Japan's Growth Driven by Financial and Tax Support

Government Seeks System Improvements and Greater Investment Accessibility

Dividend Tax Reform Efforts Also Seen as a Positive Signal

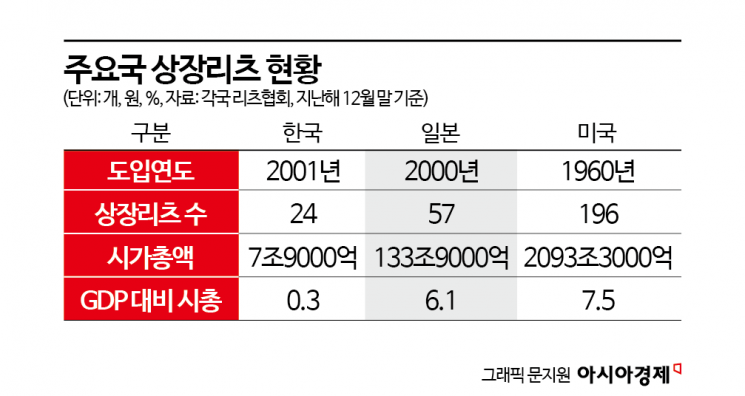

The size of the listed REITs (Real Estate Investment Trusts) market in South Korea is only about one-seventeenth that of Japan. Although the introduction of the system in both countries was just one year apart, the pace of market growth is incomparable. Industry experts point out that fundamental growth will be difficult without tax reforms.

According to the Korea REITs Association on June 13, as of the end of last year, Japan had 57 listed REITs with a total market capitalization of 133.9 trillion won. In contrast, South Korea had only 24 listed REITs, with a market capitalization of just 7.9 trillion won. When comparing the size of the REITs market to GDP, Japan's REITs market accounts for 2.2%, while South Korea's is only 0.3%. Relative to the commercial real estate market, the figures are 4.9% for Japan and 0.7% for South Korea. The listed REITs system was introduced in Japan in 2000 and in South Korea in 2001. Despite the one-year difference, the market gap has already widened to a factor of 17.

The Secret Behind Japan's REIT Growth: Sponsor REITs and Government Support

Experts cite the dominance of large financial groups and the "sponsor REIT" model as the main reasons for Japan's success. Major financial groups such as Mitsui Sumitomo and Mitsubishi UFJ have contributed their core real estate holdings to REITs as in-kind investments and have directly participated in asset management, instilling stability and trust in the market.

The Bank of Japan, the country's central bank, supplied liquidity to the market by purchasing REIT shares worth about 6.2 trillion won over a period of approximately 13 years. The government also provided tax incentives by reducing the acquisition tax base by 60% when REITs acquired real estate, lowering the effective tax rate from 2% to 1.3%.

In contrast, it is difficult to expect financial support in the South Korean market. The industry's long-standing wish for "acquisition tax reduction for REITs" is also unlikely to be realized soon. There were temporary tax benefits in the past, but they expired at the end of 2014. In addition, capital gains taxes incurred when contributing core assets to REITs as in-kind investments discourage asset holders from making such contributions. Although a tax deferral system was introduced for public REITs, its effectiveness was limited due to strict requirements, and even this expired at the end of 2022.

South Korea also faces relatively higher land prices, continued strong demand for development, and higher interest rates compared to Japan, making it difficult to simply apply the Japanese model as is. However, both industry and government agree that it is necessary to strengthen the REITs system itself, which diversifies asset-building opportunities for the public and provides fair investment opportunities that extend beyond institutional investors to individual investors.

South Korea Also Moves to Revitalize REITs, But...

Recently, the South Korean government has begun to revise the system to revitalize listed REITs. The Ministry of Land, Infrastructure and Transport has commissioned the Korean Association for Real Estate Analysis to conduct a study on "System Improvement Measures to Promote Public Investment in Listed REITs." The core of this study is to comprehensively overhaul the system so that the general public can more easily invest in listed REITs. Key directions being considered by the ministry include inclusion of listed REITs in the KOSPI 200 index, shifting from an approval system to a registration system, promoting private-sector development through the activation of project REITs, and expanding REIT investment by middle-class assets such as pensions and IRPs.

The government plans to foster REITs as a core pillar of a "sound capital circulation structure" connecting the capital market and the real estate market. This is also in line with recent remarks by President Lee Jaemyung regarding dividend expansion and tax reform. On June 11, President Lee visited the Korea Exchange and announced plans to reform the dividend tax system so that the public can earn interim dividends and living expenses through stock investment. This is a measure to increase public participation in the stock market. It is also a measure that could be applied to REITs, which are characterized by high dividend yields. If measures to reduce the burden of dividend income tax are introduced, the attractiveness of REIT investment could increase.

"Tax Reform Is the First Step to Properly Foster REITs"

Contrary to the government's actions, industry officials unanimously agree that tax reform should be the top priority. In a policy proposal submitted to the Democratic Party last month, the Korea REITs Association identified acquisition tax reduction and capital gains tax deferral for in-kind contributions as the most urgent tasks. A representative from the Korea REITs Association stated, "Allowing tax deferral for in-kind contributions to existing listed REITs would enable asset inclusion without paid-in capital increases, which would help expand the market." Regarding the recently introduced "project REITs," the industry believes that "tax deferral limited to project REITs alone is insufficient."

Restrictions on mergers between REITs are also seen as an obstacle to market growth. Under the current system, listed REITs (public REITs) are prohibited from merging with exception REITs (mainly private REITs). To include high-quality unlisted assets, direct acquisition through separate fundraising is the only option. Industry experts point out that this structure hinders the scaling up and competitiveness of listed REITs. Although the government announced the "6·17 REITs Revitalization Plan" last year, which included easing these regulations, the relevant laws have yet to be amended. At a "REITs Policy Briefing for the Advancement of the Real Estate Industry" last month, a Ministry of Land official stated, "We are preparing specific measures in cooperation with related ministries to introduce the system," adding, "We are designing the system to suit Korea's circumstances, referencing the United States, Japan, and Singapore."

Another issue is that the share prices of listed REITs tend to plummet whenever they conduct paid-in capital increases. Because listed REITs hold very little cash, they must raise funds through paid-in capital increases to acquire new assets. An industry official explained, "Although dividend yields are maintained after paid-in capital increases, share prices fall because institutional investors sell existing REIT shares and participate in the capital increase," emphasizing, "It is necessary to shorten the capital increase process and adjust institutional investors' alternative investment limits."

A representative from the REITs Association stated, "REITs are a system that combines public interest and asset-building functions, as anyone can invest small amounts in high-quality real estate," adding, "Although the government is working to revitalize listed REITs, it will be difficult to achieve substantial growth without core tax support such as capital gains tax, acquisition tax, and dividend income tax."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.