External Financial Assets Increased by $172.4 Billion Last Year

U.S. Financial Assets Reach $962.6 Billion, Accounting for a Record 45.9%

China's Share Falls to 6.6%, Marking a Record Low for Three Consecutive Years

Last year, the amount invested by residents of Korea in the United States increased by $158.1 billion, marking an all-time high. This was driven by a surge in U.S. stock prices, which led to more individuals, including so-called “Seohak Ants” (Korean retail investors in foreign stocks), investing in U.S. equities, as well as an increase in direct investments by domestic companies in the U.S. in sectors such as automobiles and secondary batteries.

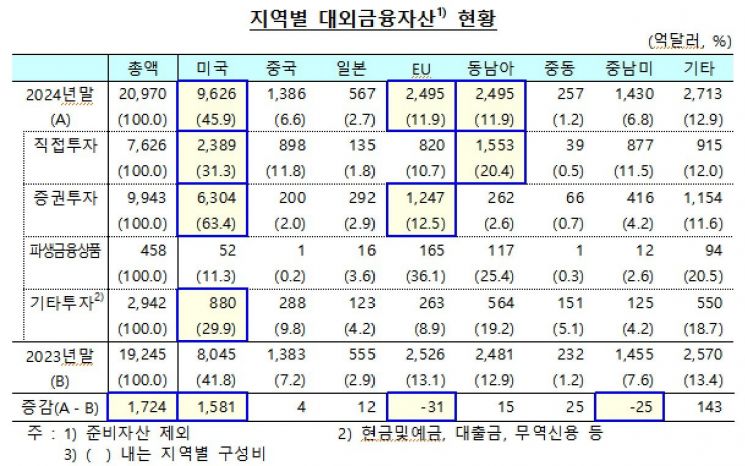

According to the “2024 International Investment Position by Region and Currency (Preliminary)” released by the Bank of Korea on June 26, Korea’s external financial assets (excluding reserve assets) stood at $2.097 trillion at the end of last year. This represents an increase of $172.4 billion from the end of the previous year, an approximately 9% rise in one year. External financial assets refer to overseas financial assets held by Korean nationals.

By region, the balance of investments in the United States was $962.6 billion, accounting for 45.9% of the total and ranking highest. This figure increased by $158.1 billion from the previous year, marking the largest increase since statistics began to be compiled. The share also reached a record high for the second consecutive year.

Park Seonggon, head of the Overseas Investment Statistics Team at the Economic Statistics Department 1 of the Bank of Korea, explained, “The overseas stock investment boom that began after COVID-19 continued last year, resulting in a significant increase in Korean investors’ holdings of U.S. stocks. In addition, U.S. stock prices continued to rise throughout the year, repeatedly surpassing previous highs.” He added, “As a result, Korean overseas stock investments became even more concentrated in the U.S., and valuation gains at year-end also increased significantly, which led to the largest-ever increase in the balance of U.S. stock investments.”

Direct investments by domestic companies in the U.S. also contributed to the increase in U.S. financial assets. Park explained, “This was mainly due to increased investments in production facilities in the U.S., particularly in the automobile and secondary battery sectors.”

In terms of investment balance, Southeast Asia ($249.5 billion, 11.9%) and the European Union (EU, $249.5 billion, 11.9%) followed the U.S. Excluding the U.S., growth compared to the previous year was minimal or declined. This was due to losses on assets denominated in currencies other than the U.S. dollar, as the dollar strengthened. The Middle East ($2.5 billion) and Southeast Asia ($1.5 billion) saw slight increases, while the EU (down $3.1 billion) and Central and South America (down $2.5 billion) experienced decreases.

In the case of China, its share of Korea’s external financial assets has been clearly declining. Financial assets in China amounted to $138.6 billion last year, accounting for 6.6% of the total. This share marked a record low for the third consecutive year. Park explained, “Direct investment accounts for a large portion in China, but investment conditions have deteriorated due to the ongoing U.S.-China conflict and sluggish domestic demand in China, as well as the impact of global supply chain restructuring. As a result, investments have declined for two consecutive years. There was also a knock-on effect from the sharp increase in the share of U.S. financial assets.”

By type of investment, direct investment was highest in the U.S. ($238.9 billion) and Southeast Asia ($155.3 billion); securities investment was highest in the U.S. ($630.4 billion) and the EU ($124.7 billion); and other investments were highest in the U.S. ($88.0 billion).

However, the amount of investment in the U.S. may decrease this year. Park noted, “So far this year, U.S. stocks have been fluctuating, so it is uncertain whether last year’s upward trend will continue. Concerns persist that U.S. assets are overvalued, and with the recent improvement in the domestic stock market, there is a possibility that investors will return to the Korean market. If the trend in the first half continues into the second half, the increase in U.S. assets may slow.”

Korea’s external financial liabilities, which represent the balance of foreign investment in Korea, decreased by $129.0 billion over the past year to $1.4105 trillion.

By region, Southeast Asia ranked first for the first time since statistics began, with $328.0 billion, accounting for 23.3% of the total. This was followed by the U.S. ($319.1 billion, 22.6%) and the EU ($231.7 billion, 16.4%). Park explained, “Last year, Korean stock prices declined significantly and the won depreciated, which led to a decrease in the balance of U.S. liabilities. The results also reflect investments in Korean bonds by institutional investors from Hong Kong and Singapore, as well as foreign currency supply through borrowing by Chinese-affiliated foreign bank branches.”

By type of investment, direct investment was highest in the EU ($70.0 billion); securities investment was highest in the U.S. ($241.3 billion); and other investments were highest in Southeast Asia ($82.9 billion).

Meanwhile, when looking at Korea’s external financial assets (excluding reserve assets) by currency at the end of last year, U.S. dollar-denominated financial assets amounted to $1.2985 trillion, accounting for 61.9% of the total and ranking highest. This was followed by euro-denominated assets at $180.1 billion (8.6%) and yuan-denominated assets at $107.1 billion (5.1%). Compared to the previous year, dollar-denominated assets increased by $166.7 billion, yen-denominated assets by $3.5 billion, and Hong Kong dollar-denominated assets by $3.4 billion, while euro-denominated assets decreased by $7.8 billion.

For external financial liabilities, won-denominated financial liabilities were the highest at $868.8 billion (61.6%), followed by dollar-denominated liabilities at $411.3 billion (29.2%) and euro-denominated liabilities at $40.7 billion (2.9%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.