One Year Since Park Sangshin's Return as CEO:

'Conservative Management' Bears Fruit

Likely to Join the '100 Billion Won Club' for Operating Profit

for the First Time in 10 Quarters

Housing Cost Ratio Improves to 88.8% ...

Plant Division Also Drives Performance

"First Construction Company to Emerge

from the Long Tunnel of Deteriorating Cost Ratios"

There are growing expectations that DL E&C will recover quarterly operating profit in the 100 billion won range for the first time in over two years. The improvement in housing cost ratios, selective order-taking, and a conservative construction commencement strategy are cited as the main drivers behind this rebound in performance. The management focus on internal stability, led by CEO Park Sangshin, who returned to the company in July last year, appears to be bearing tangible results after one year.

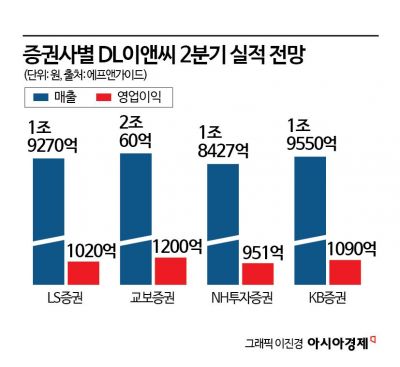

According to financial information provider FnGuide on July 3, the consensus (average forecast) for DL E&C's consolidated operating profit in the second quarter of this year is 108.2 billion won. This represents a 232.9% increase compared to the same period last year, and marks the first time in ten quarters since the fourth quarter of 2022 (operating profit of 120.2 billion won) that operating profit is expected to surpass the 100 billion won mark. Out of 17 securities firms, 14 forecasted operating profit of over 100 billion won. The official performance announcement is scheduled for the end of this month. Revenue is projected to reach 1.9174 trillion won, a 7.4% decrease compared to the same period last year.

As the cost ratio in the housing division improves, overall performance is also expanding. The housing division, which accounts for more than half of total revenue, had been burdened by high-cost projects, but profitability has shown a marked recovery in the second quarter. KB Securities estimated DL E&C's standalone housing cost ratio for the second quarter at 88.8%. This is a clear decline compared to 90.7% in the first quarter and 93.0% in the same period last year.

The recovery in performance is also evident in the plant division. Revenue is being recognized from projects such as S-Oil's Shaheen Project and the Russia Baltic Project. Expansion of orders based on FEED (Front-End Engineering Design) is also underway. As a mid- to long-term strategy, DL E&C is pursuing expansion in the SMR (Small Modular Reactor) business. DL E&C has invested 25 billion won in U.S. SMR developer X-energy, securing approximately a 2% stake. X-energy has signed a power supply contract for SMRs with Amazon and has received $1.2 billion in support from the U.S. government. The scope of cooperation is also expanding, including nuclear power plant development in Norway and participation in SMR bidding in Washington State, U.S.

Since taking office, CEO Park has focused on reducing cost ratios. According to Kyobo Securities, the proportion of low-margin, high-cost projects at DL E&C is expected to decrease from 91% in 2023, to 80% last year, 41% this year, and 29% next year. Given the nature of the construction industry, where projects commenced in the past are reflected in revenue over a long period, DL E&C is now considered to have entered a full-fledged phase of structural improvement.

The management strategy of prioritizing profitability over growth in scale has also proven effective. This year, DL E&C aims to commence construction of 7,940 units on a standalone basis, and a total of 11,945 units including DL Construction. This is about half the level of competitors, who are targeting around 20,000 units annually. A significant portion of this year's performance was already secured in the first quarter. As of the end of April, the sales rate was 100% in the Seoul metropolitan area and Seoul, and over 85% in regional areas, indicating stable recovery speed.

The market is also responding to these developments. The National Pension Service increased its stake in DL E&C from 10.30% to 12.21% this year. Among the top five listed construction companies in Korea, DL E&C has the highest shareholding ratio by the National Pension Service. KB Securities analysts Jang Moonjun and Kang Minchang commented, "DL E&C will be the first construction company to emerge from the long tunnel of deteriorating cost ratios," adding, "The conservative approach to project commencement and risk management strategy is translating into improved performance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.