Shilla and Shinsegae Request Rent Reduction, Second Mediation Set for August 14

Incheon Airport Maintains Firm Stance Against Acceptance

Legal Representatives for Both Companies: "Withdrawal from Airport May Be Unavoidable"

Court Orders Appraisal... Seen as Willingness to Mediate

"Temporary Rent Cut Needed Considering Jobs and Competitiveness"

As the second round of mediation regarding the request by Shilla Duty Free and Shinsegae Duty Free to lower the rental fees for duty-free shops at Incheon International Airport approaches in about two weeks, duty-free operators are raising the possibility of withdrawing from the airport as their final card, taking a firm stand. This comes as Incheon Airport maintains a strong position that it cannot lower rental fees and has indicated it will not comply with the court's mediation.

On July 30, legal representatives for Shilla Duty Free and Shinsegae Duty Free told Asia Economy, "Although both companies still have a long period left to operate their duty-free shops at Incheon Airport, the business environment continues to be poor, making it increasingly difficult to endure losses and continue operations." They argued, "If negotiations break down, these duty-free shops will ultimately have to withdraw from Incheon Airport."

Duty-Free Shops at Incheon Airport Request Lower Rent ... Court Mediation Sought

They further stated, "Even if a new bidding process is held, considering the current state of the duty-free industry, the rental fee must be set much lower than it is now for new operators to enter. From Incheon Airport's perspective, this could actually be a loss, so it would be more desirable to adjust the rental fee to an appropriate level through negotiations with Shilla Duty Free and Shinsegae Duty Free."

Incheon District Court, which is handling this civil mediation, decided on July 14 to commission Samil PwC and other expert organizations to appraise the likely rental fee level in the event of a new bid for the duty-free shops. Such a commission is a procedure where the court requests an external expert institution to verify facts or assist in judgment. The duty-free industry interprets this as the court signaling its intention to mediate ahead of the second mediation session scheduled for August 14.

The legal representatives for Shilla Duty Free and Shinsegae Duty Free explained, "The court is trying to determine the rental fee level that would be set in a new bid assuming both companies withdraw, and compare it to the current level to judge what degree of reduction would be reasonable for mediation. This is a very common-sense procedure." The appraisal results are expected to be released early next month.

Previously, Shilla Duty Free and Shinsegae Duty Free, citing the burden caused by poor business conditions, each filed for mediation in April and May, requesting a 40% reduction in the rental fees for cosmetics, perfume, liquor, and tobacco shops at Incheon Airport's Terminal 1 and 2. In contrast, Incheon Airport submitted a written opinion to the court before the first mediation session on June 30, stating that it could not accept the mediation proposal due to the following reasons: ▲ failure to meet the requirements for rent reduction ▲ concerns over undermining the fairness of the bidding process ▲ issues of equity with other operators ▲ potential negative impact on future bidding markets.

Incheon Airport Corporation Announces "Disagreement" and Plans to Abstain

It is expected that Incheon Airport will again state its disagreement and abstain from the second mediation session scheduled for August 14. If this happens, negotiations will collapse, and the court will proceed with compulsory mediation. If Incheon Airport refuses to accept even this, duty-free operators are expected to either file a main lawsuit or withdraw from the premises. Shilla Duty Free and Shinsegae Duty Free secured the rights to operate duty-free shops in the departure halls of Incheon Airport for 10 years starting from July 2023, leaving them with eight years of operation remaining.

The amount proposed by both companies during the 2023 duty-free license bidding was approximately 10,000 KRW per passenger. The rental fee is calculated by multiplying this amount by the number of airport users. Last year, 35.31 million passengers departed through Incheon Airport, averaging about 3 million per month. Based on this, each company pays about 30 billion KRW in rental fees per month.

The two companies argue that a sharp drop in Chinese group tourists?who were major customers in the duty-free industry?along with high exchange rates and changes in the consumption patterns of both domestic and foreign individual tourists, have led to a situation where the number of duty-free buyers does not correspond to the number of passengers, making a rental fee reduction essential. Even after the transition to an endemic (periodic epidemic), revenues have declined while fixed costs remain unchanged, resulting in continued deterioration of financial performance. However, they maintain that the extent of the rental fee reduction can be adjusted through negotiation. Last year, Shilla Duty Free and Shinsegae Duty Free recorded operating losses of 69.7 billion KRW and 35.9 billion KRW, respectively, and are expected to remain in the red for the first and second quarters of this year as well.

Duty-Free Losses Continue... Incheon Airport's Non-Aviation Revenue Grows by Double Digits

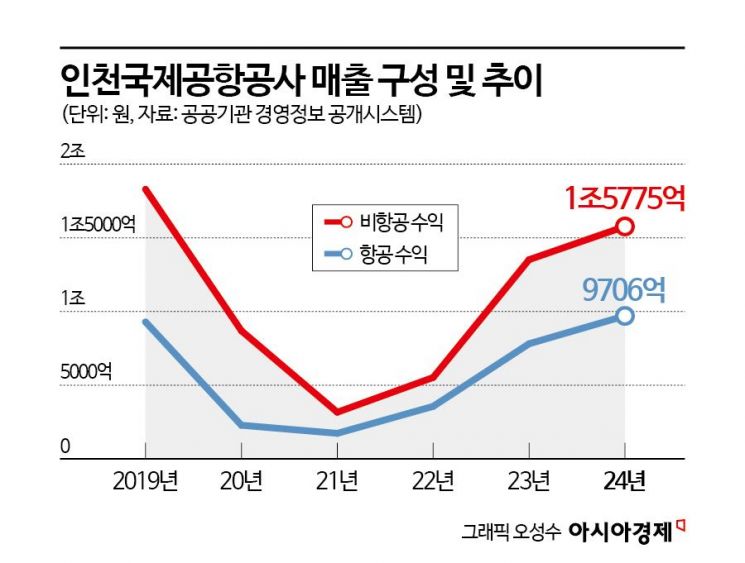

In contrast, Incheon Airport posted sales of 1.3469 trillion KRW in the first half of this year, up about 12% year-on-year, and operating profit reached 339.8 billion KRW, a 3.3% increase. During the same period, the number of passengers reached 36.36 million, the highest since the airport opened, highlighting the contrast with the duty-free industry. Non-aviation revenue, including rental fees from duty-free and F&B tenants, was 858.8 billion KRW, up 16.2% from the same period last year. Incheon Airport's non-aviation revenue, which was 1.8297 trillion KRW in 2019, fell to 316.7 billion KRW in 2021 due to COVID-19 but rebounded to 1.5775 trillion KRW last year, nearly recovering to pre-pandemic levels.

Currently, non-aviation revenue accounts for 60?65% of Incheon Airport's total revenue, higher than the Asia-Pacific average of 49%. Of this, duty-free rental fees make up a significant portion, accounting for 60% of total commercial facility rental income in 2023. Industry insiders are appealing for Incheon Airport to show flexibility in operations and participate in mediation negotiations, citing examples of global airports that have adjusted rental fees in line with duty-free business conditions. For example, Singapore Changi Airport cut rental fees for duty-free operators by 35% after COVID-19, and Shanghai Pudong Airport applied a 75% reduction to the minimum guaranteed amount.

Hong Kyuseon, a professor at Dong Seoul University, stated, "If struggling duty-free businesses can no longer hold out and give up operating at Incheon Airport, thousands of jobs related to these operations will disappear, and from the airport's perspective, this could negatively affect global evaluations and profits, which are based on infrastructure and services." He added, "Considering the broader goal of strengthening related industries and national competitiveness, the relevant ministries and Incheon Airport should temporarily lower rental fees to give operators some breathing room."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.