IMF Raises Global Economic Growth Outlook by 0.2 Percentage Points to 3.0%

Major Economies Including the U.S., China, and Japan See Upward Revisions

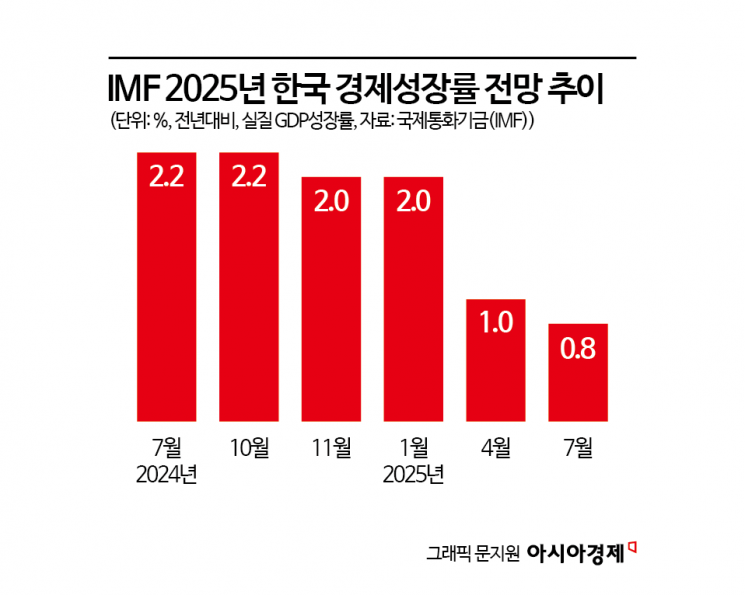

The International Monetary Fund (IMF) has revised its forecast for South Korea's economic growth rate this year, lowering it from the previous 1.0% to 0.8%. While the global economic growth rate for the same period was revised upward, South Korea's decline was the most pronounced among major countries.

According to the Ministry of Economy and Finance, the IMF projected South Korea's real Gross Domestic Product (GDP) growth rate for this year at 0.8% in its revised "July World Economic Outlook" report released on July 29 (local time). This is 0.2 percentage points lower than the forecast made in April. In contrast, the forecast for next year was raised by 0.4 percentage points to 1.8%.

This IMF forecast is the lowest among those announced so far by major domestic and international institutions. Previously, the Bank of Korea and the Korea Development Institute (KDI) both projected South Korea's growth rate at 0.8% for this year in May, while the Asian Development Bank (ADB) also sharply lowered its forecast from 1.5% to 0.8% in its "July Asian Economic Outlook."

Although the IMF report did not provide detailed explanations regarding South Korea, the downward revision is interpreted as reflecting the impact of increased U.S. tariffs, a slowdown in the construction sector, and the effects of an export-oriented economic structure. In particular, South Korea's high dependence on external trade and the contraction in global demand appear to have been major factors contributing to the decline in the growth rate.

On the other hand, the IMF raised its global economic growth forecasts to 3.0% for this year and 3.1% for next year, up by 0.2 and 0.1 percentage points, respectively. The IMF explained that the easing of global financial conditions was due to factors such as a decline in the effective U.S. tariff rate, increased early shipments prompted by concerns over high tariffs, a weaker dollar, and fiscal expansion in major countries.

The average growth rate forecast for advanced economies (41 countries including South Korea, the United States, Japan, Germany, France, and the United Kingdom) was also revised upward by 0.1 percentage points each to 1.5% for this year and 1.6% for next year. The United States is projected to grow by 1.9% this year and 2.0% next year, reflecting the impact of tax reforms such as the One Big Beautiful Bill Act (OBBBA) and improvements in financial conditions. The Eurozone (20 countries using the euro) saw its growth forecast for this year raised to 1.0%, mainly due to increased pharmaceutical exports from Ireland to the U.S., while the forecast for next year was maintained at 1.2%.

For other advanced economies, despite an accommodative financial environment, the growth rate for this year is expected to decline due to currency appreciation and increased tariffs on products such as steel and automobiles, with a slight improvement projected for next year.

Emerging and developing economies (155 countries including China, India, Russia, and Brazil) are forecast to grow by 4.1% this year and 4.0% next year, up by 0.4 and 0.1 percentage points, respectively. China's growth forecast for this year was raised to 4.8%, reflecting better-than-expected performance in the first half and the reduction of tariffs between the U.S. and China. India is projected to grow by 6.4% both this year and next, reflecting improvements in external conditions.

Export and import cargo containers are piled high at Busan Port Sinsundae Pier, with bright lights illuminating the area for nighttime loading operations even in the middle of the night. Photo by Kang Jinhyung

Export and import cargo containers are piled high at Busan Port Sinsundae Pier, with bright lights illuminating the area for nighttime loading operations even in the middle of the night. Photo by Kang Jinhyung

Global inflation is expected to gradually slow, from 5.6% in 2024 to 4.2% this year and 3.6% next year. Inflation in advanced economies is forecast at 2.5% this year and 2.1% next year, while emerging and developing economies are projected at 5.4% and 4.5%, respectively. In the United States, inflationary pressure is expected to persist through the second half of this year as tariffs are passed on to consumer prices, while in Europe, inflation is projected to ease relatively due to the strength of the euro.

The IMF diagnosed in this report that risks to the global economy remain tilted to the downside. The IMF expressed concern that an increase in effective tariff rates, uncertainty in trade policy, geopolitical tensions, and fiscal deterioration in major countries could dampen corporate investment and trade flows. In particular, the IMF analyzed that high fiscal deficits and national debt in major countries such as the United States and France could lead to higher long-term interest rates and tighter financial conditions, posing a burden on the global economy.

However, the IMF also assessed that if future trade negotiations yield positive results, greater policy predictability and improvements in investment and productivity could act as upside factors for the global economy. The IMF recommended policy responses such as fostering a predictable trade environment, minimizing market distortions from industrial policy, and expanding regional and multilateral trade agreements.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.