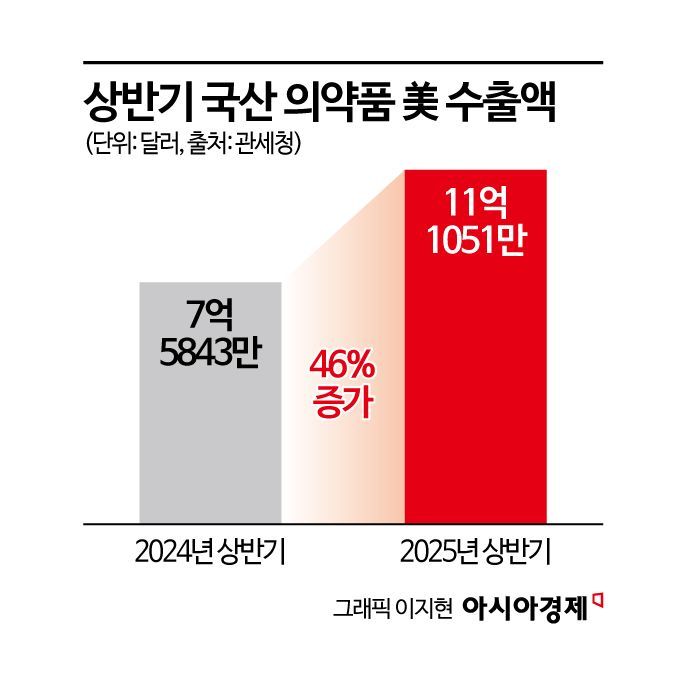

Pharmaceutical Exports to the U.S. Surge by 46% in the First Half of the Year

Large-Scale Exports Made in Advance to Secure Inventory Before Tariffs Are Imposed in the U.S.

In the first half of this year, exports of domestically produced pharmaceuticals to the United States surged. This is seen as a result of large-scale exports being made in advance in response to the U.S. move to impose tariffs on pharmaceuticals. In addition, domestic pharmaceutical companies are reportedly considering expanding local production and partnerships in the United States to mitigate risks.

According to the Korea Customs Service on July 18, exports of Korean pharmaceuticals to the United States in the first half of this year reached $1.11051 billion (approximately 1.545 trillion won). This represents a 46% increase compared to $758.43 million (approximately 1.055 trillion won) during the same period last year.

The sharp increase in pharmaceutical exports to the United States in the first half of the year is attributed to preemptive action by domestic pharmaceutical companies. Previously, U.S. President Donald Trump had openly announced plans to impose tariffs on pharmaceuticals since taking office. The imposition of pharmaceutical tariffs is expected to begin as early as the end of this month at a low rate. Furthermore, the U.S. position is to impose tariffs as high as 200% about a year later, once companies have secured production facilities within the United States.

However, there is still a possibility that the situation could change through additional trade agreements between the two countries. On July 15 (local time), President Trump stated regarding the possibility of announcing an additional trade agreement, "The key is for our trading partners to open their markets," adding, "It appears that Korea is willing to open its market."

In response, major domestic pharmaceutical companies adopted a strategy of exporting large quantities of pharmaceuticals to the United States in advance during the first half of the year to secure inventory before tariffs are imposed. This was a measure to minimize short-term cost burdens and market shocks.

SK Biopharmaceuticals, which exports the new epilepsy treatment cenobamate (U.S. name: Xcopri), reportedly already has all the inventory needed for this year delivered to the United States. Celltrion, which exports the autoimmune disease treatment Zympentra (U.S. name: Remsima SC), also stated that it has secured about two years’ worth of inventory.

Notably, about 41% of total exports in the first half were concentrated in June, the final month of the period. Last month, exports of Korean pharmaceuticals to the United States amounted to $458.38 million (approximately 630 billion won). This is nearly equivalent to the export performance of the previous four months (February to May), which totaled $475.82 million (approximately 660.1 billion won). Hugel, a leading domestic botulinum toxin company, also announced that it shipped all the quantities needed for the year to the United States through additional shipments last month.

To resolve tariff risks, expanding local production and partnerships in the United States is also being considered. SK Biopharmaceuticals is discussing the possibility of producing products in Puerto Rico. If products are manufactured in Puerto Rico, a U.S. territory, tariffs will not be imposed.

Celltrion is also reported to have signed a contract with a contract manufacturing organization (CMO) partner to enable direct production of products in the United States. In the long term, the company is even considering acquiring a company with production facilities in the United States.

Companies such as Samsung Biologics, whose contract development and manufacturing organization (CDMO) business is relatively less affected by tariffs, are also said to be considering future response measures depending on U.S. actions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.