Subsidiary DNC Duckeun Stake Sold for 35 Billion Won

13 Regional Sales Offices and Idle Properties Nationwide Listed for Sale

Six Properties Including Namyangju Branch Auctioned, 19.6 Billion Won Recovered

1 Trillion Won in Cash to Be Secured Over Three Years... Increased Investment in Core Businesses and Shareholder Returns

KT&G is accelerating the disposal of non-core assets. Since last year, the company has divested a wide range of assets, including stakes in subsidiaries, regional office buildings, and prime real estate. By 2027, KT&G plans to sell more than 100 assets, securing approximately 1 trillion won in cash, which will be used to invest in core businesses such as electronic cigarettes and health functional foods, as well as to expand shareholder returns.

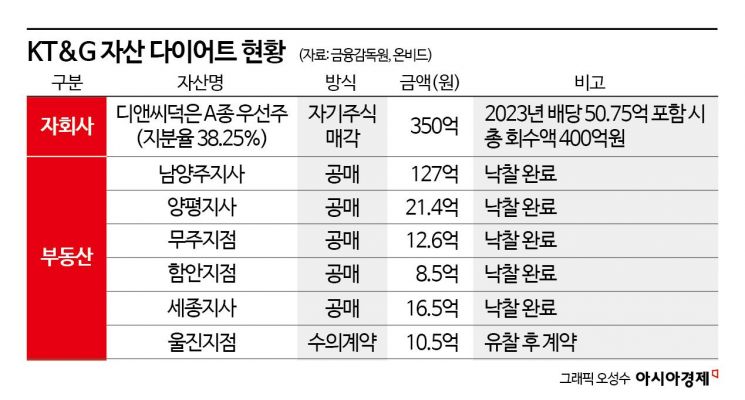

According to the Financial Supervisory Service and Onbid on June 17, KT&G sold its stake in its subsidiary DNC Duckeun for 35 billion won in April. In March 2023, KT&G had acquired 3,825 shares (representing a 38.25% stake) of Class A preferred stock in the company for about 35.3 billion won. This stock is an investment-type preferred share that guarantees an internal rate of return (IRR) of 14.5% per year. KT&G received a total dividend of 5.075 billion won at the end of last year, just one year after the investment, and in April this year, DNC Duckeun repurchased the shares as treasury stock, allowing KT&G to recover over 40 billion won in total. This is interpreted as an exit at the point when the IRR target set at the time of investment was met.

DNC Duckeun is the developer of 'GL Metro City' in the Hyangdong District. The project, which began sales in 2021, recorded cumulative sales revenue of 520.4 billion won as of the end of last year. The largest shareholder of DNC Duckeun is currently Executive Director Hwang Junyeon, who holds about 25.65% of the shares, including both common and non-voting preferred shares. KT&G's stake has been converted to treasury stock, thus losing voting rights, and Director Hwang is considered the de facto largest shareholder. A KT&G representative explained, "The sale of the DNC Duckeun stake was to recover the investment following the achievement of business objectives such as sales."

The company is also proceeding with real estate securitization. Last year, it secured about 160 billion won in cash through asset sales. In addition to Bundang Tower (120 billion won), KT&G also disposed of regional offices nationwide. The company listed 13 regional offices and idle properties on Onbid, of which six were successfully auctioned: Namyangju Branch (12.7 billion won), Yangpyeong Branch (2.1 billion won), Muju Branch (1.2 billion won), Haman Branch (850 million won), Sejong Branch (1.65 billion won), and Uljin Branch (1.05 billion won). One asset was sold via private contract. The total amount recovered was about 19.67 billion won, with successful bid rates ranging from 70% to 90% of appraised value.

Among the properties listed on Onbid, six assets remain unsold: Goyang Branch (Ilsan-dong), Gapyeong Arts School (former branch school), Asan Branch, and units 601 and 801 in the North Busan Building. The total appraised value is 26.5 billion won. KT&G plans to continue with the sales process, including re-bidding, within this year.

The company is also seeking to sell major real estate assets in Seoul. The 'Courtyard Marriott Seoul Namdaemun Hotel' in Jung-gu, Namdaemun, is being marketed for sale at a price between 100 billion and 200 billion won. The 'KT&G Euljiro Tower' at Euljiro Entrance is being offered at about 27 million won per 3.3 square meters, with a total asking price of around 150 billion won. Both assets are reportedly in contact with multiple domestic and international investors. The company intends to continue the securitization of non-core assets such as rental buildings, commercial properties, and regional sales offices throughout this year.

Through restructuring, KT&G expects to generate about 1 trillion won in cumulative cash by 2027. This is equivalent to one-sixth of last year's annual sales of 5.9087 trillion won. To achieve this, KT&G plans to dispose of 57 real estate assets and 60 financial assets by 2027.

KT&G will use the cash secured through asset securitization to increase investment in its core businesses. In the electronic cigarette and overseas cigarette businesses, the company will invest in establishing overseas production systems. In the health functional foods business, it will support the globalization of red ginseng. The company will also expand new product lines such as smokeless tobacco and nicotine pouches. KT&G is considering a variety of approaches, including external partnerships, in-house development, and mergers and acquisitions.

The funds will also be used for shareholder returns. KT&G plans to invest 3.7 trillion won to enhance corporate value by 2027. Of this, 1.3 trillion won will be allocated to share buybacks and cancellations, and 2.4 trillion won to dividends. This year, the company expects to execute more than 900 billion won for these purposes. At the shareholders' meeting, Kangman Bang, President of KT&G, stated, "Enhancing profitability and accelerating growth are our top priorities for increasing corporate value," and added, "We will further strengthen market leadership by transforming our cigarette-centered business structure into an expanded 'modern product' system."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.