices

"U.S. Pharmaceutical Prices 2.8 Times Higher Than OECD Average"

Gap Widens Further Compared to Korea

Complex Pricing Structures and Lack of Controls Drive Up Costs

Trump Urges Global Pharmaceutical Companies to Lower U.S. Drug Prices

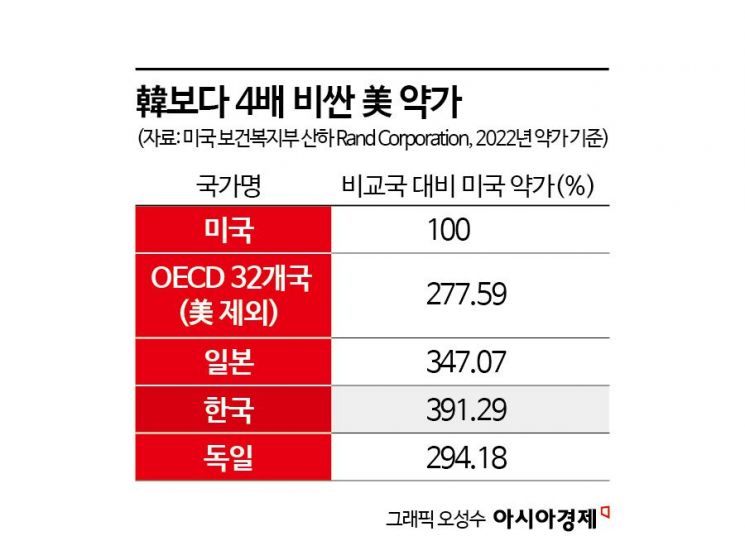

It has been analyzed that pharmaceutical prices in the United States are 2.8 times higher than the average among OECD (Organisation for Economic Co-operation and Development) countries, and nearly four times higher compared to Korea.

On August 4, the Bioeconomy Research Center of the KoreaBio Association released an issue briefing titled "U.S. Drug Price Levels Compared to OECD," stating, "The price of specialty pharmaceuticals in the United States is approximately 277.6% higher than the average of 32 OECD countries." The briefing cited a study by the RAND Corporation, a public policy research institute supported by the U.S. Department of Health and Human Services (HHS).

In particular, when looking only at branded pharmaceuticals, prices in the United States reached 4.2 times (422%) the OECD average, while the top 60 best-selling products exceeded five times (504%) the average. Biopharmaceuticals were also 3.6 times (359%) more expensive than the OECD average.

The gap widens further when compared to Korea. According to the report, U.S. drug prices are 391.3% higher than those in Korea, meaning Korean prices are only about 25.6% of those in the United States. For branded pharmaceuticals, the figure is 14.2%; for the top 60 best-selling products, it is 11.9%; and for biopharmaceuticals, it is 17.5%. The gap with Turkey exceeds a factor of 10.

The high drug prices in the United States are attributed to the government's lack of price controls and the limited price negotiation power of public insurance. Broad patent protection for new drugs and restricted entry of biosimilars (biopharmaceutical generics) have also hindered price reductions. Additionally, pharmacy benefit managers (PBMs) have created complex pricing and rebate structures, distorting consumer prices. These conditions have resulted in pharmaceutical companies having greater market dominance compared to the public sector.

Previously, on July 31 (local time), former U.S. President Donald Trump sent an open letter to 17 global pharmaceutical companies, urging them to lower drug prices in the United States within 60 days. On that day, President Trump disclosed the letter he sent to 17 companies, including Novo Nordisk, Eli Lilly, and GlaxoSmithKline (GSK), on Truth Social.

He stated, "The prices of branded pharmaceuticals in the United States are two to three times higher than in other countries," and demanded that prices be lowered to the minimum levels charged in other advanced nations. President Trump added, "The proposals received from pharmaceutical companies by previous U.S. administrations have been aimed at avoiding blame rather than 'solving' this serious problem," and said, "Accordingly, I am demanding that all pharmaceutical companies operating within the United States implement the following measures within the next 60 days."

Specifically, President Trump called on pharmaceutical companies to apply the "Most Favored Nation (MFN)" pricing for all drugs provided to Medicaid (the health insurance program for low-income individuals), and to offer a price portfolio accordingly.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)