KDB Future Strategy Research Institute

2025 Revised Economic Outlook

Export Contraction Due to Deteriorating Trade Environment

Continued Sluggishness in Construction Investment as a Constraint

However, Domestic Demand Expected to Gradually Improve

Led by Private Consumption as Political Uncertainty Eases

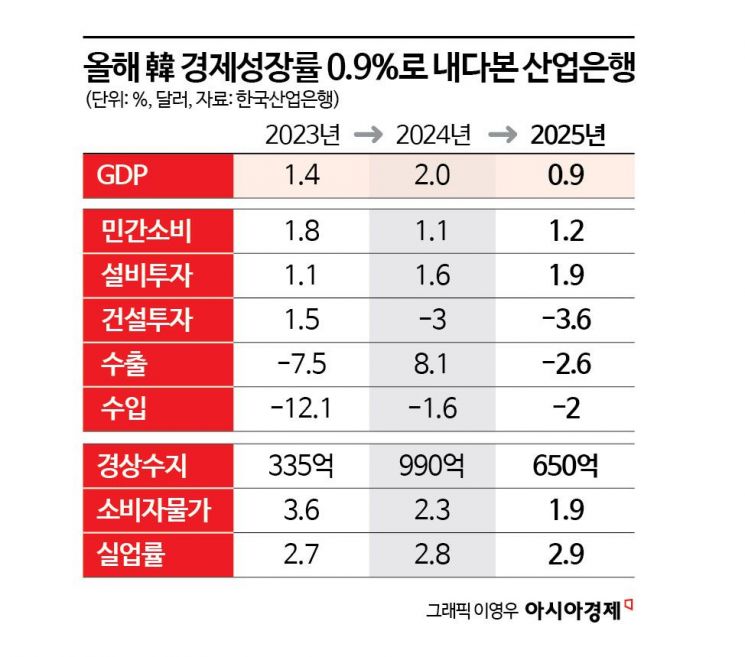

The Korea Development Bank (KDB) has revised this year's economic growth forecast for South Korea to 0.9%. This is 1.2 percentage points lower than its previous projection of 2.1% last year. The bank cited sluggishness in the construction sector as a factor on the domestic front, and deterioration in the trade environment?such as the tariff policies of the Donald Trump administration in the United States?as a factor on the export front, both contributing to the slowdown in growth. This adjustment aligns KDB with the pessimistic outlooks of not only overseas investment banks (IBs) but also domestic institutions such as the Bank of Korea and the Korea Development Institute (KDI).

According to the financial industry on the 16th, the Economic Research Team at the KDB Future Strategy Research Institute recently stated in its '2025 Revised Economic Outlook' that "despite continued growth in semiconductor demand, export contraction due to worsening trade conditions and continued sluggishness in construction investment will act as constraints on growth." Specifically, the report analyzed that, although domestic demand will gradually improve, led by private consumption, as political uncertainty eases after the election of President Lee Jaemyung in the second quarter, the recovery will be limited because the severe slump in construction investment in the first half of the year will be difficult to offset.

Last November, KDB projected this year's economic growth rate at 2.1%. The bank expected that price stability and interest rate cuts would lead to a recovery in private consumption and facility investment, but cited continued sluggishness in construction investment and a slowdown in export growth as reasons for caution. While the forecast has been lowered, the underlying causes remain unchanged.

Regarding the negative growth of the South Korean economy in the first quarter, which recorded a -0.1% growth rate, KDB pointed to a series of emergency martial law situations and the trade environment triggered by the Trump administration as causes. KDB explained, "Despite a solid increase in facility investment (up 4.2% year-on-year), domestic demand was weak as private consumption (0.5% growth) and construction investment (down 12.2%) both contracted due to domestic political uncertainty." Exports also decreased by 2.1%, and imports fell by 1.6% due to a reduction in intermediate goods imports following the decline in exports.

From the second quarter onward, KDB expects that private consumption will gradually recover, and that facility investment?centered on demand for semiconductor investment?will maintain stable growth, leading to a slight improvement in domestic demand. By sector, private consumption is projected to increase by 1.2% year-on-year, as consumer sentiment recovers due to the easing of political uncertainty, the implementation of economic stimulus measures such as a supplementary budget, and price stability. However, KDB noted that uncertainty surrounding US tariff policies is clouding the global economic outlook, and that continued high exchange rates and the growing scale of household debt are expected to negatively affect private consumption.

In the investment sector, KDB forecasts that facility investment will increase by only 1.9%, despite continued investment growth in the semiconductor sector, including artificial intelligence (AI), because the recovery in business sentiment has been delayed. Construction investment is expected to remain a 'drag' on domestic demand recovery, as the severe slump in the first half of the year will be difficult to offset, even though the downturn may gradually ease in the second half. In the first quarter, construction investment decreased by 12.2% year-on-year due to high interest rates, an increase in real estate project financing (PF) delinquencies, and a prolonged slump in order intake?marking the largest decline since the 2000s. Additional factors such as concerns over construction company insolvencies, an increase in unsold housing units, and stricter stress-based debt service ratio (DSR) regulations are also expected to dampen the construction market. On a positive note, KDB evaluated that the effects of increased construction orders from the second to fourth quarters of last year, the expansion of building start areas from the fourth quarter of 2023 to the third quarter of last year, and the stabilization of intermediate goods prices for construction will begin to appear in the second half of this year.

Exports are expected to decrease by 2.6% due to uncertainties in the trade environment stemming from US tariff policies. Factors such as reduced global trade volume caused by tariff policies and the imposition of item-specific tariffs by the US on South Korea's key export items?including steel and automobiles?could act as downward pressures. However, if tariff negotiations with the US are resolved favorably, the decline in exports could be mitigated. Imports are projected to decrease by 2% due to reduced demand for intermediate goods imports following the decline in exports. In addition, KDB forecasts a current account surplus of $65 billion, down from $99 billion last year, and expects consumer prices to rise by 1.9% due to weak domestic demand.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.