Japan: Concerns Over US Tariff Uncertainties

US: Solid Employment Data and Cautious Approach

Different Reasons for Expected Rate Holds

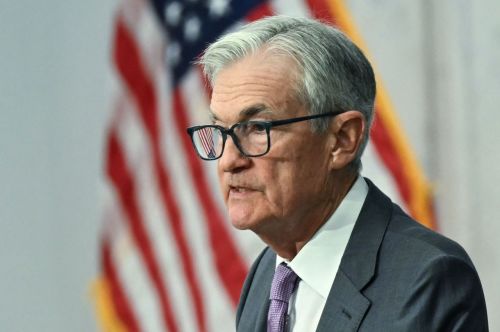

Both the US and Japanese central banks are widely expected to keep their policy rates unchanged at their respective monetary policy meetings next week. Kazuo Ueda, Governor of the Bank of Japan (BOJ), is anticipated to take a step back due to uncertainties such as US tariff policies, while Jerome Powell, Chair of the United States Federal Reserve (Fed), is expected to maintain the current rate, supported by robust US employment data.

Asahi: "High Probability of Three Consecutive Rate Holds in Japan"

The Asahi Shimbun and other Japanese media reported on June 12 that the Bank of Japan, the country's central bank, is highly likely to keep its short-term policy rate unchanged for a third consecutive meeting at its upcoming Monetary Policy Meeting next week.

The Bank of Japan is expected to maintain its policy rate at "around 0.5%" at the Monetary Policy Meeting scheduled for June 16-17, taking into account uncertainties stemming from the US tariff policies under the Donald Trump administration. In this context, the Asahi Shimbun explained that there is a growing sentiment within the BOJ that both businesses and households are increasingly adopting a wait-and-see approach to investment and consumption.

One point of interest is whether Kazuo Ueda, Governor of the Bank of Japan, who has repeatedly emphasized his intention to pursue a rate hike, will comment on the timing and pace of future increases.

Given this atmosphere, Japanese media are focusing more on the BOJ’s interim assessment regarding the reduction of long-term government bond purchases rather than a rate hike. In mid-May, yields on long-term bonds such as 20-year and 30-year maturities surged, as concerns mounted that the BOJ was reducing its long-term bond purchases too quickly.

However, the Bank of Japan is expected to stick to its existing plan through March next year, considering that there is not a strong demand from the market to revise its approach. The Asahi Shimbun reported, "The Bank of Japan is likely to continue reducing purchases after April next year," but also noted, "Within the BOJ, there is a strong opinion that the pace of reduction should be slowed after April next year to avoid negative impacts on the market."

US FedWatch: 99% Probability of Rate Hold...Trump's Pressure

In contrast, in the United States, despite ongoing pressure from President Donald Trump to cut rates, there is growing speculation that Jerome Powell, Chair of the Fed, will maintain the current policy rate.

According to CME FedWatch, the interest rate futures market sees a 99.1% probability that the Fed will keep its benchmark rate unchanged at 4.25-4.5% following the Federal Open Market Committee (FOMC) meeting on June 18. A Reuters survey of economists conducted through June 10 also showed that 103 out of 105 respondents expected a rate hold in June.

At a press conference following last month’s FOMC meeting, Chair Powell reiterated the need to wait until the economic impact of tariff policies becomes clearer, citing ongoing uncertainties. John Williams, President of the Federal Reserve Bank of New York, also recently supported this cautious stance, stating, "I don't think we will understand what is happening in the US economy in June or July."

US employment data also remains strong. According to the US Department of Labor, nonfarm payrolls increased by 139,000 in May compared to the previous month, surpassing the Wall Street Journal's expert forecast of 125,000, indicating solid job growth. Employment figures and the inflation rate are the two key indicators the Fed closely monitors. For this reason, there is a view that the Fed has no need to rush into a rate cut.

The Fed has maintained a rate hold since the rate cut in December last year. The probability of a rate hold in July stands at 84.8%, while a 0.25 percentage point cut in September is expected by 52.8% of the market, compared to a 38.9% probability of a hold. The remaining FOMC meetings this year are scheduled for June, July, September, October, and December.

However, this stance by the Fed is in direct opposition to the Trump administration. On June 11, following the release of a moderate May Consumer Price Index (CPI), President Trump called for a 1 percentage point rate cut in a post on the social media platform Truth Social. Since the launch of his second administration, he has consistently expressed dissatisfaction with Chair Powell's policy of holding the policy rate steady.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.