Household Loans Rise by 5.2 Trillion Won in May,

Driven by Increased Housing Transactions in Gangnam

Mortgage Loans See Largest Growth Since April,

Reflecting Delayed Impact of Permit Zone Lifting

Bank Deposits Rebound by 20 Trillion Won,

Supported by Demand and Time Deposit Inflows

Corporate Loans and Asset Management Deposits Also Increase,

Amid Expanding Bank Lending and Attractive Fund Yields

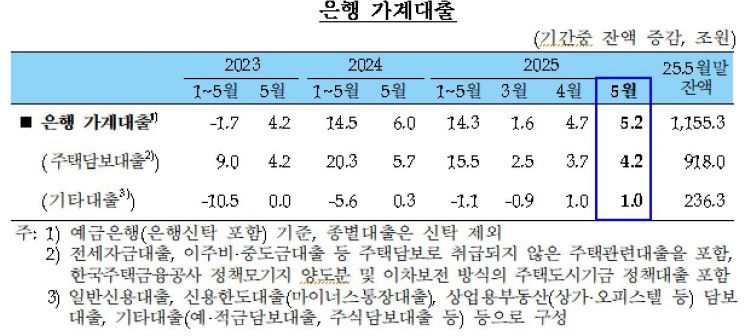

Last month, household loans from banks increased by 5.2 trillion won, expanding even more than the sharp rise seen in April. This was the result of increased housing transactions following the lifting of land transaction permit zones in the Gangnam area of Seoul, which affected household loans with a time lag. Although housing transactions seemed to stabilize somewhat after the re-designation of the permit zones, they have recently started to rise again. Considering this time lag, there are expectations that upward pressure on household loan growth will continue for the time being.

According to the "Financial Market Trends in May 2025" released by the Bank of Korea on the 11th, the outstanding balance of household loans from banks at the end of last month stood at 1,155.3 trillion won, an increase of 5.2 trillion won from the end of the previous month. This increase was even larger than the 4.2 trillion won rise in April, which itself was a sharp jump from the 1.4 trillion won increase in March.

Among household loans, mortgage loans increased by 4.2 trillion won to reach 918 trillion won. This was a greater increase than the 3.7 trillion won rise recorded in April. The surge in mortgage loans began in April, as the increased housing transactions in February and March following the lifting of the permit zones started to be reflected in household loans with a time lag. The larger increase last month was due to March transactions being reflected in May. According to the Ministry of Land, Infrastructure and Transport, the number of apartment sales in Seoul was 6,200 in February and 9,500 in March.

In April, apartment transactions dropped to 5,000, coming down from the March peak. However, the Bank of Korea expects that the upward trend in household loans will continue until at least August, due to factors such as the last-minute demand to meet the Debt Service Ratio (DSR) requirements. Park Mincheol, head of the Market Operations Team at the Bank of Korea's Financial Markets Department, stated, "The overheating trend subsided somewhat after late March, but in May, the increase in Seoul apartment prices has accelerated again. Judging by the trend, the number of transactions in May will also be slightly higher than in April," adding, "Since the increase in apartment prices is widening again and transaction volumes have not sufficiently decreased, there are concerns that household loans, particularly those related to housing, will continue to face significant upward pressure for the time being."

Jeonse loans, which are included in mortgage loans, increased by 500 billion won from the end of the previous month. Other loans rose by 1 trillion won for the second consecutive month, due to seasonal demand for funds such as expenditures related to Family Month. Other loans include general credit loans, credit line loans (overdraft accounts), commercial real estate collateral loans, deposit and savings collateral loans, and stock collateral loans.

Corporate loans from banks also increased in May. At the end of last month, the outstanding balance of corporate loans from banks stood at 1,346.4 trillion won, an increase of 8 trillion won from the end of the previous month. This was a smaller increase compared to the 14.4 trillion won rise in April.

Loans to large corporations increased by 5.4 trillion won from the end of the previous month, as major banks expanded their lending operations and some large corporations raised temporary operating funds. Loans to small and medium-sized enterprises (SMEs) increased by only 2.6 trillion won, as policy-based loan supply continued, but banks strengthened credit risk management and seasonal factors such as VAT payments disappeared compared to the previous month.

Looking at corporate fundraising through direct finance, corporate bonds shifted to net redemption last month due to seasonal off-peak factors such as the submission of quarterly reports and refinancing in the previous month. After increasing by 1.9 trillion won in April, corporate bonds decreased by 400 billion won last month. Commercial paper (CP) and short-term bonds also shifted to net redemption, mainly among public enterprises, decreasing by 200 billion won from the end of the previous month. Stock issuance increased by 1.8 trillion won, driven by large-scale rights offerings by some companies.

Bank deposits in May increased by 20.2 trillion won from the end of the previous month, reversing the 25.9 trillion won decrease seen at the end of the previous month. The turnaround in deposits within a month was due to demand deposits, which had sharply decreased in April, increasing again. Demand deposits, which had declined by 36.8 trillion won in April, rose by 700 billion won last month as local government funds were deposited in anticipation of fiscal spending and corporate settlement funds flowed in. Time deposits also increased by 19.2 trillion won from the end of the previous month, as some banks expanded deposit mobilization in response to rising loans and local governments made temporary deposits.

Deposits at asset management companies increased by 25.2 trillion won from the end of the previous month. After decreasing by 13.1 trillion won in March, they surged by 38.4 trillion won in April and continued to increase last month. Money market funds (MMFs) increased by 8.1 trillion won, mainly due to their attractive yields, particularly among corporate funds. Bond funds and equity funds also saw larger inflows compared to the previous month, increasing by 10.2 trillion won and 4.5 trillion won, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.