Numerous Construction-Related Bills Reflecting Industry Demands Remain Pending

Ministerial Appointment and Local Government Cooperation to Influence Future Policy

Although a new administration has taken office, the construction and real estate industries are adopting a wait-and-see approach rather than expressing high expectations for policy changes. Industry insiders point out that the regulatory easing and tax adjustments they have demanded are stalled in the National Assembly, and the government's specific policy direction remains unclear. The industry believes that the appointment of the Minister of Land, Infrastructure and Transport will serve as a watershed for future policy direction.

◆More of a 'wait-and-see' than expectations for policy changes= On June 8, a housing construction industry official stated, "The most urgent issue is the unsold housing inventory in provincial areas, but tax relief measures such as acquisition tax cuts are intertwined with local government finances, making it difficult to pass the National Assembly." The official added, "President Lee Jaemyung declared that 'the era of controlling real estate with taxes is over,' but most regulatory measures are already reflected in current policies, so there will be no significant changes in the market." Currently, numerous construction and real estate-related bills reflecting industry demands?such as acquisition tax relief for unsold homes in provincial areas, reform of the reconstruction excess profit recovery system, and reduction of development charges?are pending in the National Assembly. Most of these bills have been proposed by the pro-business People Power Party, and progress is unlikely without cooperation from the Democratic Party.

The construction industry particularly notes that, because the presidential election was held early, real estate policy did not become a major campaign issue. An industry official commented, "Only abstract directions such as 'public-led supply' or 'revitalization of redevelopment projects' have been presented, and there is no clear picture of what the new administration intends to do." The official continued, "Rather than general directions like supply expansion, which anyone can suggest, what is urgently needed are practical policies to revive the construction market." President Lee's campaign pledges also focused mostly on general principles such as support for single-person households and expansion of housing supply, without specifying concrete supply targets or implementation plans.

Among the legislative tasks, there is speculation that bills related to reconstruction and redevelopment may move first. The People Power Party has introduced bills to simplify approval procedures and ease floor area ratio restrictions in areas near subway stations, and the Democratic Party does not appear to oppose these measures. However, it is likely that the Democratic Party will take the lead in processing the bills by amending certain provisions.

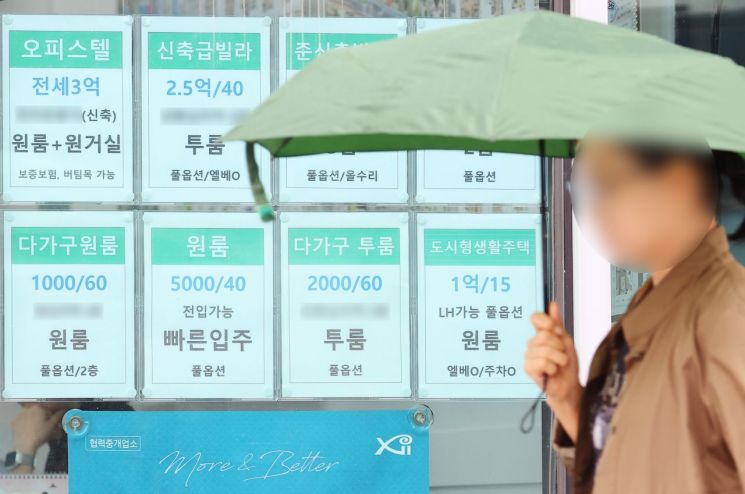

An informational notice regarding monthly rent and lease in a real estate office in downtown Seoul on the 2nd. Yonhap News

An informational notice regarding monthly rent and lease in a real estate office in downtown Seoul on the 2nd. Yonhap News

In provincial real estate markets, there are also calls for tax relief for owners of multiple homes. A housing construction industry official said, "The situation in the Seoul metropolitan area may be different, but in the provinces, the market has already frozen. Without tax relief, it is difficult to even proceed with new sales."

However, there are critical views regarding the repeated nature of these industry demands. Civic groups argue that the construction industry has consistently called for tax cuts and regulatory easing under the pretext of 'market recovery,' which has pushed the goal of strengthening public interest for housing stability to the back burner. The Citizens' Coalition for Economic Justice (CCEJ) assessed during the recent presidential election that "the Democratic Party's policy direction has shifted from its previous emphasis on public interest to a 'rightward turn' focused on expanding the private market and easing regulations."

Regardless of such criticism, it remains uncertain whether industry demands will actually translate into policy. In particular, sensitive financial and tax policies such as the total debt service ratio (DSR) and the easing of capital gains and acquisition taxes are seen as politically burdensome for the government, making it unlikely that they will be implemented in the short term.

◆Ministerial appointment likely to signal policy direction= The industry believes that the upcoming appointment of the Minister of Land, Infrastructure and Transport could serve as a barometer for the government's real estate policy. If a politician is appointed, it may signal a strong governmental push, while the selection of a bureaucrat or a civic group figure would suggest a cautious, public-sector-led approach.

An industry insider commented, "To revitalize private sector redevelopment projects, it is necessary to appoint a bureaucrat with practical experience in redevelopment." Another official added, "If someone from a civic group or policy research background is appointed, sensitive issues such as easing reconstruction regulations could become even more rigid." During the 19th presidential election, which was also held early, the Minister of Land, Infrastructure and Transport was officially appointed just 43 days after President Moon Jaein took office.

Meanwhile, some analysts point out that the role of local governments is also important. This is because certain regulations, such as increasing the floor area ratio, require not only the Ministry of Land, Infrastructure and Transport but also the judgment of local governments. An industry official stated, "Even with the same law, interpretation and application differ by local government. The speed and success of redevelopment projects will depend not only on the central government but also on how actively each local government cooperates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.