Accumulating Technology in Digital Assets Including Stablecoins

Participation in 'Project Hangang,' the CBDC Real-World Test

Stock Price Rises Driven by Foreign and Institutional Net Buying

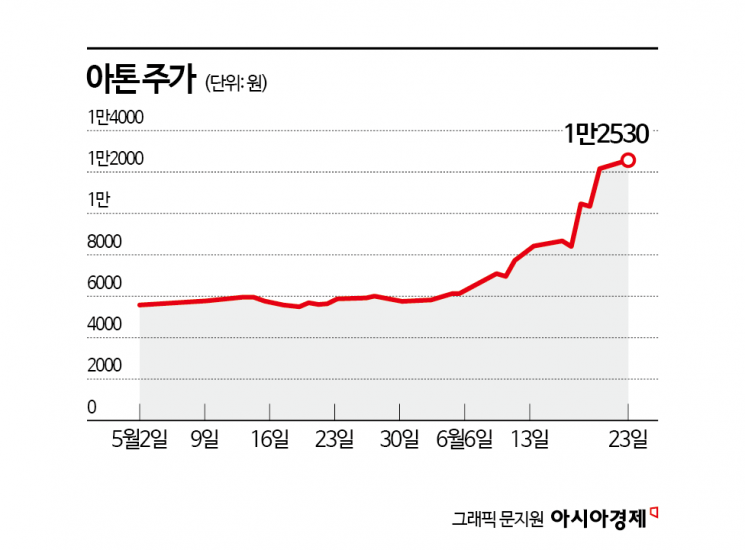

Fintech security company Aton's stock price has surged significantly this month. After remaining in a narrow range until last month, the stock began an upward trajectory amid growing expectations for the stablecoin market. As stablecoin-related stocks such as Kakao Pay and ITCen Global soared, investor interest has expanded to fintech security firms like Aton.

According to the financial investment industry on June 24, Aton's stock price has risen by 119.1% so far this month. Over the same period, the KOSDAQ index increased by 6.9%. Foreign investors and institutional investors led the stock's rise, recording net purchases of 5.5 billion KRW and 5.3 billion KRW, respectively. Foreign investors purchased shares at an average price of 7,780 KRW per share, achieving a return of 61%.

Aton was the first in Korea to develop and supply a mobile trading service (MTS) to securities firms in 2000. It also introduced the world's first chip-based mobile banking service. Based on software-type security modules, the company has distributed authentication and security solutions to major domestic financial institutions. Aton is leading the era of simple authentication certificates that are replacing the traditional authorized certificate system. Major clients include large banks such as Shinhan, NH Nonghyup, KB Kookmin, Hana, and IBK, as well as major securities firms like Shinhan Investment, Korea Investment & Securities, and Samsung Securities.

Aton also provides a variety of fintech services, including the PASS certificate service, on the electronic signature platform 'PASS' operated by the three major telecom companies?SK Telecom, KT, and LG Uplus. The company exclusively supplies the payment solution for Tmoney, Korea's number one transportation card. In the first quarter of this year, Aton posted sales of 17 billion KRW and operating profit of 2.1 billion KRW.

Aton's advanced technology has been recognized, leading to its participation in the Bank of Korea's central bank digital currency (CBDC) real-world test, 'Project Hangang.' The company successfully built the response system for NH Nonghyup Bank. In the CBDC pilot involving 100,000 participants, Aton was responsible for the entire process, including building a cloud platform-based blockchain infrastructure, developing a deposit token conversion system, integrating with NH All One Bank, and implementing the real payment system. This demonstrated Aton's capabilities in building digital currency systems.

The government and political circles are considering various measures to legislate stablecoins. As calls grow for the introduction of a KRW-based stablecoin, capabilities in security technology and regulatory compliance are emerging as key competitive advantages. The Bank of Korea has expressed concerns about the potential side effects of non-bank issuance of KRW stablecoins. The central bank warned that if a private currency ecosystem that is not subject to monetary policy grows larger, the effectiveness of policy could be weakened.

Digital assets, including stablecoins, could become a new business area for the banking sector. Through its participation in the banking sector's tokenized securities (STO) consortium, Aton has explored ways to integrate traditional financial institutions with digital asset technologies. The company expects this to help establish a foundation for financial sector cooperation necessary for the operation of CBDCs and stablecoins.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.