Analysis of Financial Product Subscription Data

Among Customers Predicted by AI to Have High Subscription Potential,

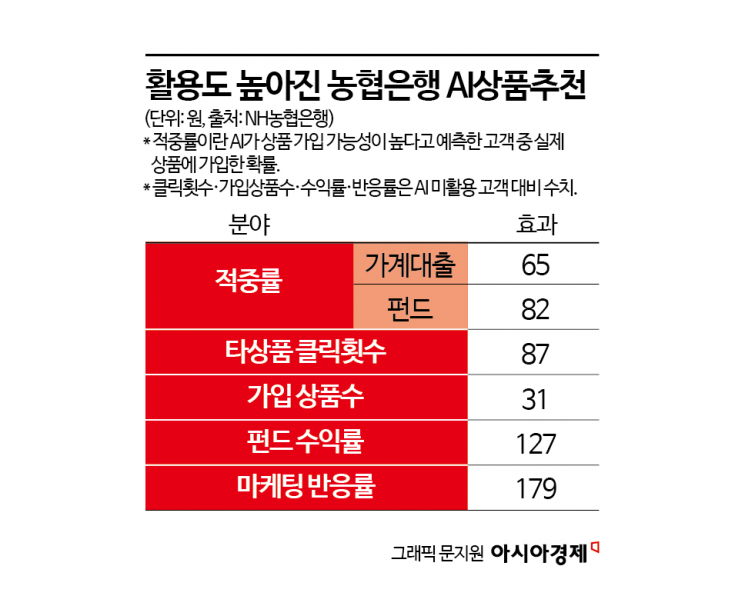

Actual Product Subscription Rate Reaches Up to 82%

"Contributing to Profitability and Customer Satisfaction"

Customers who used NH NongHyup Bank's artificial intelligence (AI) product recommendation service were found to be significantly more likely to subscribe to products compared to those who did not use AI. In cases where AI predicted a high likelihood of product subscription, the actual subscription rate reached up to 82%.

According to the financial sector on June 30, NongHyup Bank announced statistics related to AI product recommendations by utilizing its own financial product subscription data, non-face-to-face marketing data, and application (app) access logs.

NongHyup Bank announced statistics related to AI product recommendations by utilizing financial product subscription data, non-face-to-face marketing data, and application (app) access logs. NongHyup Bank

NongHyup Bank announced statistics related to AI product recommendations by utilizing financial product subscription data, non-face-to-face marketing data, and application (app) access logs. NongHyup Bank

As a result of analyzing the conversion rates of 10,000 users each?those who used and those who did not use the AI product recommendation?among visitors to the NH All One Bank financial product mall from March last year to the first quarter of this year, customers who used the AI product recommendation subscribed to products 377% more than those who did not use it.

NongHyup Bank's AI product recommendation goes through four steps to recommend products that customers need. First, it connects all fragmented customer data to create big data. This includes all financial data from both the bank and other banks, such as transaction and holding data, log data, market data such as interest rates, exchange rates, and stock prices, as well as everyday data such as usage of convenience stores or coffee shops.

Second, using machine learning or deep learning models, the big data is meticulously analyzed to calculate, in real time, the "needs score" for each product group for each customer. To do this, it predicts the probability of subscription for each customer and product group. Even if a customer has not subscribed to a product, it uses a serendipity model to predict "unexpected experience values" for product groups recently subscribed to by people with similar gender, age, assets, and consumption patterns. It also predicts probabilities in real time for triggers such as deposit/withdrawal events or changes in investment preferences, and applies trends based on market conditions or product subscription rates.

Based on these product group scores, it simulates policies and interest rates, then recommends selected products, high-yield products based on yield simulations, and popular products among similar customer groups. NongHyup Bank explained that, by leveraging big data, it also uses generative AI and explainable AI (XAI) to provide the "reason for recommendation."

According to NongHyup Bank, the effectiveness of the AI product recommendation is clear. Looking at the "hit rate"?the proportion of customers who actually subscribed among those whom AI predicted to have a high likelihood of subscribing?in the third quarter of last year, the rate was 65% for household loans and 82% for funds. It was also found to contribute to both profitability and customer satisfaction. Customers who used the AI product recommendation clicked on other products 87% more and subscribed to 31% more products than those who did not use it. Fund yields (127%) and marketing response rates (179%) were also higher among users of the AI product recommendation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.