Not a Single Day Without Gains This Month

Up 35% This Month, 211% Year-to-Date

Market Cap Ranking Jumps from 35th to 11th This Year

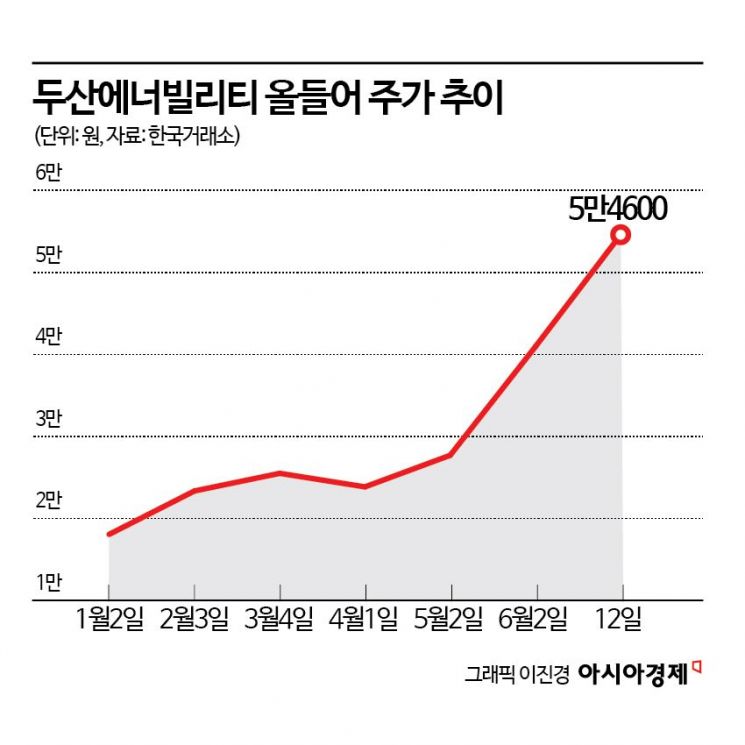

Doosan Enerbility continues its unstoppable upward momentum amid growing expectations for increased nuclear power plant orders. Having surged more than 200% this year, Doosan Enerbility is now on the verge of entering the top ten in market capitalization.

According to the Korea Exchange on June 13, Doosan Enerbility closed the previous day at 54,600 won, up 6.85%. The company has maintained a rally for seven consecutive trading days, reaching an all-time intraday high of 56,300 won.

Doosan Enerbility has recorded gains every single day this month, rising more than 35% since the beginning of June alone. Year-to-date, the stock has jumped 211%, with its share price climbing from the 18,000 won range at the start of the year to over 50,000 won.

Market capitalization, which stood at around 11 trillion won at the beginning of the year, has increased to 35 trillion won. As a result, Doosan Enerbility's market cap ranking has soared from 35th at the start of the year to 11th place. This month, Doosan Enerbility surpassed Shinhan Financial Group and Naver in market cap ranking. The gap with Celltrion, currently ranked 10th, is 1.1553 trillion won.

Continuous order wins are fueling the strong upward trend. So far this year, Doosan Enerbility has secured a total of five overseas gas combined cycle power plant projects worth approximately 4.3 trillion won. Starting with a peaking unit project in Qatar (about 290 billion won) in February, the company went on to win the Luma 1 and Nairiyah 1 projects (about 2.2 trillion won) and the PP12 project (about 890 billion won) in Saudi Arabia in March. On June 9, Doosan Enerbility announced it had signed a contract worth about 900 billion won with Vietnam's largest state-owned enterprise, the National Industrial Energy Group (PVN), for the construction of the "O Mon 4" gas combined cycle power plant.

Expectations are also high for an expansion of nuclear power plant orders. The recent signing of the main contract for the Dukovany nuclear power plant in the Czech Republic is expected to mark the company's full-scale entry into the European market, and additional orders for the Temelin nuclear power plant in the Czech Republic are considered highly likely. Furthermore, in January, Westinghouse in the United States and Korea Hydro & Nuclear Power (KHNP) agreed to cooperate in the global nuclear power market, which is expected to lead to an increase in orders for large-scale nuclear power plant equipment in the future.

Kim Youngho, a researcher at Samsung Securities, commented, "As nuclear power and liquefied natural gas (LNG) are once again drawing attention amid the energy transition for carbon neutrality, Doosan Enerbility, which operates both nuclear and gas turbine businesses, is expected to benefit. With structural demand expected to increase and supply likely to remain limited, order growth and performance improvement are expected to continue."

However, the elevated valuation resulting from the rapid share price increase is a concern. Choi Kyuhun, a researcher at Shinhan Investment Corp., analyzed, "Doosan Enerbility's share price has risen rapidly on expectations for growth businesses, but substantial top-line and earnings improvements will begin in earnest from 2027. For the valuation burden to be immediately alleviated, performance improvements in 2025 and 2026 are necessary. However, since growth businesses, especially nuclear power, require a longer time frame, the relief of the valuation burden will be limited." He added that new orders will be needed to justify the current valuation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.