Secondary Battery Stocks Continue Rebound Since June After Hitting Record Lows

Global Industry Conditions Remain Challenging... Uncertainties Must Be Resolved

Secondary battery stocks have continued their rebound for the first time in a while. This trend is believed to be influenced by optimism surrounding the commercialization of Tesla's robotaxi. However, the securities industry expects secondary battery-related stocks to underperform this year. This is due to the ongoing sluggishness in electric vehicle sales in the United States, which is the world's largest market, as well as persistent concerns over tariffs.

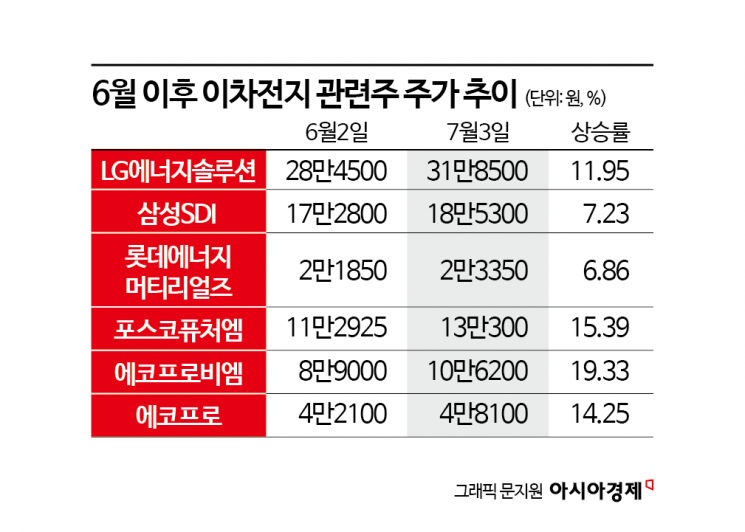

According to the Korea Exchange on July 4, LG Energy Solution closed at 318,500 won the previous day. This represents an 11.95% increase compared to the closing price on June 2. During the same period, Samsung SDI rose 7.23% to 185,300 won. Ecopro BM and Ecopro also jumped by 19.33% and 14.25%, respectively.

This year, the share prices of secondary battery-related stocks have continued to decline. In the case of LG Energy Solution, the stock hit an all-time intraday low on May 23, 2025, and the weak trend persisted. However, since June, the atmosphere has shifted. The domestic index has been rising overall, and expectations for Tesla's unmanned robotaxi have been reflected in the market.

Last month, Tesla launched a pilot paid robotaxi service in Austin, Texas, United States. The fare is set at a flat rate of $4.20. The securities industry expects robotaxis to expand their presence based on their affordable pricing.

However, uncertainties in the electric vehicle market itself remain a source of concern. In Europe, growth in the electric vehicle market is anticipated due to strengthened environmental regulations. In contrast, the United States, which is the world's largest market, is expected to experience a slowdown due to unfavorable policies. The U.S. Senate recently passed the "One Big Beautiful Bill" (OBBBA), which includes a provision that limits the electric vehicle tax credit to only being available until September 30, 2025.

Joo Minwoo, a researcher at NH Investment & Securities, said, "Due to unfavorable policy changes, there are signs that the slowdown in U.S. electric vehicle demand may become prolonged," and added, "Tariffs, which will be implemented in earnest after July, are also a factor that will dampen electric vehicle demand."

While growth is expected in Europe, market share remains an issue for domestic companies. Park Jinsu, a researcher at Shin Young Securities, assessed, "In the European market, it is difficult for domestic companies to recover their market share in the short term, as major clients are expanding the launch of new vehicles based on LFP (lithium iron phosphate) and Chinese battery makers are ramping up local production."

Given the unfavorable market environment, the securities industry advises that either a Tesla value chain effect or a resolution of sector uncertainties is needed.

Researcher Joo Minwoo explained, "Tesla announced at its 2024 robotaxi unveiling event that it is targeting a fare of $0.40 per mile. If this becomes a reality, consumers will be able to travel at a lower cost than using their own cars, which could lead to a rapid expansion in adoption."

Researcher Park Jinsu stated, "From a stock price perspective, policy uncertainty in the U.S. market is being reflected even more strongly at present. Until this risk is resolved, it will be difficult for the entire sector to enter a phase of sustained rebound." He added, "For a fundamental recovery in investment sentiment, concerns about the contraction of the U.S. electric vehicle market need to be alleviated, or there must be a recovery in market share within Europe."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.