A Sudden Blow to Gap Investors Facing Final Payments

Struggling to Find Tenants Under the Seller's Name After Conditional Jeonse Loan Ban

#Kim Myungshin (alias), an office worker living in Seongbuk-gu, Seoul, has been unable to sleep as she faces the deadline for paying the balance on her apartment purchase contract in October. Last month, after signing a sales contract for an apartment currently occupied by the owner, Kim planned to use the new tenant's jeonse loan to pay the remaining balance. However, her plan fell apart after the government announced new loan regulations. With the ban on conditional jeonse loans tied to ownership transfer, she now has to come up with the remaining 400 million won herself. Kim persuaded the owner to allow a tenant to move in first. The owner and the tenant signed a jeonse contract, and Kim arranged to take over the apartment by succeeding the contract. In return, Kim agreed to pay the owner a fee for the extra effort.

After the government blocked conditional jeonse loans tied to ownership transfer, some gap investors have been seeking such workarounds to prevent transaction cancellations. The new buyer can still make a gap investment without a conditional jeonse loan, as long as they pay only the amount excluding the jeonse deposit.

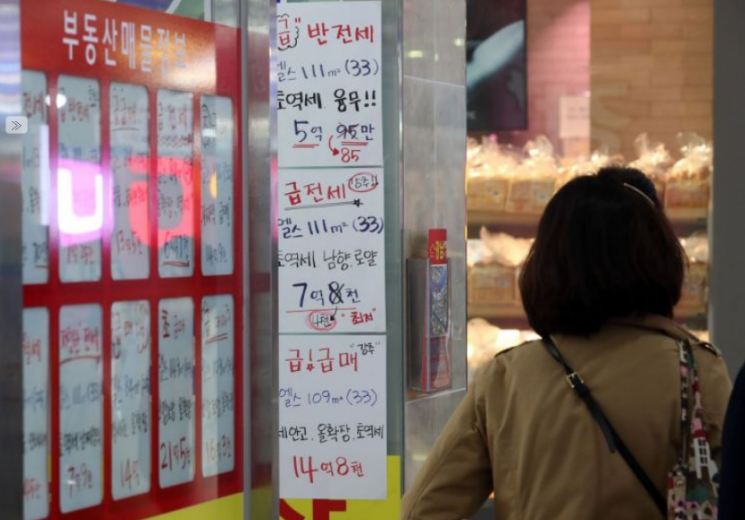

According to industry sources on July 3, since June 27, conditional jeonse loans tied to ownership transfer have been banned in the Seoul metropolitan area and other regulated regions, effectively closing the door on gap investments. Conditional ownership transfer loans refer to loans where the ownership of the property changes on the same day the tenant receives the jeonse loan. Simply put, the new owner's balance payment date and the tenant's jeonse loan execution date are set for the same day, and the jeonse deposit received that day is used to pay the previous owner. This has been a common method for gap investors to secure funds.

Online real estate communities have been flooded with complaints from people whose funding plans have been disrupted by the new regulations just before their balance payments. One post read, "I signed a sales contract early last month and was looking for a jeonse tenant when the new loan regulation was announced. Now that conditional jeonse loans are unavailable, I don't have enough cash on hand to pay the balance, and my hands are shaking."

Various strategies are being employed to prevent contract cancellations. A typical method is for the owner to sign a jeonse contract with a tenant before the sales contract, and then have the new owner succeed the jeonse contract. By using this approach, the new owner can pay the balance without relying on a conditional jeonse loan. The buyer only needs to pay the difference between the sales price and the sum of the down payment and the jeonse deposit, under the condition that they succeed the seller's status as landlord. While this is not illegal, it is considered a loophole to circumvent regulations.

However, it is expected to be difficult to gain the seller's cooperation. The seller must sign the lease contract directly and vacate the property for the new tenant in advance. Song Seunghyun, CEO of Urban & Economy, said, "This is only possible if the interests of the seller and buyer align perfectly. While it exploits a loophole in the system, it will not be easy for the seller to urgently find a jeonse tenant under their own name before the buyer pays the balance."

Experts believe these workaround methods will ultimately be only temporary solutions. Since the government has shown a strong determination to block gap investments through these new loan regulations, such methods could also be restricted in the future.

Yoon Sumin, a real estate expert at NH Nonghyup Bank, said, "Unless the area is subject to a land transaction permit system requiring actual residence, it will be difficult to completely eliminate gap investments from the market. However, due to the impact of these regulations, the market may come to realize that the days of easy gap investing are over." He added, "Going forward, the number of investors willing to actively pursue gap investments while bearing the risks is expected to decrease."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.