Naver Hits Consecutive Record Highs After Producing the First 'Chief of AI'

Kakao Surges 65% from Its Low

AI Business Results Expected to Accelerate in the Second Half

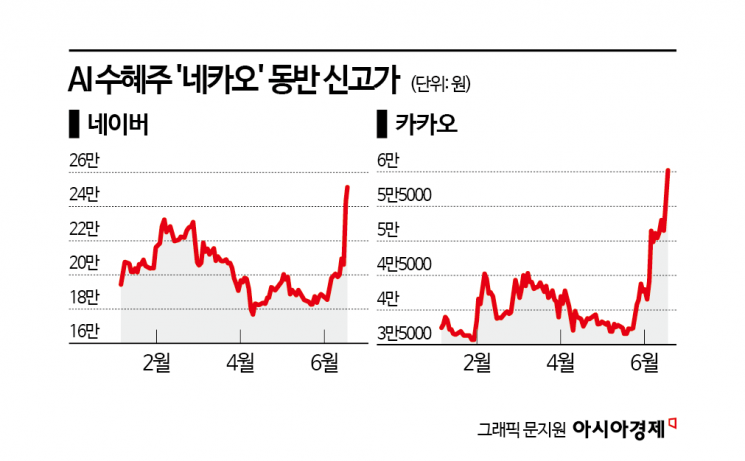

Leading IT stocks Naver and Kakao have been on a winning streak, celebrating consecutive rallies. As the KOSPI index pauses just short of the 3,000 mark, there is growing speculation that policy beneficiaries such as artificial intelligence (AI)-related stocks will increasingly stand out.

According to the Korea Exchange on June 20, the previous day Naver closed at 252,000 won, up 3.49%, while Kakao surged 9.42% to finish at 60,400 won. Both stocks set new 52-week highs during intraday trading. For Kakao, surpassing the 60,000 won mark intraday was the first time in about one year and three months, since February 15, 2024. Naver also posted its highest price since August 2022. Notably, institutional investors have been at the center of this rally, having purchased approximately 350 billion won worth of Kakao (267 billion won, ranked first in net purchases) and Naver (79.3 billion won, ranked fifth) shares so far this month.

After peaking in February and then trending downward, the share prices of these companies reversed course at the end of last month amid heightened expectations for the launch of a new government. The Lee Jaemyung administration ignited investor sentiment by announcing a plan to invest over 16 trillion won in the AI industry over five years, including securing 50,000 advanced graphics processing units (GPUs) and expanding data centers. In particular, investor expectations for Naver rose further when Ha Jungwoo, head of the Naver Cloud AI Innovation Center, was appointed as the inaugural Chief of AI Future Planning to lead the new government's AI policy roadmap.

As a series of positive developments emerged, both domestic and global securities firms have been raising their target prices. Citi Securities selected Naver as its top pick among Korean internet platform companies and raised its target price from 270,000 won to 300,000 won. JP Morgan also increased its target price from 250,000 won to 270,000 won, stating that Naver is expected to benefit from the Korean government's 100 trillion won AI policy initiative. Heungkuk Securities set a target price of 63,000 won for Kakao, forecasting growth in advertising profits due to improved industry conditions and economic recovery in the second half of the year.

With macroeconomic uncertainties such as US-driven tariff shocks and Middle East geopolitical crises expected to subside in the second half, the AI businesses pursued by both companies are also anticipated to yield tangible results. Naver plans to launch a shopping AI agent on Naver Plus Store within the year, and in 2026 will introduce an 'AI Tab' similar to Google's 'AI Mode' to defend its market share in search.

Kim Hyeyoung, a researcher at Daol Investment & Securities, stated, "Strengthening search services with AI is a strategy to keep pace with global competition, and by increasing user dwell time and usage, the platform's value can be maintained." She added, "There is also potential for new advertising revenue in the future." This year, Naver's annual revenue is estimated to grow 10.4% year-on-year to 11.8526 trillion won, with operating profit projected to rise 11.8% to 2.2231 trillion won.

For Kakao, a major overhaul of KakaoTalk is planned for the second half of the year, including a new 'Discovery Area' that will provide various types of content such as short-form videos in a feed format, as well as generative AI search features. Results from a collaborative project with OpenAI, the developer of ChatGPT, are also expected to be unveiled within the year. Kim commented, "Kakao is entering a phase of gradual growth in revenue and momentum, driven by increased advertising inventory and user dwell time through the Discovery Area, higher Power Link revenue from AI search, and collaboration with OpenAI." She forecast that Kakao's annual revenue will surpass 8 trillion won this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.