Domestic Companies See Surge in Exports and Performance, Active M&A

"High Growth Potential Expected for Energy-Based Medical Devices and Skin Boosters"

Recently, as domestic beauty medical device and injectable product companies have successfully entered global markets, they are emerging as a new growth engine for K-beauty. However, analysts point out that in order to achieve sustainable growth, it is necessary to secure advanced product technology, enhance trust in procedures, and diversify both regional and product portfolios.

On July 28, Samil PwC announced the publication of a report titled "The Rise of K-Beauty Medical Devices as a New Growth Engine for K-Beauty." The report analyzes domestic and international market and M&A trends, and provides strategic recommendations for related companies.

Domestic Companies Armed with Advanced Technology and Price Competitiveness

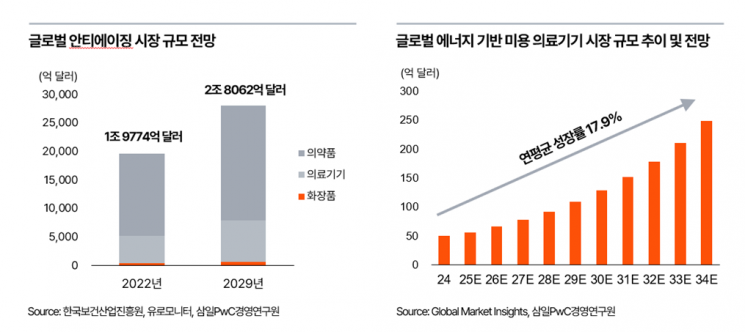

The K-beauty industry is rapidly evolving into a "technology-driven complex industry" that encompasses not only cosmetics but also beauty medical devices, injectables, and home-care devices. The global rise in anti-aging interest due to aging populations, the preference for minimally invasive (procedures involving needle penetration without incisions or tissue removal) and non-surgical treatments, and the popularization of obesity treatments are all independently driving explosive growth in the beauty medical device and injectable markets. Domestic companies are also rapidly expanding their presence in the global market, leveraging their advanced technology and price competitiveness.

In fact, major domestic companies are recording solid performances in energy-based medical devices (EBD) such as high-intensity focused ultrasound (HIFU) and radiofrequency (RF), as well as in injectables like botulinum toxin, fillers, and skin boosters, and are steadily entering overseas markets. Notable examples include Classys, Hugel, and PharmaResearch, which are increasing their export ratios and strengthening global certification and localization strategies.

In the case of EBDs, recurring revenue is generated from consumables (tips, cartridges), which have relatively high margins, leading to active M&A transactions in the sector. The global EBD market is expected to grow at a compound annual growth rate of 17.9%, reaching $24.9 billion by 2034. The report highlights the skin booster market, a subcategory of EBDs and fillers, as a sector with high growth potential. By 2030, the domestic EBD and beauty injectable markets are projected to grow at annual rates of 17.1% and 14.3%, respectively.

"Need for R&D Investment, Strategies to Compete with Global Giants, and K-Content Linked Marketing"

The report assessed that domestic beauty medical device companies "have established themselves not as simple low-cost OEM suppliers, but as manufacturers with their own brands and proprietary technologies," and "are emerging as technology and clinical leaders in the global medical beauty ecosystem." To secure future competitiveness, the report identified several key tasks: ▲accumulating clinical data and strengthening government support to obtain global certifications, ▲diversifying product portfolios and regional sales, ▲investing in R&D to differentiate product technology and efficacy, ▲ensuring procedural safety and reliability, and ▲building global infrastructure such as practitioner training centers.

Hong Junhyeok, Bio and Healthcare Industry Partner at Samil PwC, stated, "K-beauty medical device companies are expanding their presence in the global market based on advanced technology and price competitiveness." He advised, "To overcome global certification barriers and enter diverse markets, companies should not only invest in R&D, but also strengthen capital capabilities through various partnership-based strategies to compete with global top-tier medical devices, expand distribution channels, adopt premium brand strategies, and consider K-content linked marketing."

Further details can be found on the Samil PwC website.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)