Strong Correlation Between Money Supply and Real Estate Prices

Unusual Trend: M2 Average Balance Decreases from Previous Month

Meanwhile, Seoul Apartment Prices See Largest Increase in 10 Months

"If Money Is Released, Prices Will Inevitably Rise"... Market Already Reflecting Expected Liquidity Expansion

When looking solely at the growth rate of the money supply in circulation based on broad money (M2), it appears to be far from a "real estate boom." However, apartment prices in Seoul have recorded their largest weekly increase in ten months. Some analysts suggest that the market sentiment is being stimulated in advance by the Lee Jaemyung administration's "expansionary monetary policy." There is an interpretation that expectations of increased liquidity are leading the market, especially with the possibility of an additional supplementary budget estimated at 20 trillion won and even a potential base interest rate cut being discussed.

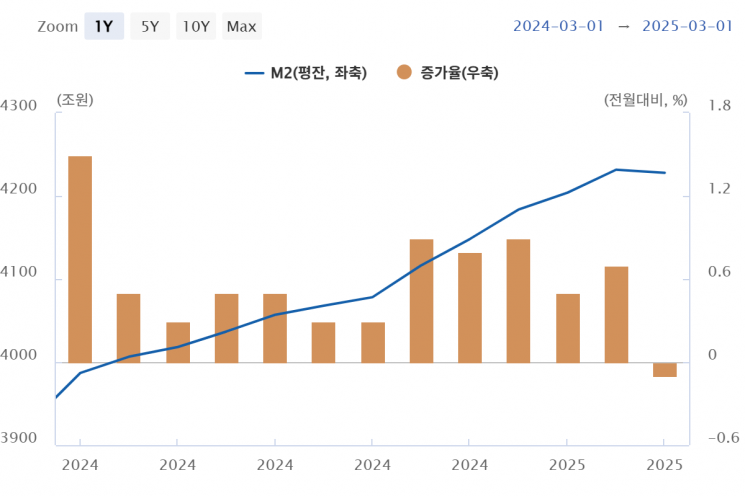

According to the Bank of Korea on June 15, the average M2 balance as of the end of March was 4,227.8 trillion won. This represents a 6.1% increase compared to the same period last year, but a 0.1% decrease compared to the previous month. It is rare for the money supply to decrease on a month-to-month basis. M2 is the total sum of liquidity, including cash in circulation, demand deposits, and time deposits. Over the long term, it steadily increases, depending on the Bank of Korea's monetary policy, economic growth rate, and inflation.

The money supply is often referred to as the "container" that holds real estate. In South Korea, real estate is the largest asset and channel that absorbs liquidity. There is a strong correlation between increases in the money supply and rising housing prices. This response is especially rapid in the Seoul metropolitan area, where both infrastructure and demand are concentrated. In 2021, the M2 growth rate posted double-digit year-on-year increases every month. The following year, in 2022, the real housing price growth rate reached 14%. This clearly demonstrates that increases in the money supply, with a slight time lag, lead to rising housing prices.

In contrast to the subdued money supply, Seoul apartment prices are showing signs of overheating. According to the Korea Real Estate Board, apartment sale prices in Seoul for the second week of this month (as of the 9th) rose by 0.26% compared to the previous week. This is the largest weekly increase since the fourth week of August last year (0.28%). The upward trend that began in the three Gangnam districts is now spreading through a balloon effect to areas such as Gangdong, Dongjak, and Seongdong?the so-called "Hangang Belt." In particular, Gangdong-gu (0.50%) saw its largest weekly increase in six years and nine months. Moreover, the warmth is spreading throughout the entire Seoul metropolitan area. Apartment prices in the metropolitan area as a whole rose by 0.09%, an increase from the previous week's 0.05%.

Based solely on monetary indicators, liquidity has not yet been significantly released, but the upward trend in Seoul, centered on Gangnam, and the buying sentiment focused on redevelopment areas are moving ahead of these indicators. This is interpreted as investors reflecting in advance the expected interest rate cuts and shifts in government policy. Recently, real estate communities have been flooded with comments such as, "If the government releases money, real estate prices will inevitably rise," and "You must buy now if you don't want to become a 'lightning pauper.'" Market participants are highly alert to the possibility of a "real estate boom," depending on the government's monetary policy direction, the size of the supplementary budget, and the timing of interest rate cuts.

Although the current M2 is on a downward trend, the market is paying attention to the possibility of a rapid increase in the future. With the possibility of an additional base rate cut by the Bank of Korea being raised, and the implementation of a supplementary budget estimated at over 20 trillion won expected to begin in earnest, there is a high likelihood that the money supply will shift to a sharp increase. The Lee Jaemyung administration, symbolized by so-called "hotel economics," is expected to pursue an aggressive fiscal policy. Major global investment banks (IBs) share a similar outlook. Recently, Morgan Stanley stated in a report titled "Transfer of Supreme Power" that "economic recovery is the top policy priority, and a stimulus package of at least 35 trillion won will be implemented in the third quarter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.