Seven Major Foreign Companies Including Chanel, Louis Vuitton, and Hermes

Remitted 1.4 Trillion Won to Headquarters Last Year... Up 26%

Total Net Profit 1.2944 Trillion Won vs. Corporate Tax 366.2 Billion Won

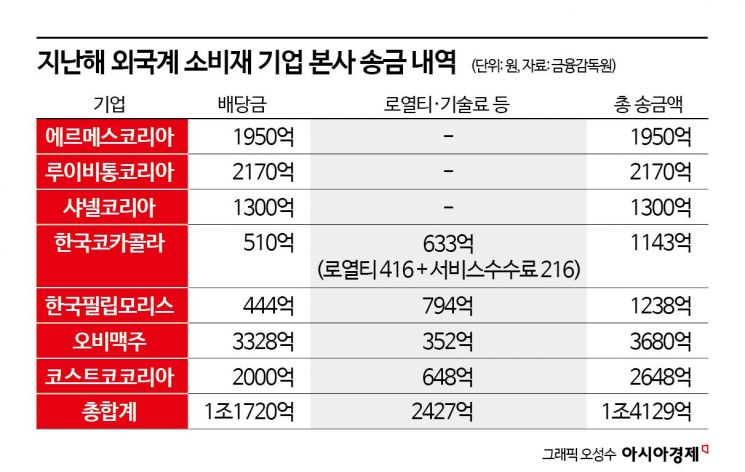

It has been revealed that the total amount remitted to headquarters by seven major foreign consumer goods and retail companies?including Chanel Korea, Louis Vuitton Korea, Hermes Korea, Coca-Cola Korea, Philip Morris Korea, OB Beer, and Costco Korea?in the form of dividends and royalties last year exceeded 1.4 trillion won. These companies transferred funds overseas at levels far surpassing their operating profits generated in Korea, thereby reducing their corporate tax burdens. However, this large-scale outflow of capital has led to a deterioration in Korea's current account balance.

According to the Financial Supervisory Service's electronic disclosure system on June 11, the total amount of dividends remitted to headquarters by these seven foreign companies for the 2024 fiscal year was 1.4129 trillion won, an increase of about 26% compared to the previous year. During the same period, their combined net profit was 1.2944 trillion won. The amount remitted to headquarters exceeded net profit by 118.5 billion won.

By company, Coca-Cola Korea sent 114.3 billion won to its headquarters, which is 222% of its net profit of 51.6 billion won. This amount includes dividends (51 billion won), trademark royalties (41.6 billion won), and service fees (21.6 billion won).

Philip Morris Korea showed a similar pattern. Philip Morris Korea paid 44.4 billion won as interim dividends and 79.4 billion won in royalties for brand usage, sending a total of 123.8 billion won to its headquarters.

Costco Korea remitted 264.8 billion won to headquarters, which is 118% of its net profit of 224 billion won. Of this, 200 billion won was dividends and 64.8 billion won was royalties. The royalties are structured as a fixed 1% of sales, meaning these costs are incurred regardless of the size of profits. OB Beer sent 332.8 billion won to headquarters as dividends. With a net profit of 241 billion won, its dividend payout ratio was 138%.

The three luxury brands also made large-scale dividend payments. Louis Vuitton Korea paid out 217 billion won in dividends from a net profit of 281.5 billion won, resulting in a payout ratio of 77%. Hermes Korea paid 195 billion won in dividends from a net profit of 209.5 billion won, and Chanel Korea paid 130 billion won from a net profit of 206 billion won. Their dividend payout ratios were 93% and 63%, respectively.

In contrast, the total corporate tax paid domestically by these seven foreign companies last year was only 366.2 billion won. This is less than half the amount remitted to headquarters as dividends and royalties. In particular, Costco Korea paid only 2.2 billion won in corporate tax, which is just 1% of its net profit. This has led to criticism that foreign companies view their Korean operations merely as 'cash dispensers.'

Remittances by foreign companies also impact the current account balance. In April, when dividend remittances by foreign companies are concentrated, the primary income balance?which shows the difference in 'wages and salaries' and 'investment income' between residents and non-residents?often records a deficit. According to the Bank of Korea, the current account balance in April was $5.7 billion (about 7.725 trillion won), a decrease of more than $3 billion from March due to foreign dividend payments. The primary income balance shifted from a $3.23 billion surplus in March to a $190 million deficit in April. Since 2010, except for 2012 (when it was $22.41 billion), the primary income balance in April has always posted a deficit through last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.