If 25% Tariff on Automobiles Is Applied,

Japanese Economy Will Be Hit

Investment Funds to Be Used for Supply Chain Crisis Relief

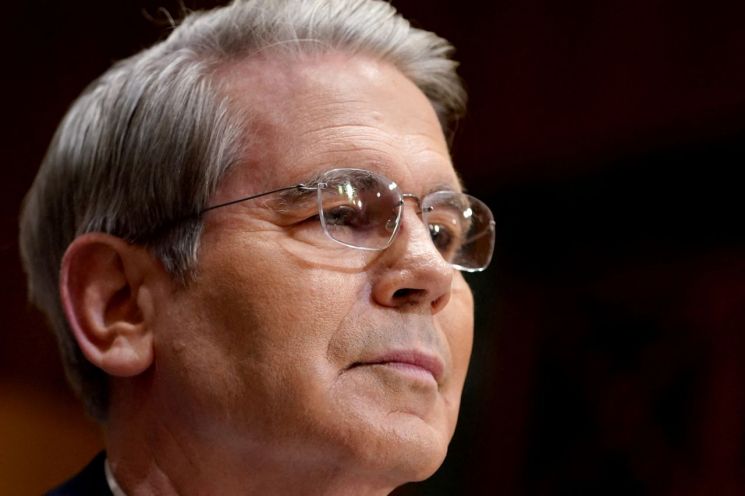

On July 23 (local time), U.S. Treasury Secretary Scott Besant warned that if Japan fails to properly implement the trade agreement, the two countries will revert to the originally set 25% reciprocal tariffs.

In an interview with Fox News that day, when asked, "How do you plan to ensure that Japan complies with the agreement?" Secretary Besant said, "We will evaluate on a quarterly basis, and if the President is not satisfied, the tariff rate on automobiles and other products will return to 25%." He added, "With a 25% tariff on automobiles, the Japanese economy will not function."

Previously, on July 22, Japan concluded trade negotiations with the United States and agreed to apply a 15% reciprocal tariff. This is a reduction of 10 percentage points from the originally set 25%. In exchange for lowering the tariff rate, Japan agreed to invest $550 billion (about 759 trillion won) in the United States.

Secretary Besant explained, "Even with a 15% tariff rate, the United States will be able to secure significant tariff revenue," and regarding the trade agreement with Japan, he said, "There are three elements: the opening of the Japanese economy, a $550 billion joint partnership in which the United States will take 90% of the profits, and 15% tariff revenue on all products Japan sells to us."

The investment funds received from Japan are expected to be used to alleviate supply chain crises. Regarding how Japan's investment in the United States will be used, he said, "Loans, credit guarantees, and equity investments," and added, "President Trump will direct where these funds are invested, and they will be used to alleviate supply chain crises in areas such as critical minerals, pharmaceuticals, semiconductors, and shipbuilding."

Secretary Besant, regarding the upcoming third high-level trade talks with China to be held in Stockholm, Sweden, on July 28-29, said, "China is the world's second-largest economy with a population of 1.4 billion. We want to bring precision manufacturing back to the United States, but the more products we produce, the more we will need new, large-scale markets to sell them. Therefore, I believe President Trump could become the president who opens the Chinese market."

He added, "We will discuss market opening, but we will also address the issue of China purchasing Iranian oil or Russian oil, which are subject to sanctions."

Meanwhile, regarding the appointment of a successor to Jerome Powell, Chair of the Federal Reserve, the U.S. central bank, Secretary Besant said, "We will probably announce a new Fed chair nominee in December of this year or January of next year," adding, "From that point, the market will pay attention to the statements of the future Fed chair."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.