Attention on Whether Social Dialogue Body Including Baemin Will Reach a Conclusion Next Month

Discussions on introducing a 'delivery fee cap system' are gaining momentum. This comes as the Democratic Party of Korea, led by Lee Jae-myung's administration, has begun operating a social dialogue body involving Woowa Brothers?the top delivery app operator?and participating partner businesses. Delivery platforms have proposed a system in which the platform subsidizes delivery fees for small-amount orders, where the burden on business owners is relatively high. However, there remains a significant gap between the positions of the platforms and the partner businesses. The complex structure of delivery fees and commissions also makes it difficult to apply a uniform system. If a consensus is not reached through these discussions, there is speculation that a legal cap on commissions?one of President Lee Jae-myung's campaign pledges?could be pursued. However, this would take time and could face opposition as a regulation that runs counter to market economy principles, introducing additional variables.

According to the industry on June 12, discussions on a delivery fee cap system have begun within the social dialogue body on delivery apps, led by the Democratic Party's Committee for the Protection of the Underdog (Euljiro Committee). Since June 9, after the presidential election, this social dialogue body has reconvened with participation from organizations such as the National Franchisee Association, the Association for Fair Platforms, and Woowa Brothers (Baemin). Coupang Eats is not currently participating in these discussions. The social dialogue body is expected to hold meetings weekly or biweekly to narrow differences. Although no specific deadline has been set, there are internal plans to reach an agreement by next month.

According to the delivery industry and partner organizations, Baemin has proposed that for small-amount orders of 15,000 won or less, the total burden on partner businesses?including intermediary commissions and delivery fees?should be reduced to 30-35% or less of the total order amount. Since the burden rate for partner businesses increases as the order amount decreases, the proposal centers on subsidizing delivery fees to reduce this burden. Baemin explains that this proposal was developed as an agenda item through discussions and consensus-building with partner businesses since March.

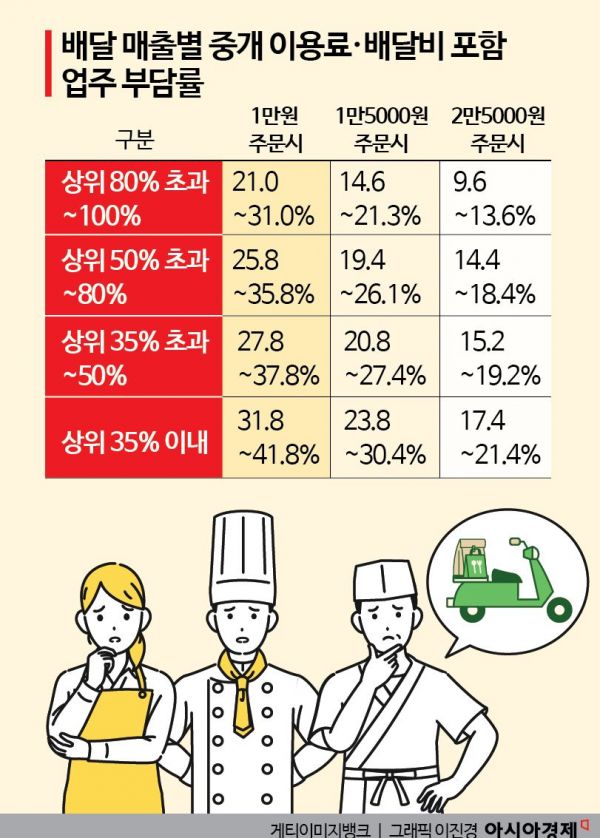

The industry explains that Baemin's 15,000 won threshold is a commonly recognized standard for small-amount orders, such as single-serving orders. Under the current delivery app fee system, which applies different intermediary commissions and delivery fees based on sales brackets as per last year's win-win agreement, the burden rate for partner businesses varies widely depending on the sales bracket and order amount. For a 10,000 won order, the burden rate ranges from a minimum of 21.0% to a maximum of 41.8%. For a 15,000 won order, it ranges from 14.6% to 30.4%. For the average order amount of 25,000 won, the burden rate is between 9.6% and 21.4%. The higher the bracket and the lower the order amount, the greater the burden on partner businesses. This is why platforms have proposed reducing delivery fees for small-amount orders.

However, this proposal is still far from the position of partner businesses. Partner organizations argue that the total commission should not exceed 15% of the food price, and that for small-amount orders of 15,000 won or less, the total commission rate should be capped at 25%. They also insist that, in addition to intermediary commissions and delivery fees, payment processing fees and value-added tax should be included in the calculation. Even when looking at the proposed caps, the gap between the positions of the platforms and partner businesses is clear. Furthermore, including the delivery fee paid to riders, payment processing fees, and value-added tax in the cap could give the impression that platforms have been unfairly profiting, which is a source of concern for delivery app operators.

Even if an agreement is reached, it would only be effective if Coupang Eats, the second-largest operator, also participates in the discussions. In this case, the process could resemble last year's win-win council, which was prolonged. Coupang Eats has not yet stated its position on the commission cap system. An industry official said, "Given the new administration's direction, there is a possibility of legislating a cap system, but there are also concerns that it would run counter to the principles of a market economy," adding, "Delivery app costs affect not only partner businesses but also consumers and delivery riders, so a nuanced approach is needed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.