Samsung Electronics Surpasses 70,000 Won for the First Time in 11 Months

Individuals Sell 3.47 Trillion Won This Month

Brokerages Continue to Raise Target Prices

The so-called "national stock" Samsung Electronics has reached the 70,000 won mark, buoyed by a series of positive developments. As the two giants of the KOSPI face off, foreign investors are taking the side of Samsung Electronics, while individual investors are betting on SK Hynix, leading to contrasting fortunes for each group.

70,000 Won Mark After 326 Days Signals a Shift in Sentiment

According to the Korea Exchange on July 29, Samsung Electronics closed at 70,400 won the previous day, up 6.83%. This surge in investment sentiment is attributed to two key factors: Chairman Lee Jae-yong of Samsung Electronics being freed from "judicial shackles," and the company's foundry (semiconductor contract manufacturing) division, which had been posting multi-trillion-won losses, securing a massive order worth 22.7647 trillion won from Tesla. Doosan Tesna, a post-process foundry partner, also hit its upper price limit on expectations of benefiting from this deal.

This is the first time in 326 days?since September 5 last year?that Samsung Electronics has surpassed the 70,000 won mark during trading hours. With the gap in foundry market share with Taiwan's TSMC widening, and even its position as the world's top DRAM supplier being overtaken by SK Hynix in the first quarter, this news comes as much-needed relief for Samsung Electronics. Son Injun, a researcher at Heungkuk Securities, commented, "Recently, both performance and investor sentiment across the semiconductor business, including DRAM and foundry, appear to have bottomed out and are now entering a recovery phase," raising the target price to 78,000 won.

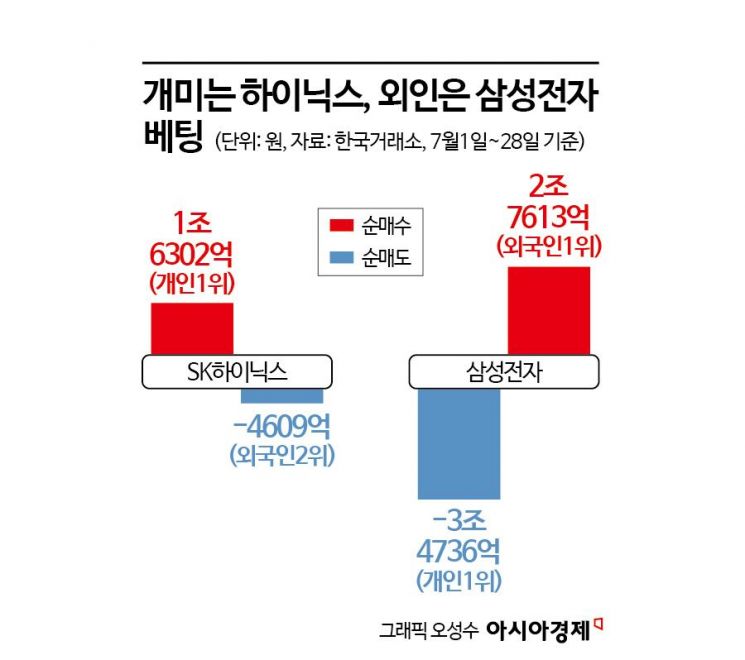

Individuals Favor Hynix, Foreigners Favor Samsung... Diverging Bets

Despite this record milestone for the KOSPI's largest company by market capitalization, individual investors are not entirely celebratory. Those who predicted SK Hynix would win the battle between the two memory semiconductor giants have been selling Samsung Electronics shares in response. The net selling by individual investors, which stood at about 490.5 billion won last month, has surged by approximately 400% to 3.4736 trillion won this month. In contrast, foreign investors have net purchased 3.4638 trillion won worth of Samsung Electronics shares during this period, absorbing all the shares sold by individuals.

Byun Junho, a researcher at IBK Investment & Securities, stated, "Historically, during foreign capital inflow cycles, large-cap stocks?especially semiconductors?have tended to outperform the market significantly." He added, "If the trend of improved foreign inflows continues in the second half of the year, Samsung Electronics could benefit from a favorable supply-demand environment for its stock price."

Although Samsung Electronics recorded an "earnings shock" in the second quarter due to one-off costs and a decline in exchange rates, a significant improvement in performance is expected in the third quarter, driven by seasonal factors. Park Yuak, a researcher at Kiwoom Securities, said, "For DRAM, a sharp improvement in performance is expected due to increased sales of high-bandwidth memory (HBM) to major clients such as AMD and a reduction in one-off costs. For foundry, operating losses are expected to decrease thanks to higher utilization rates and reduced one-off costs." He estimated Samsung Electronics' operating profit for the third quarter of this year at 8.4 trillion won, up 83% from the previous quarter, and raised the target price from 80,000 won to 89,000 won.

The Semiconductor Tariff Variable

However, the impending deadline (August 1) for the Korea-US trade negotiations set by US President Donald Trump is seen as a variable. Previously, US Secretary of Commerce Howard Lutnick announced on July 27 (local time) that the current reciprocal tariff suspension measures applied to trading partners would not be extended beyond August 1, and signaled that semiconductor tariffs under Section 232 of the Trade Expansion Act would be announced within two weeks. If high tariffs are imposed on semiconductors?a key export item for Korea?companies such as Samsung Electronics and SK Hynix, as well as the broader industry, are expected to suffer significant setbacks.

Researcher Son noted, "From the end of the year, tariffs are expected to impact the entire IT device sector, which could become a burden on overall performance." He added, "Due to delayed recovery in Samsung Electronics' HBM sales, sluggish NAND market conditions, and the gradual recovery from foundry losses, this year's performance is likely to show negative growth compared to last year." He estimated Samsung Electronics' annual sales this year at 307.1 trillion won (up 2% year-on-year) and operating profit at 27.5 trillion won (down 16%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.