Foreign Investor Trading Value Approaches 9%

'30% Rule' on Trading Volume Already Exceeded

Proactive Suspension Expected for Certain Stocks

The first domestic alternative trading system (ATS), NextTrade, which ushered in an era of stock trading during commuting hours, has reached its 100th day since launch and is making steady progress, addressing challenges such as expanding foreign investor participation. Industry analysts believe that relaxing NextTrade's trading volume limits will be a key turning point for its future growth.

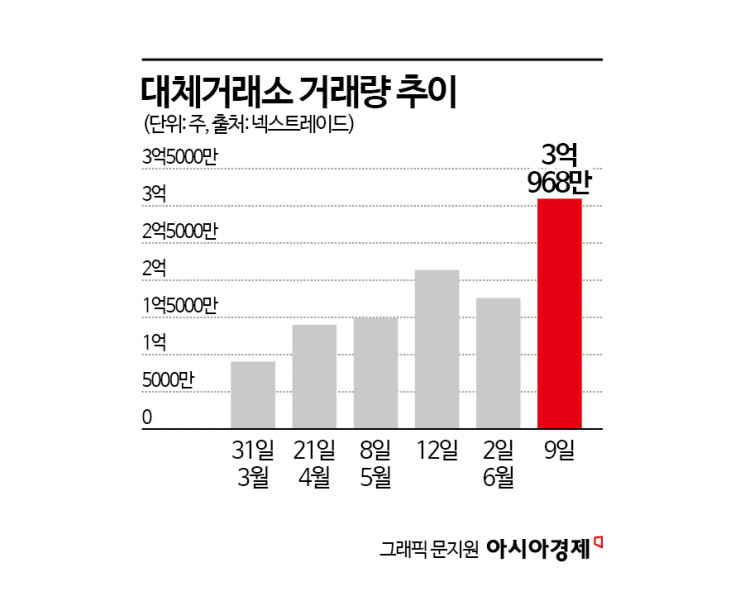

According to NextTrade on June 11, a total of 309,689,005 shares were traded on the ATS regular market on June 9, surpassing the '300 million shares' milestone for the first time. This represents 19.4% of the total trading volume in the domestic stock market (Korea Exchange KOSPI and KOSDAQ markets plus NextTrade). The following day, the trading value reached 10,060,279,754,017 won, setting a new milestone by exceeding 10 trillion won for the first time.

This growth is noteworthy because it has been accompanied by increased participation from foreign investors, which was initially seen as a weakness at launch. In the first week of April (March 31 to April 4), when the number of tradable stocks on the ATS was expanded to 800, foreign investors accounted for only 2% of trading value. However, by last week (June 2 to 5), this figure had soared to 8.8%, more than quadrupling. This is attributed to the 'honeymoon rally' in the stock market, with over 3 trillion won in foreign capital flowing into the KOSPI alone following the presidential election.

The problem is that NextTrade's trading limits have already reached their ceiling. Under current regulations, NextTrade's average daily trading volume over six months cannot exceed 15% of the total market trading volume. If the average daily trading volume of an individual stock over six months exceeds 30% of that stock's total trading volume, trading is also restricted. With only three months left until September, which is the reference point for financial authorities' assessment, there are growing calls for prompt discussions on relaxing trading volume limits.

A NextTrade official stated, "To comply with the legally mandated trading limits, the only option is to suspend trading." The official added, "Although nothing has been decided yet, we are considering preemptively applying a trading volume restriction buffer for certain stocks." For example, for stocks with high trading volumes, they plan to proactively impose a trading volume limit of 10 to 14.5% before September, to ensure that the legal cap is not exceeded. NextTrade plans to announce detailed guidelines on this as early as the end of this month.

On the 4th, the opening ceremony of the alternative trading system (ATS) 'NextTrade (NXT)' was held at the Financial Investment Center Building in Yeouido, Seoul. From the third person on the left, key attendees including Jung Eunbo, Chairman of the Korea Exchange, Lee Bokhyun, Governor of the Financial Supervisory Service, Yoon Hanhong, Chairman of the National Assembly's Political Affairs Committee, Kim Haksoo, CEO of NextTrade, and Kim Byunghwan, Chairman of the Financial Services Commission, are participating in the opening commemorative ceremony. 2025.03.04 Photo by Yoon Dongjoo

On the 4th, the opening ceremony of the alternative trading system (ATS) 'NextTrade (NXT)' was held at the Financial Investment Center Building in Yeouido, Seoul. From the third person on the left, key attendees including Jung Eunbo, Chairman of the Korea Exchange, Lee Bokhyun, Governor of the Financial Supervisory Service, Yoon Hanhong, Chairman of the National Assembly's Political Affairs Committee, Kim Haksoo, CEO of NextTrade, and Kim Byunghwan, Chairman of the Financial Services Commission, are participating in the opening commemorative ceremony. 2025.03.04 Photo by Yoon Dongjoo

There are still unresolved issues, such as the insufficient participation of institutional investors and concerns about system stability. Despite lower fees (0.00134%) compared to the Korea Exchange, NextTrade's block and basket trading market, which faced difficulties at launch due to the volatility interruption mechanism (VI), has only recorded one instance: AJ Networks traded 2.74 million shares in two transactions on April 30 and May 20.

A NextTrade official explained, "For institutional participants to switch trading markets, they must obtain internal approval from securities firms and also explain it to their clients." The official added, "The direct benefit (fee reduction) they can obtain does not seem very attractive compared to the effort required." The lack of a robust order book, which is cited as a cause of price distortion at market open on the ATS, also remains an issue, as the insufficient exemption system makes it difficult for securities firms to participate as market makers.

NextTrade plans to complete the integration of the main markets of 14 securities firms, which currently participate only in the pre- and after-market, through a 'second opening' at the end of October. Foreign securities firms are also expected to participate at that time. A financial investment industry official said, "The integration was originally scheduled for September, but it appears to have been postponed to October, which is when the Korea Exchange conducts its regular system upgrades in the second half, due to recent consecutive financial IT incidents."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.