NongHyup Bank Data Analysis

Yoajeong's Sales at Yogurt Stores

Increase by 2,100% Over the Same Period

Women in Their 20s Drive Sales Growth

Linked to Rising Consumption of Fermented Dairy Products

Solo Consumption Growth Among Dairy Categories

There is a self-employed business sector that has shown remarkable growth even amid the economic downturn: yogurt specialty stores. Over the past two years, sales have increased by more than 2.5 times, and some brands have recorded explosive growth rates exceeding 2,100%. Analysts attribute this rapid expansion of the yogurt market to a shift in dairy consumption patterns from milk to fermented dairy products, combined with rising dessert demand among women in their 20s.

According to the financial sector on July 28, NongHyup Bank recently released an analysis of 'NH Members Hanaro Mart Dairy Product Consumption Data' (8.4 million members, 203 million transactions) and 'NongHyup Card Yogurt Specialty Store Payment Records' (400,000 people, 770,000 transactions) from 2022 to last year. The results show that total sales at yogurt-related stores rose by 256% last year compared to 2022. When setting 2022 sales as 100, sales reached 141 in 2023 and 356 last year.

Looking at individual stores, the yogurt ice cream specialty brand Yoajeong (Yogurt Ice Cream Jeongseok) stood out for its growth. Yoajeong accounted for 9 out of 100 in total sales in 2022, 16 in 2023, and soared to 198 last year, marking a 2,100% increase compared to 2022. Yogurt World accounted for 62 last year, Yogurt Purple for 9, and restaurants with 'Greek' or 'Yogurt' in their franchise names recorded 80 in 2022, 101 in 2023, and 87 last year. The number of yogurt-related stores also increased from 600 in 2022 to 986 last year, with Yoajeong accounting for the largest share, rising from 129 to 573 locations over the same period.

The survey found that women in their 20s are the biggest consumers of yogurt. Last year, consumers in their 20s accounted for 36% of yogurt store customers, the largest share. They were followed by those in their 30s (17%), 40s (17%), and 50s (16%), while those under 10 and over 60 each accounted for 7%. In terms of gender, women consumed 67% of yogurt, 2.09 times more than men (32%). For Yoajeong and Yogurt World, sales surged during the hot summer (August). In particular, Yoajeong's sales in August last year increased by 2,138% compared to January.

Examining consumption patterns by brand, NongHyup Bank explained that Yoajeong and Yogurt World had a high proportion of payments after 8 p.m., indicating strong demand for after-meal desserts. The average transaction amount was highest at Yoajeong (16,600 won), followed by Yogurt World (13,000 won), Greek Yogurt (11,800 won), and Yogurt Purple (11,000 won).

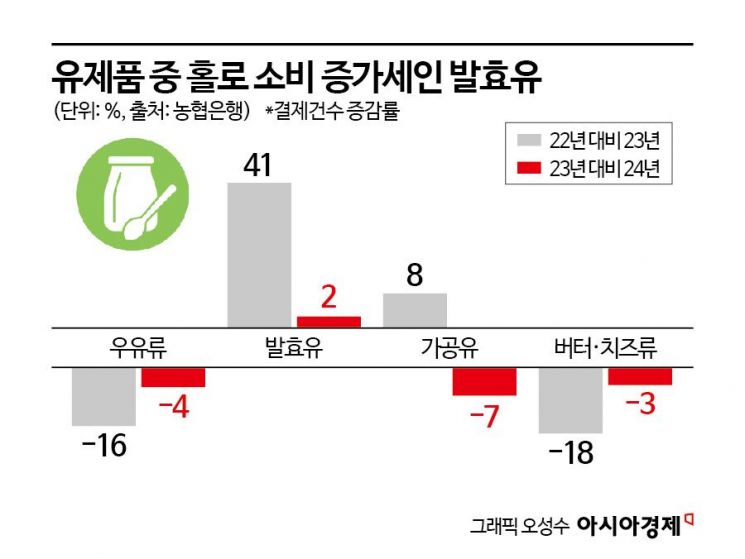

This growth in yogurt stores appears to be linked to increased consumption of fermented dairy products. Analyzing the consumption data of 8.4 million people who purchased dairy products at Hanaro Mart from 2022 to last year, the total number of dairy product purchases last year decreased by 2% compared to 2022. In particular, the proportion of customers who purchased milk more than twice a month fell from 49% in 2022 to 47% last year, a decrease of 2 percentage points, and the number of milk purchases also declined by 20% over the same period. In contrast, purchases of fermented dairy products increased by 44%, and the number of transactions for fermented dairy products continued to rise steadily from 2022, unlike other categories (milk, processed milk, butter, and cheese).

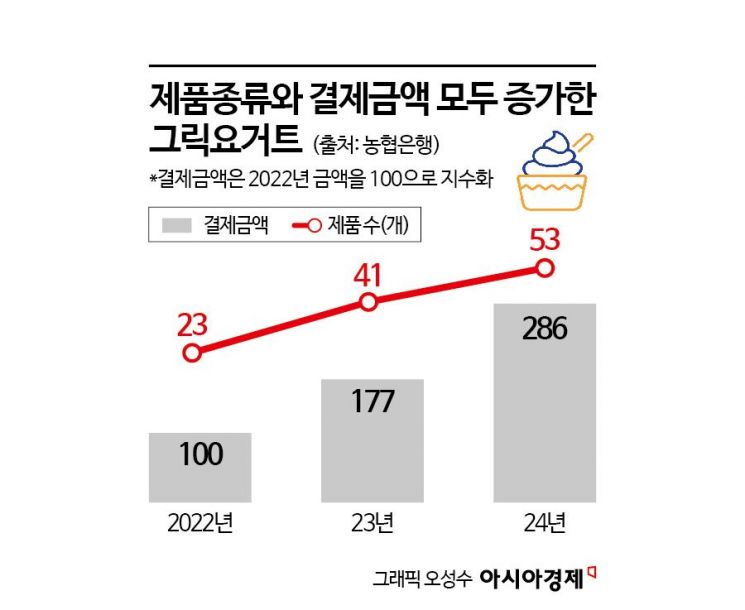

Fermented dairy products are also frequently found in customers' shopping baskets. According to the 'basket share'?the ratio of receipts containing a specific product group to total receipts?fermented dairy products accounted for 10% of all baskets. Tofu was the most commonly added item, followed by milk in second place and fermented dairy products in fourth. Among fermented dairy products, Greek yogurt stood out, with the number of product types increasing by 130% and payment amounts rising by 186% over the past two years.

Meanwhile, NongHyup Bank analyzed that dairy consumption trends are changing. Last year, payments for low-fat milk decreased by 36% compared to 2022, but functional milk (such as easily digestible milk and protein milk) grew by 250%. NongHyup Bank explained, "The trend in dairy product consumption is shifting from 'lightness' to 'comfort,'" and added, "There is a noticeable preference for products that address lactose intolerance and have high protein content."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.