Bitcoin Surpasses Gold in Returns

Becomes World's Fourth Largest Asset, Overtaking Amazon

The price of Bitcoin has surpassed $123,000 for the first time in history. This milestone was reached as the U.S. Congress entered the so-called "crypto week," a period of intensive discussion on pro-cryptocurrency legislation. The rally was driven by a combination of factors, including expectations for reduced regulatory risks, moves toward institutional integration, and inflows of institutional capital. Bitcoin has outperformed gold in annual returns, emerging as the best-performing investment asset of the year, and has even overtaken Amazon.com, the world’s fourth-largest company by market capitalization.

According to U.S. cryptocurrency exchange Coinbase, as of 3:38 a.m. Eastern Time on the 14th (local time), the price of one Bitcoin reached $123,211. Just a week earlier, Bitcoin was trading at around $108,000. After surpassing the $120,000 mark for the first time the previous day, Bitcoin went on to exceed $123,000. Later in the day, it traded below $120,000, hovering around $119,700 as of 8:00 p.m.

With Bitcoin’s sharp price increase, it has also outpaced gold?long considered the quintessential safe asset?in annual returns. According to related statistics, Bitcoin’s annual return for this year stands at about 30%, surpassing gold’s 27% return. Bitcoin’s outperformance of gold is interpreted as the market’s growing recognition of its asset value as "digital gold."

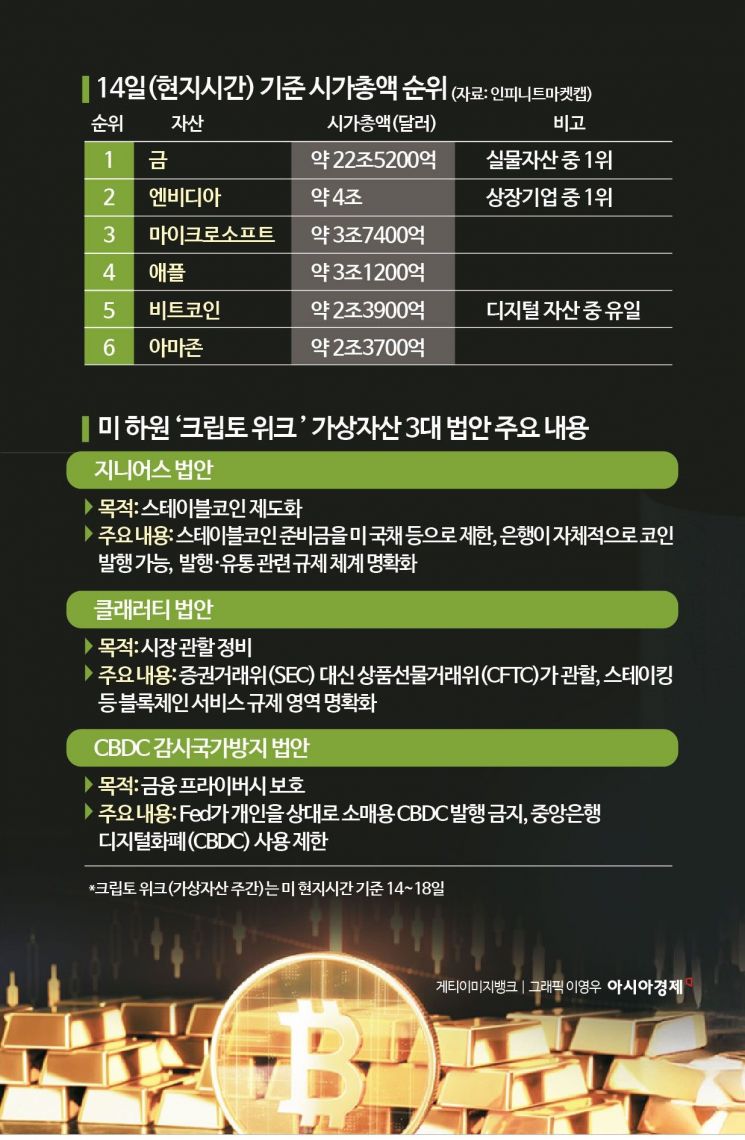

Bitcoin’s market capitalization has also surged to approximately $2.4 trillion, making it the world’s fifth-largest asset after gold, Nvidia, Microsoft (MS), and Apple. It has overtaken not only big tech companies such as Amazon, Alphabet (Google), and Meta (Facebook), but also the market capitalization of silver. Its market value now exceeds that of the domestic Korean stock markets (KOSPI and KOSDAQ), which recently surpassed 3,000 trillion won.

Boosted by Bitcoin’s price rally, related stocks also rose across the board. Shares of cryptocurrency exchange Coinbase and online brokerage Robinhood each climbed about 2% for the day, both hitting new 52-week highs. U.S. payments giant PayPal saw its share price rise by 3.5%, while MicroStrategy, the world’s largest corporate Bitcoin holder, jumped about 4%. New listings (IPOs) of cryptocurrency-related companies are also on the rise. U.S. asset manager Grayscale Investments announced that it had submitted a confidential IPO filing to the U.S. Securities and Exchange Commission (SEC) that day. Previously, stablecoin issuer Circle Internet Group was listed on the New York Stock Exchange in early June.

Bitcoin’s steep upward trend coincided with the U.S. House of Representatives’ formal consideration of cryptocurrency-related bills. The House designated this week (July 14?18) as a period for intensive discussion of three major cryptocurrency bills. These include the "Genius Act" (institutionalizing stablecoins), the "Clarity Act" (clarifying oversight of the cryptocurrency market), and the "CBDC Anti-Surveillance State Act" (protecting consumer financial privacy).

The legislative momentum for cryptocurrency has also been bolstered by the pro-crypto stance of the Donald Trump administration. President Trump has declared that he will make the United States the "global center for cryptocurrency" during his second term. The Trump family is now directly involved across the cryptocurrency industry, including mining operations, large-scale Bitcoin purchases, and the issuance of their own stablecoins and meme coins.

With moves toward cryptocurrency institutionalization, institutions have begun to consider Bitcoin as an investment asset. In fact, after major asset managers such as BlackRock and Fidelity launched spot exchange-traded funds (ETFs), more than $15 billion has flowed into these ETFs alone. Some companies, including MicroStrategy, have started to restructure their balance sheets, viewing Bitcoin as an alternative to cash assets. According to the Associated Press, "Several listed companies are adopting Bitcoin as a central pillar of their asset allocation strategies, pursuing Bitcoin purchases through stock buybacks and debt issuance."

U.S. market research firm Kovesi Letter stated that "even conservative institutions such as family offices and hedge funds that manage the assets of the wealthy can no longer ignore Bitcoin."

The perception of Bitcoin among ordinary investors is also changing. According to a survey conducted by U.S. security firm Security on 2,000 Americans, about 30% of respondents currently own cryptocurrencies, and among them, 67% plan to buy more in the future. Among respondents who do not currently own cryptocurrencies, 14% expressed an intention to purchase in the future. Additionally, 60% of respondents expect cryptocurrency prices to rise during President Trump’s term. This appears to reflect the Trump administration’s pro-cryptocurrency policy stance.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.