Financial Supervisory Service Announces "Business Performance of Asset Management Companies for Q1 2025"

Net Profit Reaches 444.5 Billion Won... Up 53% Compared to Q4 Last Year

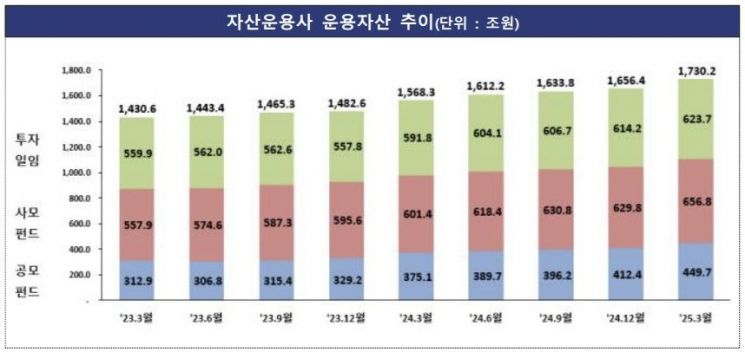

In the first quarter of this year, the total assets under management by asset management companies, including fund trust assets and discretionary investment contracts, reached 1,730 trillion won.

According to the "Business Performance of Asset Management Companies for the First Quarter of 2025 (Provisional)" released by the Financial Supervisory Service on June 19, the assets under management of 497 asset management companies in the first quarter of this year amounted to 1,730.2 trillion won, an increase of 73.8 trillion won (4.5%) compared to the end of last year.

Fund trust assets stood at 1,106.5 trillion won, up 64.3 trillion won (6.2%) from 1,042.2 trillion won at the end of last year. This was influenced by an increase in money market funds (MMFs) and bond funds, both of which are considered stable investment options, amid rising economic uncertainty. During the same period, public offering funds increased by 37.3 trillion won (9.0%) to 449.7 trillion won, while private equity funds rose by 27 trillion won (4.3%) to 656.8 trillion won. Discretionary investment contracts increased by 9.5 trillion won to reach 623.7 trillion won.

The net profit of asset management companies in the first quarter of this year was 444.5 billion won. This represents an increase of 154.5 billion won (53.3%) compared to 290 billion won in the fourth quarter of last year. However, it marks a decrease of 81.7 billion won (15.5%) compared to the same period last year.

Operating revenue was 1.3638 trillion won, a decrease of 213.2 billion won (13.5%) compared to the end of last year. This was mainly due to a decline in commission income. Operating expenses were 958.6 billion won, down 208.9 billion won (22.7%) from the previous quarter. The return on equity (ROE) for the first quarter of this year was 11.0%, a decrease of 0.6 percentage points compared to 11.6% last year.

Among the 497 asset management companies in the first quarter of this year, 227 recorded a profit, while 270 posted a loss. The proportion of loss-making companies reached 54.3%, an increase of 11.6 percentage points compared to last year. The Financial Supervisory Service explained, "Among 418 private equity management companies, 253 recorded losses, resulting in a loss ratio of 60.5%. This is an increase of 13.3 percentage points compared to 47.2% last year."

Commission income for asset management companies in the first quarter of this year was 1.0488 trillion won, a decrease of 139.2 billion won (11.7%) from 1.188 trillion won in the previous quarter. However, compared to the same period last year, it increased by 28.8 billion won (2.8%).

Fund-related commissions amounted to 865.4 billion won, a decrease of 97.1 billion won (10.1%) from the previous quarter, but an increase of 21.7 billion won (2.6%) compared to the same period last year. Discretionary advisory commissions were 183.4 billion won, down 42.1 billion won (18.7%) from the previous quarter, but up 7.1 billion won (4.1%) year-on-year.

Selling and administrative expenses in the first quarter were 742.7 billion won, a decrease of 173.2 billion won (18.9%) from the previous quarter. Compared to the same period last year, this was an increase of 39.7 billion won (5.6%). In addition, securities investment gains were 73.2 billion won, an increase of 20.1 billion won (38.0%) from the previous quarter, but a decrease of 81.3 billion won (52.6%) compared to the same period last year.

The Financial Supervisory Service stated, "In the first quarter, the assets under management of asset management companies continued to increase and net profit also improved somewhat compared to the previous quarter. However, profitability indicators remain weak due to a decrease in commission income and a continued rise in the proportion of loss-making companies. Therefore, it is necessary to enhance the soundness of the financial structure by reducing volatility in the income structure."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.