Restoring the People's Economy and Fostering High-Tech Industries as Key Policies

Support Extended to Small Business Owners Who Closed After Martial Law

Reviewing Conditions for Maturity Extension, Interest Deferral, and Principal Reduction

Will the Fourth Internet Bank Serve as a Specialized Medium-Interest Lender?

Details of Bad Bank Establishment Under Discussion

High-Tech Industry Fund Realistically Set to Reach Up to 100 Trillion Won

With the appointments finalized for the head of the National Policy Planning Committee, who will outline the policy blueprint for the Lee Jaemyung administration, and the first chief of policy, who will set the direction for economic policy, the Financial Services Commission has swiftly begun preparations for its first policy briefing to the new government. The key themes for the briefing are summarized as "support for small business owners" and "financial support for high-tech industries." The aim is to promote "real growth" by implementing policies for the recovery of the people's livelihoods and the development of strategic high-tech industries.

According to the Financial Services Commission on June 10, Secretary General Kwon Daeyoung and the Financial Policy Division began reviewing policies for the briefing last week, based on the government’s list of campaign pledges. Lee Hanju, the head of the National Policy Planning Committee, will draw the initial blueprint and work with Chief of Policy Kim Yongbeom to flesh out the details.

Support Measures for Small Business Owners to Restore Livelihoods...Even Those Who Closed After Martial Law Included

The first campaign pledge the Financial Services Commission checked after the presidential election was the financial policy for small business owners. This is because this issue occupies a significant portion of the Democratic Party’s campaign pledges related to the people's livelihoods. The most prominent aspect of the small business owner policy is the "significant alleviation of financial burdens."

In the campaign pledges, President Lee stated that he would implement extraordinary measures regarding COVID-19 loans, ranging from debt adjustment to cancellation. The key issue is how to differentiate these measures from existing policies. According to the Financial Services Commission, since 2020, the total amount of loans to self-employed individuals has reached 76.2 trillion won. As of the first quarter of this year, the amount of loans with extended maturities alone stands at 47.4 trillion won.

Currently, there are three debt adjustment programs for self-employed individuals: ▲ Small Business Owner 119 Plus (for those not yet delinquent), ▲ Low-interest installment repayment for business closures (for those not yet delinquent), and ▲ New Start Fund (for those in delinquency). Banks are also voluntarily participating in debt adjustment for borrowers without delinquencies as part of "coexistence finance." Borrowers who are delinquent can have up to 90% of their principal reduced through the New Start Fund.

The "coexistence finance" program for borrowers not yet delinquent is likely to be renamed and structured similarly to existing programs to encourage voluntary participation from the banking sector. There is also keen interest in how the "New Start Fund" for self-employed individuals in delinquency will be utilized. In March of this year, the Financial Services Commission expanded the eligibility for the New Start Fund. Originally, the program was available to self-employed individuals who started their businesses between April 2020 and June 2024. However, as the number of business closures surged due to the economic downturn, eligibility was expanded to include small business owners and self-employed individuals who started their businesses by November 2024.

It is expected that eligibility will be further expanded to include small business owners and self-employed individuals who started their businesses after December 3 of last year and before the presidential election. This is because the campaign pledges mention support measures for small business owners and self-employed individuals affected by the aftermath of martial law.

Will the Fourth Internet Bank Become a Medium-Interest Loan Channel for Small Business Owners...Interest in Establishing a Bad Bank

The Financial Services Commission is also considering, at the idea stage, ways to link the fourth internet bank to the campaign pledges. The pledges include the establishment of a specialized internet bank for medium-interest loans for financially vulnerable groups such as low-income individuals and small business owners. The main points are to enhance the credit review system using artificial intelligence (AI) and to increase the mandatory loan ratio for those with mid-to-low credit scores.

An official from the Financial Services Commission said, "We are considering how to link the campaign pledge of establishing a specialized internet bank for medium-interest loans for the financially vulnerable with the ongoing review of the fourth internet bank," adding, "However, no concrete outline has been decided yet, and the process will be aligned with the new government's policy direction."

In this case, it is important to differentiate from the "Plan to Enhance the Role of Savings Banks" announced by the Financial Services Commission in March of this year. At that time, the commission stated as its first major point that it would strengthen the supply of financial services to those with mid-to-low credit scores. Previously, 70% of Saitdol loans were supplied to the bottom 30% of credit scores, but the scope was expanded to include the bottom 50%.

At the same time, ideas regarding the establishment of a bad bank are also being collected. The campaign pledges specify the temporary establishment of a large-scale fund to write off non-performing loans held by private financial institutions. Details such as the size of the fund and participating entities are under review.

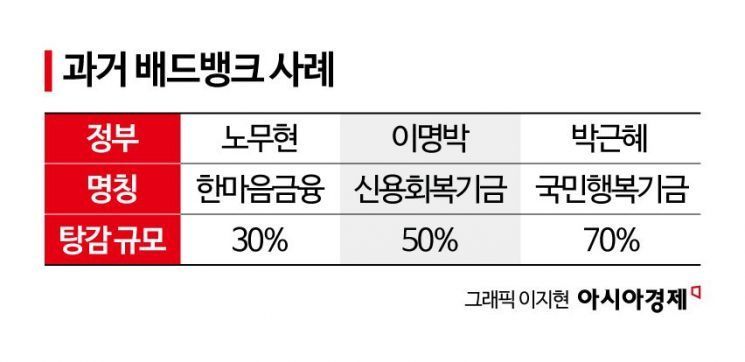

The concept of a bad bank is not new. Previous examples include "Hanmaeum Finance" under the Roh Moo-hyun administration, the "Credit Recovery Fund" under the Lee Myung-bak administration, and the "National Happiness Fund" under the Park Geun-hye administration. Hanmaeum Finance wrote off 33% of principal, the Credit Recovery Fund 50%, and the National Happiness Fund up to 70%. Under the Yoon Suk-yeol administration, the "New Start Fund" was created, allowing up to 90% principal reduction and long-term installment repayment.

An industry official explained, "In the case of unsecured loans, the haircut (debt write-off) usually results in sales at 1-3% of face value," adding, "Since it involves selling off loans deemed 100% uncollectible at a set price, financial institutions are not necessarily opposed, but the scale and the scope of eligible loans are important factors."

Countermeasures for the Trump Trade War...Up to 100 Trillion Won in Financial Support for High-Tech Industries

The high-tech strategic industry fund is also a key policy initiative. In March of this year, the Financial Services Commission, together with related ministries, announced the creation of a "High-Tech Strategic Industry Fund." This is a financial support measure to foster future industries such as semiconductors, bio, AI, and defense.

The size of the High-Tech Strategic Industry Fund is 50 trillion won, but with the participation of pension funds and others, it could be expanded up to 100 trillion won. The plan is to raise 50 trillion won through unexecuted amounts from the semiconductor financial support program (12.75 trillion won) and government-guaranteed bonds, with pension funds and private financial institutions participating as well.

The support targets range from large corporations to mid-sized and small businesses. The semiconductor (AI) sector is expected to be the first beneficiary, as President Lee has emphasized large-scale investment in AI. In this presidential election, he declared the realization of the "AI G3" as his top pledge and visited the AI semiconductor design startup FuriosaAI. In fact, President Lee established the Office of AI Future Planning just two days after taking office.

However, cooperation from the National Assembly is required for the launch of the High-Tech Strategic Industry Fund. Although an amendment to the Korea Development Bank Act has been prepared to enable the fund's launch, procedures such as passage through the National Assembly remain. If the amendment is passed at the plenary session of the National Assembly scheduled for June 12, the initiative is expected to move forward in earnest.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.