Stronger Tax Collection on "Corporations Subject to Certified Tax Compliance"

for Lowering Taxes through Corporate Conversion

Following Exclusion from Minimum Tax Rate (9%)

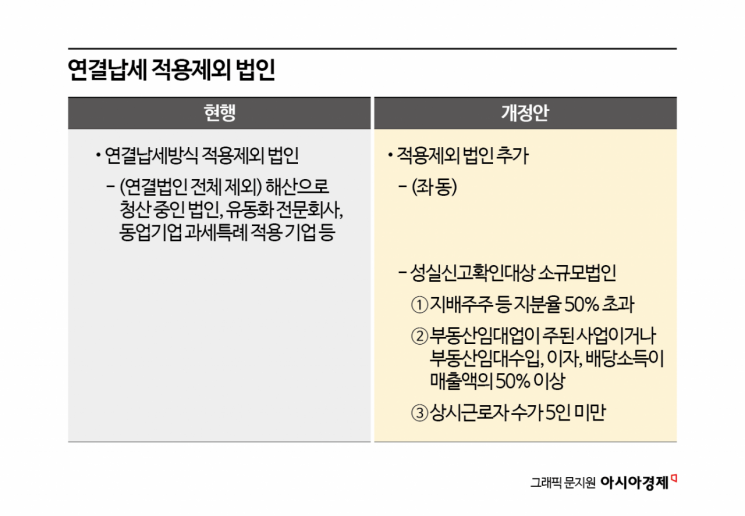

Consolidated Tax Filing to Be Excluded as Well

The government is moving to block tax-saving strategies used by small corporations that seek to reduce their tax burden through corporate conversion. Typical examples include family-owned or one-person corporations established by those in the real estate rental business, high-income celebrities, and freelancers. Starting next year, the government will exclude these corporations from the consolidated tax payment system, making tax avoidance more difficult.

This measure is included in the 2025 tax reform plan announced by the Ministry of Economy and Finance on July 31. The ministry will revise the enforcement decree related to corporate tax so that, going forward, "small corporations subject to certified tax compliance" will no longer be permitted to use consolidated tax filing. An official from the ministry explained, "This administration has included this measure to prevent and curb tax avoidance as much as possible."

Small corporations subject to certified tax compliance are defined as corporations where: ▲ the controlling shareholder owns more than 50% of shares; ▲ the main business is real estate rental, or rental income, interest, and dividend income account for more than 50% of total sales; and ▲ the number of regular employees is fewer than five. High-income celebrities and freelancers have been establishing small corporations to pay less tax by applying the corporate tax rate (19?24%) instead of the comprehensive income tax rate (up to 45%).

To minimize such intentional tax avoidance, the government plans to strengthen tax collection. The ministry official said, "There are many cases where corporations are intentionally established to benefit from the relatively lower corporate tax rate," and added, "Last year, the government also adjusted the tax base brackets and rates so that these corporations would not benefit from the minimum tax rate (9%) as part of efforts to block such loophole strategies." Through last year’s tax law revision, the ministry began applying the corporate tax rate starting from 19% for small corporations subject to certified tax compliance.

In this amendment, these corporations will no longer be able to reduce their tax burden through consolidated tax filing. The consolidated tax system treats a parent company and its subsidiaries as a single tax unit, integrating profits and losses for tax purposes. If one subsidiary incurs a loss, it can be offset against the profits of another subsidiary to reduce the overall corporate tax burden. For example, if Company A wholly owns Subsidiary B and B incurs a loss, A can combine this loss to reduce its tax liability. By operating a subsidiary like B and incurring various private expenses, the parent company A can combine the results and treat these private expenses as losses, thereby reducing its taxes.

An official from the ministry stated, "While the decision to establish and operate subsidiaries is up to each company, there have been cases where this structure is used to lower tax burdens," and added, "There was a need to put a stop to such expedient tax-saving strategies." The intent is to curb tax evasion by high-income individuals such as celebrities who purchase buildings through corporations and profit from rental income or capital gains.

Meanwhile, the government is also strengthening its oversight of one-person corporations established by celebrities and others. There is increased monitoring of cases where broadcasting appearance fees and advertising revenues are received under the corporation's name and only the lower corporate tax is paid, or where buildings are purchased under the corporation's name and rental income or capital gains are earned. Recently, the National Tax Service has been intensifying additional tax collection measures, determining that even if income is received by the corporation, the actual taxpayer is the individual, and thus imposing comprehensive income tax in accordance with the substance-over-form principle.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.